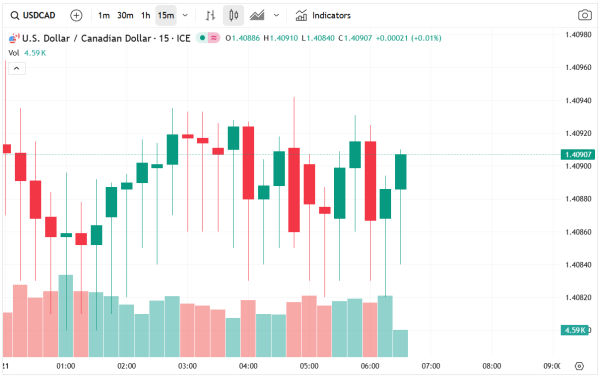

The USD/CAD currency pair pushed higher during Wednesday’s trading session, extending its broader bullish trend as the 1.40 support level continues to hold firm. This technical area has acted as a major floor in price action, supporting the pair repeatedly and reminding traders that the underlying bias remains tilted to the upside.

With the US dollar benefiting from improving yield dynamics and persistent demand flows, the Canadian dollar continues to face headwinds driven by both domestic and cross-border factors. In this article, Arbitics brokers take a closer look at the most important aspects of the topic.

Technical Overview: USD/CAD Extends Gains From 1.40 Support

During Wednesday’s trading session, the US dollar surged higher against the Canadian dollar, reinforcing the significance of the 1.40 handle as a strong support zone. For several weeks, traders have treated this level as a strategic barrier, and Wednesday’s reaction only adds weight to its role in determining near-term momentum.

50-Day EMA Offers a Bullish Signal

One of the most important technical developments this week was the market’s response to the 50-day Exponential Moving Average (EMA). The pair found clean support at this dynamic indicator, suggesting that trend-following algorithms, institutional models, and systematic trading strategies continue to lean bullish.

The 50-day EMA often acts as a short-to-medium-term trend gauge, and its ability to hold reinforces an expectation that upward momentum remains intact.

Given this backdrop, USD/CAD appears positioned to “grind higher”, a phrase traders often use to describe an uptrend built more on persistent flows than speculative bursts. Indeed, much of the activity in this pair stems from commercial hedging, energy-market flows, and cross-border trade transactions, rather than high-beta speculative demand.

Upside Targets: 1.42 and 1.4250 in Focus

From a structural perspective, the next key upside levels include 1.42 and 1.4250, both of which serve as important resistance zones. These levels were formed following a major plunge in April, leaving behind a large concentration of supply, pending sell orders, and institutional positioning.

If USD/CAD breaks cleanly above 1.42, the market could accelerate upward in search of the next liquidity pocket near 1.4250. These areas are expected to attract algorithmic activity and may become inflection points where volatility spikes.

The Trade Rift Remains but Is Not Broad-Based

A subtle but ongoing factor influencing the Canadian dollar is the lingering trade rift between the United States and Canada. Importantly, this tension does not affect the entire trade relationship. Instead, it centers on issues left unresolved, mostly involving sector-specific disputes rather than broad tariff or structural measures.

This context is critical because the Canadian economy is deeply dependent on the US economy, with the majority of Canadian exports flowing south of the border. Even minor political uncertainty can create investor hesitation toward holding the Loonie or allocating capital into Canadian assets. This undercurrent of caution adds to the broader bearish pressure on the CAD.

Interest Rate Differential Supports USD Strength

One of the strongest drivers behind the recent USD/CAD move is the interest rate differential between the United States and Canada. The U.S. continues to offer comparatively higher yields, supported by resilient economic data and a Federal Reserve that remains cautious about cutting rates prematurely.

A notable element this week is the timing of the US nonfarm payrolls report. With the data release expected after the upcoming Federal Reserve communications, markets believe policymakers will maintain current language, reducing the likelihood of any early shifts toward rate cuts. This dynamic preserves a favorable carry advantage for traders holding long USD positions.

As a result, many market participants simply choose to hold long USD/CAD positions and collect the daily swap, especially in quieter sessions. This reinforces the “grind higher” pattern rather than explosive breakouts.

Market Tone: Volatile, Choppy, but Directionally Biased to the Upside

USD/CAD is historically known for choppy, noisy, and sometimes erratic price action due to energy market flows, commodity sensitivity, and trade-related headlines. Under normal circumstances, this pair does not always trend smoothly, and this week’s behavior continues that tradition.

Conclusion: USD/CAD Likely to Continue Its Upward Grind

The USD/CAD pair remains structurally bullish as long as the price holds above the 1.40 support level. Technical signals such as the 50-day EMA bounce, combined with macro drivers like U.S.–Canada trade dynamics and the interest rate differential, suggest continued upward drift.

Targets remain centered around 1.42 and 1.4250, though the journey will likely be uneven and characterized by typical USD/CAD volatility. For traders, this environment favors trend continuation strategies, carry-positive positioning, and close monitoring of the key resistance levels overhead.