Voyager Digital announced that it would list yearn.finance and Band Protocol on its commission-free trading platform. Both of them are emerging companies in the DeFi sector. Voyager Digital, a publicly traded and regulated crypto-asset broker that offers a turnkey solution for crypto trading, looks to further its engagement in the emerging DeFi sector.

Voyager’s Continued Expansion of its Services

Voyager has continued to expand the features and tokens offered to its customers. Since inception, the platform has built infrastructure allowing users to trade, and earn with 40+ different digital assets. In addition, Voyager is interconnected with various exchanges, providing investors with competitive pricing, fast transactions, and efficient executions.

Details of the Two Newly-Listed Companies

Yearn.finance allows customers to maximize their DeFi yields across various platforms. The project has a unique model that has played a huge role in its astronomical climb to achieve price levels of over $35,000 per coin.

Band Protocol offers a secure and decentralized oracle framework for Web 3.0 applications. The platform connects smart contracts with trusted off-chain data to preserve its integrity via tokenomic incentives. In essence, the platform is helping to create a trusted information-sharing bridge between Web 3.0 and Web 2.0.

What the Voyager Digital CEO Had to Say

While commenting on the issues, Steve Ehrlich, the Voyager Digital CEO, said that the listing of the two companies was keeping their promise to expand their DeFi product offerings. He said that it would position the platform as a secure and safe way for crypto investors to gain exposure in the DeFi markets.

The CEO noted that they had made several major upgrades to the platform since its launch to enhance the user interface. He said that as recent announcements had shown, they were committed to the improvement of the customer experience and the success of the platform.

Towards the end of August 2020, Voyager listed Polkadot, an emerging asset within the DeFi sector. Many experts predict that it will make waves in the sector due to its smart contract capabilities and interoperability.

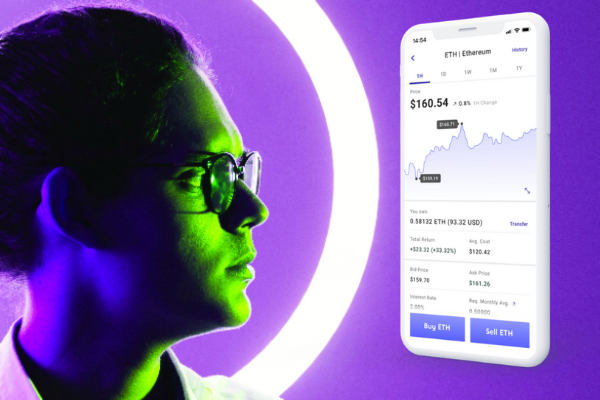

At the start of September 2020, Voyager revealed the highest interest rate since its launch. In the announcement, the platform announced that customers could earn up to 9.5% on USDC, 6.5% on BTC, and 5% on ETH. Other DeFi assets that Voyager has made available to crypto traders on its interest program are Chainlink ( LINK ) and the Kyber Network, which is the largest DeFi token.

About Voyager Digital

The Voyager Digital platform operates as a crypto-asset broker that offers both institutional and retail investors turnkey solutions to trade in the crypto space. The platform offers customers safe custody and top tier execution on some of the most popular crypto-assets.

Voyager Digital was founded by experienced financial and technology experts. These experts combined their Wall Street and Silicon Valley experience to create a more transparent, cost-effective, and better alternative market for crypto assets.

Traders on the platform benefit from no commission trading. They can access the platform via an Android or iOS app to begin trading.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice. This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.