Investment opportunities in artificial intelligence infrastructure present asymmetric risk profiles that either generate exceptional returns or destroy capital comprehensively. Companies building computing capacity for AI workloads operate at the intersection of technological revolution and potential overcapacity disaster.

Technology sector analysts at Rineplex have been evaluating whether current valuations for AI infrastructure providers reflect realistic growth scenarios or speculative euphoria untethered from practical business models.

The Nebius Investment Case

Nebius Group positions itself as a European AI infrastructure provider competing against American hyperscalers in a rapidly expanding market. The company spun out from Yandex’s international operations, carrying both technological capabilities and geographical diversification benefits.

A hypothetical $10,000 investment faces dramatically different outcomes depending on which growth scenario materializes. Bull cases assume exponential demand growth for AI computing capacity continues unabated, while bear cases envision capacity gluts and margin compression destroying profitability.

Technology analysts calculate that optimistic projections require the company capturing meaningful market share from established cloud providers while maintaining premium pricing for specialized AI workloads. Both assumptions face significant execution challenges.

The valuation implications span an enormous range. Bull scenarios project the investment growing to $50,000-$100,000 over five years if AI infrastructure demand explodes and the company successfully captures market share. Bear scenarios see complete capital loss if overcapacity materializes and the company lacks sustainable competitive advantages.

Market positioning remains precarious. The company operates between hyperscale giants with unlimited capital and specialized boutique providers with deep technical expertise. This middle position risks being squeezed from both directions without clear differentiation.

Capacity Buildout Economics

Building data centers optimized for AI workloads requires massive upfront capital expenditures before generating meaningful revenues. GPU clusters cost hundreds of millions of dollars to deploy, creating substantial financial risk if demand fails to materialize at expected levels or pricing power erodes.

The company must secure adequate power supply, cooling infrastructure, and network connectivity in markets with limited availability of these resources. European power costs typically exceed American levels, potentially creating structural disadvantages against US-based competitors.

Capital intensity ratios for AI infrastructure providers far exceed traditional software businesses. Where software companies convert revenues to cash flow efficiently, infrastructure operators consume cash building capacity that takes years to fully monetize. This dynamic strains balance sheets and tests investor patience.

Construction timelines create additional complications. Data centers require 18-24 months to build, meaning capacity comes online based on demand forecasts made years earlier. Rapidly changing AI technology or demand patterns could render planned facilities obsolete before completion.

Geographic expansion multiplies capital requirements. Each new market demands separate infrastructure investments, creating a capital-intensive growth model that quickly exhausts even substantial funding rounds without generating commensurate revenues.

Competitive Landscape Intensifies

Established cloud providers possess overwhelming advantages in scale, existing customer relationships, and technological resources. Amazon Web Services, Microsoft Azure, and Google Cloud dominate AI infrastructure conversations, making market share gains extremely difficult for smaller competitors.

Differentiation strategies focus on specialized workloads, geographic presence, or pricing advantages. Nebius emphasizes European data residency for customers requiring local hosting, a legitimate differentiator for specific use cases but insufficient to capture mass market share.

Technology sector analysts note that successful infrastructure providers typically either dominate niches comprehensively or achieve scale comparable to market leaders. Intermediate positions prove unsustainable as larger competitors squeeze margins while smaller specialists retain customer loyalty.

Price competition from hyperscalers could destroy independent provider economics overnight. Large cloud providers can subsidize AI infrastructure with profits from other services, undercutting specialized competitors who lack diversified revenue streams.

Technological advantages erode quickly in infrastructure markets. Superior GPU cluster configurations or cooling systems provide temporary differentiation, but competitors rapidly adopt innovations through either internal development or vendor partnerships.

Demand Visibility Remains Limited

Current AI enthusiasm drives infrastructure buildouts based on projected rather than contracted demand. Companies invest billions into capacity expansion assuming continued exponential growth in model training and inference workloads. This assumption requires multiple trends continuing simultaneously.

Model size growth must persist despite diminishing returns and increasing costs. Training runs for frontier models already consume months and tens of millions of dollars, approaching practical limits absent major efficiency breakthroughs.

Inference workloads need to scale dramatically as AI applications achieve mainstream adoption. While proof-of-concept deployments proliferate, production-scale implementations processing billions of queries remain relatively rare outside search and recommendation systems.

Investment Return Scenarios

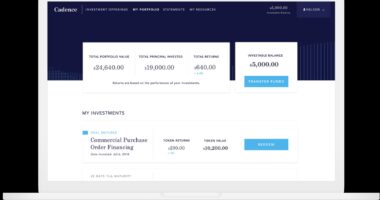

Optimistic scenarios assume the company achieves $10 billion annual revenue by 2030 with 25% EBITDA margins, producing $2.5 billion operating profit. Applying typical infrastructure multiples suggests potential market capitalizations that would return multiples on current investments.

Pessimistic scenarios envision overcapacity, brutal price competition, and margin compression eliminating profitability despite substantial revenues. These outcomes could leave infrastructure providers with massive asset bases generating insufficient returns on invested capital.

Most probable outcomes likely fall between extremes, with modest market share gains and adequate but unspectacular returns for investors willing to accept high volatility and execution risk during the buildout phase.

Liquidation scenarios deserve consideration given capital intensity. If the business model fails, physical assets retain some value through sales to competitors or alternative uses, potentially recovering portions of invested capital unlike pure software investments.