The ICO boom in 2017 was an event that many “cryptocurrency investors” will never forget. Due to retail investors not being eligible to participate in traditional VC funding, many of these individuals participated in ICO offerings. Aside from a few projects, most ICO investors either got scammed or lost tremendous amounts of money. A new report has shared feedback from 600 ICO investors in 2017. What percentage of these investors believe that initial coin offerings deceived them?

The ICO Boom

Back in 2017, investors across the globe were rushing into initial coin offerings ( ICO’s ). In a push to catch the next “Bitcoin,” investors had the opportunity to invest in a project and receive tokens in return. The problem here is that many “unsophisticated retail investors” were deploying large sums of money into these projects.

Unfortunately, many of these projects mismanaged capital and never had an actual product from the get-go. Investors saw an impressive “white-paper” and based their investment decision on a PDF report. According to Crunchbase, about $4.9 billion was raised from ICO’s in 2017. According to a report by Bitcoinist, it is estimated that ~ 74% of all ICO’s lost more than ~ 90% in value against Bitcoin. In terms of USD, the average ICO return was -87% as of data from 2019.

After crypto projects discovered this revolutionary way to raise investment capital, the SEC eventually intervened. In an attempt to protect investors, the SEC stated that many ICO’s can be “securities,” meaning they should be regulated like traditional public offerings. With this being said, many ICO’s were issuing “unregistered securities,” which did not go unnoticed. Following tougher oversight, it was reported that ICO funding tanked ~ 95% YOY in 2019.

Investors Want Answers & Solutions

Xangle, a cryptocurrency disclosure platform, recently surveyed ICO investors from 2017. According to the report, the company surveyed 600 ICO investors from the United States that invested between 2017 and October 2020. The findings further supported the theory that the digital asset space still needs transparency to grow organically. The most interesting findings were that:

- Around 33% of ICO investors believe that projects deceived them or did not provide accurate information to base investment decisions on.

- Of the 33% that believe they have been misled, 54% strongly believe that ICO leadership should be criminally liable for their behaviors.

- 56% of the participants have some interest in investing in other projects but feel they need better information and research to aid their decision.

- Investors still believe the industry needs more accountability, investor protection, and information to scale to new horizons. Also, respondents believe the lack of regulation, awareness, and security is halting market growth.

Other Data From The Survey

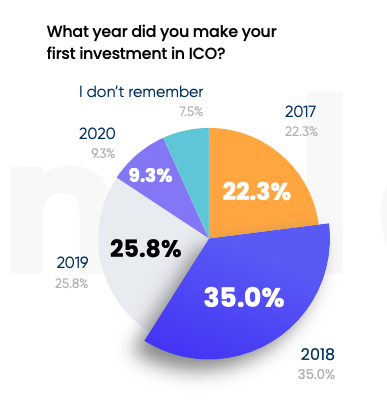

According to the report, most investors made their first ICO investment in 2018. This was right before the investment in ICO’s fell drastically in 2019. In February of 2019, the interest in token sales had fallen ~ 95% for the previous 10 months.

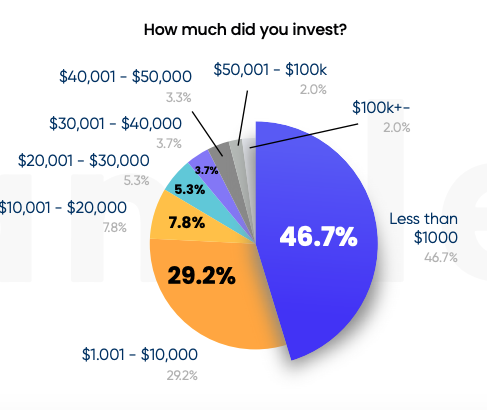

Half of the investors deployed less than $1,000 on their first ICO investment. With this form of fundraising attracting retail investors, a lower initial investment is expected. In terms of marketing, ICO’s thrived on the “crowdfunding” type strategy where they could thrive off large sums of retail investors. It is important to note that only 2% of participants invested more than $100,000.

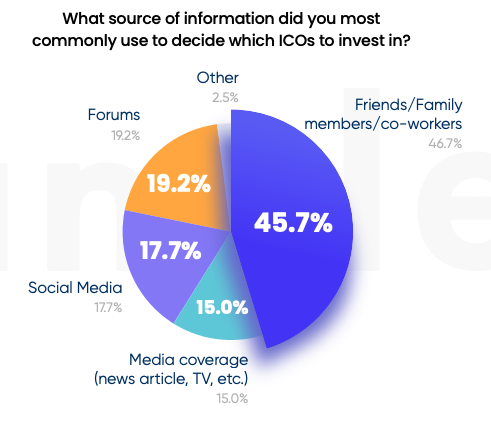

We can quickly see how this strategy can multiply. Based on further research, ~ 45.7% of participants invested in a project based on friends, family, and co-workers. This is an impressive metric, especially since it’s significantly higher than media coverage. With many media outlets pushing initial coin offerings from the get-go, it would be expected to carry more influence, but people also place a lot of value on their inner circle. When you have a market that is “booming” with low minimums to participate in, all of a sudden a project’s ability to attract investment can become quite significant through friends, family, and co-workers regardless of the substance.

The co-founder of Xangle, James Junwoo Kin, commented on the survey:

“The survey findings confirmed our belief that there’s a lot of opportunities and need in the crypto industry for better transparency and visibility for upcoming crypto projects, which can build investor trust and confidence.”

Xangle is a disclosure platform that sources important data and real-time information on various digital assets. The company works alongside global leaders to offer on-chain and off-chain data to fuel data transparency and accountability in this emerging market. The full “ICO Retail Investor Sentiment And Outlook 2020 Report” can be found here.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.