XRP price has surged ~ 371% over the last 90 days, outperforming both Bitcoin and Ethereum. Despite XRP witnessing a significant sell-off to conclude 2020, it has changed sentiment and is attracting significant risk capital in 2021. Based on current technicals, it appears that XRP is ready for another push.

XRP Price

At the time of this report, XRP is currently trading at $1.40. The fourth-largest cryptocurrency by market cap has rallied ~ 371% over the last 3 months. In comparison, Ethereum has grown ~ 98%, and Bitcoin has grown ~ 73% during the last 90 days. Last year, XRP saw its price decline ~ 65% in two days following the SECs decision to sue Ripple. Additionally, some of the largest exchanges delisted XRP, which put significant pressure on price. At the time, the market seemed to be exaggerating, especially since XRP is more superior outside the United States. Other countries like Japan have already stated that XRP is not a security. This is the battle Ripple faces in the United States and is the reason XRP is becoming dominant elsewhere.

If we fast forward to today, Ripple has done an exceptional job defending XRP in court. Even though the courts have not concluded XRPs status ( security or non-security ), there have been positive developments for Ripple such as:

- Ripple winning a ruling to show the SECs documents on Bitcoin & Ethereum

- The courts denying SEC’s request for Ripple executive’s financial records.

- Holders of XRP availed to intervene in Ripple’s lawsuit.

- Courts stating that legally, exchanges could not be selling unregistered securities.

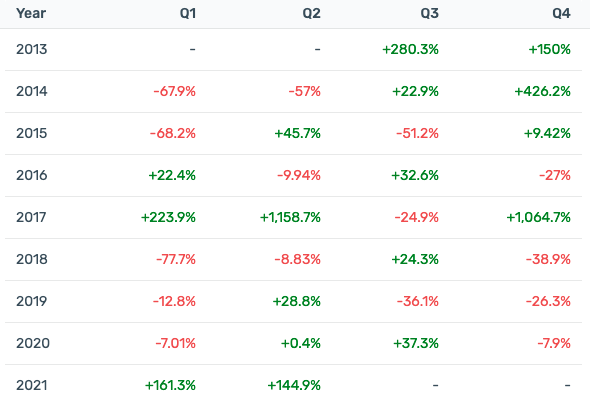

Investors around the globe continue to invest risk capital into XRP, as it offers some of the largest potential upsides in the market pending the court’s decisions. Unlike BTC and ETH, XRP is still ~ 135% below its all-time high. If we look at quarterly performance, XRP is off to one of the hottest starts since its parabolic run in 2017.

XRP Technical Analysis

In previous XRP analysis, we continued to be bullish on price action based on current technicals. It was evident that investors were deploying risk capital in a digital asset that is trading significantly below its all-time high. Despite VF taking a month off from XRP technical analysis, we have continued to follow the charts. With the Ripple lawsuit looming, we were trying to digest the fundamentals before relying solely on TA.

In prior analysis, we believed that XRP could power its way through $0.66. Ever since doing so, the digital asset has been on a tear. It is important to note that XRP has still not been relisted on top exchanges. It is crazy to imagine what this rally would look like if Coinbase and Binance still supported XRP. On the flip side, XRP’s rally to all-time highs in 2017 was accomplished without a Coinbase listing.

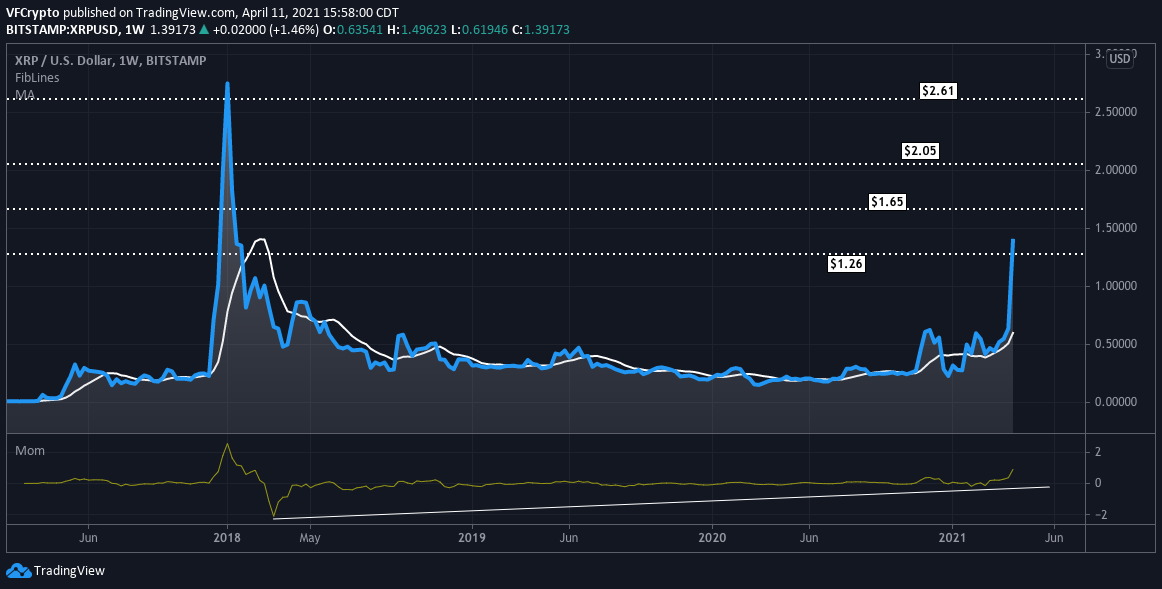

We believe that $1.26 will be a key support level moving forward. As long as XRP holds above this level, we think the rally will continue. At the time of this analysis, XRP is attempting to re-test $1.65 resistance. The last time XRP powered through $1.65 resistance was December 2017. Price action will get very interesting if XRP slashes it a second time.

A $1.65 push could easily get XRP past $2 levels in the short term. On the contrary, $1.26 support will be crucial. If XRP rejects $1.26, we believe profit-takers would come to town. In this environment, investors could see a relatively sharp correction in the short term. With XRP currently trading at $1.38, investors have a bit of a cushion before this level could get rejected.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however, no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the cryptocurrency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal, or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal, and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.