We take a look at Bitcoin and XRP prices as of September 8th, 2021. Aside from fundamentals, we rely heavily on technical analysis to assess overall sentiment. This is achieved by identifying key support and resistance levels that traders and investors will be watching in the short term. Based on the current price action, what does the sentiment look like this week?

Bitcoin Price

At the time of this analysis, Bitcoin’s price is currently trading at $46,449. The largest cryptocurrency by market cap saw a drastic ~ 10% sell-off yesterday, despite breaking news that El Salvador adopted it as legal tender. The large drawdown caused blood in the altcoin markets as well, with Ethereum falling ~ 12%. On Tuesday morning, Bitcoin fell as much as ~ 16%, which caused panic across the market. It did not help that major exchanges such as Coinbase experienced delays and canceled transactions during the increased volatility. Throughout the day, Bitcoin showed signs of recovering but ultimately failed to maintain a bullish move.

With positive news coming out of El Salvador, it seems as if the negative sentiment in Bitcoin could be short-lived. As a result of becoming the first country to make crypto its national currency, El Salvador said they purchased $20mm in BTC and installed more than 200 BTC ATMs across the region.

The Government managed wallets also saw unprecedented amounts of sign-ups as El Salvador plans to load all wallets with a $30 BTC bonus. Many traders saw today’s price action resulting from large volume traders and other institutional players that were looking to capitalize on increased volatility.

Bitcoin Technical Analysis

At the time of this report, BTC is flirting with $46,800 support. We have outlined this level in the chart below.

It will be important for Bitcoin to hold $46,800 support if it wants to recover in the short term. We will remain bearish on BTC until it can hold this level. As of now, BTC has slightly dropped below key support levels.

If BTC fails to recover above $46,800, we could see a further drawdown to $42,500 support before bulls regain momentum.

On the contrary, if Bitcoin can power back above $46,800 support, we believe it will target $50,100 resistance in the short term. At the time of this report, BTC RSI is right around 40, which has historically been bullish.

XRP Price

At the time of this report, XRP is currently trading at $1.10. As of now, all eyes continue to be on the Ripple/SEC lawsuit that is influencing XRP prices.

Due to ongoing uncertainties, U.S exchanges still offer little support for buying/selling XRP. This has been the theme since the lawsuit was initiated in late 2020. Despite this obstacle, XRP continues to be adopted in other countries, which has driven prices up ~ 363% over the last year.

Additionally, some exchanges like Phemex have relisted XRP even though the Ripple lawsuit is ongoing. Rakuten’s exchange has also stated that they plan to relist EXP starting September 8th.

XRP Technical Analysis

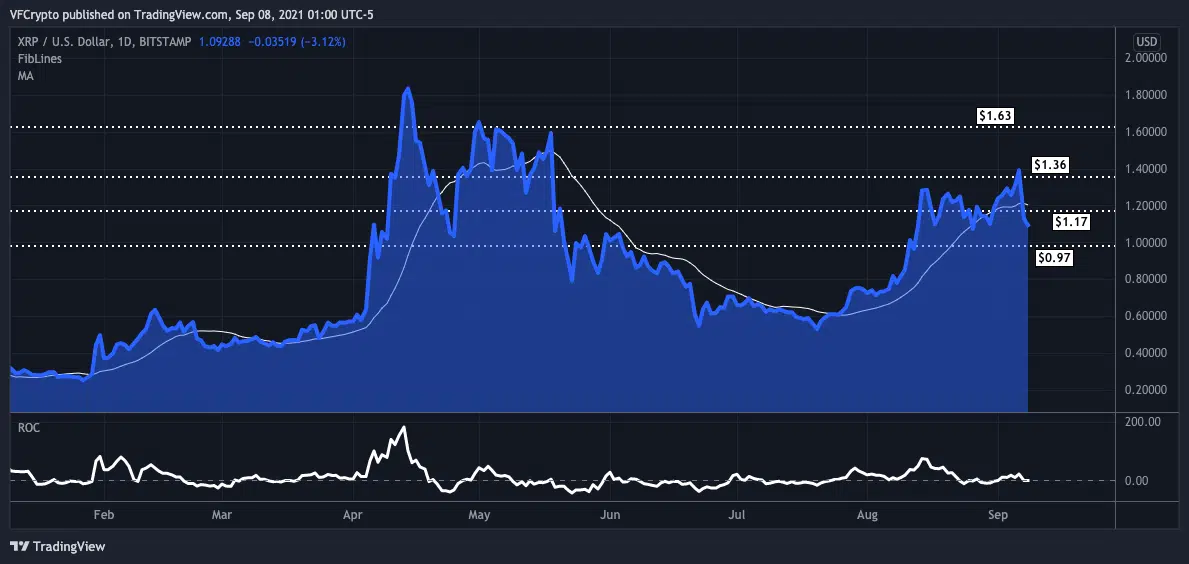

At the time of this analysis, XRP is trying to maintain $1.17 support. We have outlined this level on the chart below.

With current prices hovering around $1.10, the digital asset is having a difficult time maintaining $1.17 support. We will continue to be bearish on XRP until this level can be slashed. If XRP fails to recapture $1.17, we could see furth downside pressure to $0.97 support zones.

On the flip side, if XRP can slash $1.17 support, we believe bulls will quickly push it to $1.36 resistance levels. Breaking $1.36 resistance could send XRP to $1.60 and beyond. XRP ROC ( rate of change ) is currently around 0.00. We need to see that inch into positive territories before we see bullish momentum forming.

With the state of the market, many altcoins will be following Bitcoins price action. If BTC can start to recover from yesterday’s carnage, we expect altcoins to outperform in the short term.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however, no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the cryptocurrency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal, or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal, and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.