Big box retailers unveil quarterly results this week, spanning the late summer through early fall shopping period. These financial snapshots offer vital clues about household spending habits entering the critical holiday season. Senior market analysts at Unirock Gestion explore why one retailer looks poised for continued dominance while its rival confronts mounting obstacles threatening its competitive standing.

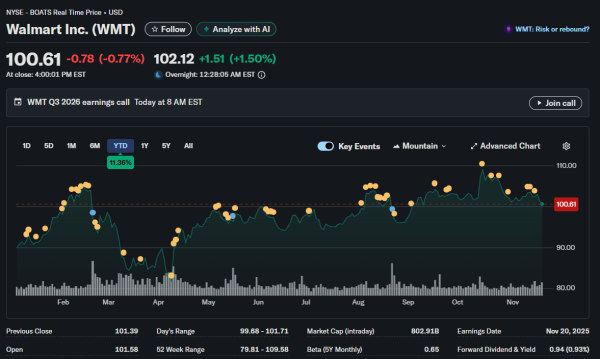

Walmart, the retail giant based in Arkansas, releases numbers Thursday morning, with Wall Street projecting 60-cent earnings per share. That compares to 58 cents from the same quarter last year.

Top line estimates sit at $177.14 billion, representing a 4.5% expansion from prior year levels. Optimistic forecasts reflect the company’s success in capturing wallet share across diverse income brackets, navigating persistent price pressures.

Walmart Captures All Demographics

Customer visits to Walmart locations rose 0.4% in the third quarter based on tracking data from Placer.ai. The modest increase nonetheless surpasses trends at competing chains experiencing traffic declines. The company’s warehouse club format posted 3.2% visitor growth, demonstrating appeal in membership-based shopping, competing against established players.

Bank of America anticipates that increased store visits, combined with tariff-driven price inflation, will fuel comparable location sales gains. Their analysts forecast U.S. same-store sales advancing 3%, slightly below the 3.8% consensus but still reflecting healthy momentum. Digital commerce operations should expand 10% year over year as the company’s third-party seller platform attracts more merchants.

Essential products, including food, represent roughly 60% of total sales at this retailer. This merchandise mix positions the chain favorably as households redirect spending from wants to needs.

The emphasis on groceries provides insulation from softness in categories like clothing and home furnishings experiencing greater pressure. Substantial investments in online ordering and rapid delivery distinguish this operator from rivals still developing omnichannel infrastructure.

The chain increasingly attracts affluent shoppers seeking better value propositions. This marks a notable shift from historical customer demographics skewing toward lower and middle-income households. Wealthier consumers initially visiting for groceries often explore additional departments, expanding average transaction values beyond staples.

Target Faces Uphill Battle

The Minneapolis-based competitor announces results on Wednesday amid tempered expectations from Wall Street analysts. The current valuation of approximately 11 times forward earnings suggests investors view the company as facing structural headwinds. By contrast, Walmart commands 35 times projected profits, creating an unusually wide valuation differential reflecting starkly different outlooks.

Projections call for 1% to 2% comparable sales declines in optional purchase categories where this retailer previously excelled. Merchandising errors in apparel and home categories led to excess inventory accumulation. Aggressive promotions to liquidate surplus stock damaged profitability while failing to restore customer traffic to satisfactory levels.

Truist Securities identified product selection and marketing missteps as significant self-inflicted damage requiring urgent attention. BTIG Research noted that competitive dynamics won’t pause while the company addresses internal issues. Rivals continue gaining market position as this chain wrestles with execution problems distinct from broader economic challenges.

Economic Backdrop Complicates Picture

While headline GDP growth appears robust, economic activity derives primarily from technology infrastructure investment rather than consumer expenditure. This creates a disconnect between macro statistics and household sentiment. Employment gains decelerated markedly from the prior year according to major payroll processors, with particular weakness in consumer-facing industries.

Workforce reductions are accelerating, with joblessness reaching levels not seen since 2021. Recent surveys indicate 40% of companies eliminated positions during 2025 through October. Approximately 60% anticipate additional workforce cuts during 2026 based on human resources professional polling. This foreshadows continued labor market softness ahead.

Announced job eliminations totaled 1.1 million workers through October, climbing 44% versus 2024, according to tracking firm Challenger, Gray & Christmas. This environment creates substantial obstacles for non-essential spending as employment uncertainty prompts households to curtail purchases regardless of income levels.

Consumer price inflation registered 3% in September, rising from 2.3% in April before tariff implementation during the spring and summer months. Effective tariff rates now reach 18% compared to 2.4% in January, per Yale Budget Lab calculations. This represents one of the most aggressive tariff escalations in modern economic history.

What Investors Should Watch

Junior finance analysts recommend focusing on forward guidance and management commentary rather than just backward-looking metrics. Retailer discussions about shopping behavior patterns, inventory positioning relative to demand forecasts, and promotional intensity plans offer insights into holiday expectations carrying more significance than past results.

Gross margin performance amid tariff costs also matters substantially for assessing business quality. Operators successfully passing expenses to customers demonstrate pricing authority.

Those absorbing tariffs through profit compression face profitability challenges that compound if duties persist at elevated levels. Management remarks about tariff navigation strategies will meaningfully influence investor sentiment.

Should Walmart exceed projections while Target falls short as widely expected, the market share gap accelerates further with potentially severe implications for competitive positioning. Alternatively, any evidence that Target stabilized operations might spark considerable short position covering given prevailing negativity. Either scenario substantially affects sector allocations through year-end and into 2026 as consumption patterns continue evolving amid economic uncertainty.