The Indian Rupee (INR) edged higher against its major peers on Friday, even as India’s private sector activity growth slowed in November. The move comes after the release of preliminary HSBC Purchasing Managers’ Index (PMI) data, showing a moderation in the expansion of the manufacturing sector, while the services sector continued to perform strongly.

Meanwhile, the US Dollar (USD) remains broadly firm, supported by recurring inflation risks and mixed labor market signals. In their newest publication, Arbitics experts explore the key elements of the topic in depth.

Indian Rupee Gains Amid Mixed PMI Data

The Indian Rupee attracted slight bids against major currencies after the release of India’s preliminary HSBC Composite PMI for November. The report indicated that overall business activity expanded at a moderate pace, but growth showed signs of cooling.

The HSBC Composite PMI declined to 59.9 from 60.4 in October, largely due to a slowdown in the manufacturing sector. The Manufacturing PMI fell to 57.4 from 59.2, despite the government’s recent reduction of Goods and Services Tax (GST) rates across all product categories. On the other hand, Services PMI expanded faster to 59.5 from 58.9, highlighting resilient domestic demand in the services segment.

Broader Drivers for INR Movements

Despite the recent uptick, the Indian Rupee has been underperforming for much of the year due to ongoing US-India trade negotiations. Although no formal trade deal has been finalized, both governments have indicated that a bilateral pact is expected soon.

Earlier in November, the US President signaled that tariffs on Indian imports might be reduced “at some point in time.” Currently, the US imposes 50% tariffs on select imports from India, including an additional 25% levy on oil imports from Russia.

On the monetary policy front, market analysts expect the Reserve Bank of India (RBI) to cut interest rates in its upcoming December policy meeting. Analysts at Morgan Stanley forecast a 25-basis point (bps) reduction in the Repo rate, bringing it down to 5.25%, citing inflation undershooting the central bank’s 2%-6% target range.

USD/INR Under Pressure as Fed Dovish Bets Decline

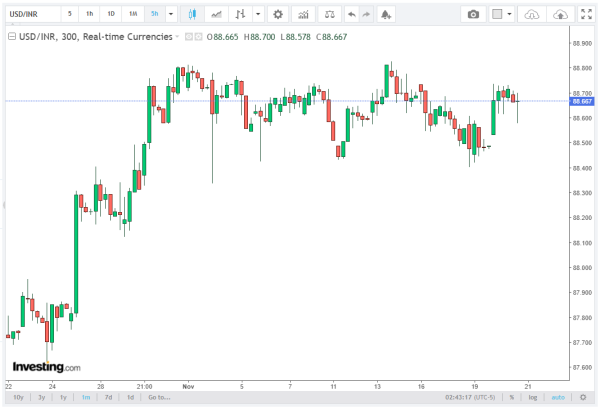

The USD/INR pair ticked down to around 88.75 following India’s HSBC PMI release, although it remains broadly firm as the US Dollar Index (DXY) trades near 100.36, the highest in over five months.

Traders have pared dovish Fed expectations, as members of the Federal Open Market Committee (FOMC) continue to emphasize a restrictive monetary policy stance to ensure inflation sustainably returns to the 2% target. The October FOMC minutes revealed reluctance among policymakers to cut interest rates in December, citing the need to maintain household confidence in the Fed’s commitment to price stability.

According to the CME FedWatch Tool, the probability of a 25-bps rate cut to 3.50%-3.75% in December now stands at 35.5%, slightly higher than 30% recorded earlier this week after the release of US Nonfarm Payrolls (NFP) data for September.

The US NFP report showed that the unemployment rate rose to 4.4% from the prior reading of 4.3%, while job creation remained robust with 119K new workers added. Cleveland Fed President Beth Hammack emphasized that the data was “a bit stale” due to **government shutdown delays,” and monetary policy must continue focusing on curbing inflation.

Technical Analysis: USD/INR Near Key Support and Resistance

From a technical perspective, the USD/INR opened near 88.80 on Friday, with the 20-day Exponential Moving Average (EMA) at 88.70 providing a crucial support level for USD bulls.

The 14-day Relative Strength Index (RSI) has rebounded towards 60.00, indicating the potential for renewed bullish momentum if it decisively breaks above that level.

On the downside, the August 21 low of 87.07 remains a critical support level. Conversely, the all-time high of 89.12 represents a key resistance barrier. Market participants will be closely monitoring these levels for potential breakouts or reversals.

Investors are also eyeing the upcoming flash US S&P Global PMI data for November, scheduled at 14:45 GMT, which could influence short-term USD/INR moves.

Outlook

In summary, the Indian Rupee edged higher amid mixed PMI data, reflecting a moderate slowdown in manufacturing growth but continued strength in services activity. The USD/INR pair remains supported by a resilient US Dollar, rising inflation risks, and cautious market expectations regarding Fed monetary policy.

Key technical levels suggest that 88.70 EMA remains pivotal for support, while the all-time high near 89.12 will likely cap upside momentum unless broader market conditions change. Investors should watch both domestic PMI indicators and US macroeconomic releases closely for guidance on USD/INR positioning.