Target, the Minneapolis-based retailer, delivered results on Wednesday that confirmed investors’ worst fears about its competitive positioning and execution capabilities. Shares plummeted following an earnings announcement that revealed comparable sales declines, compressed margins, and a cautious outlook heading into the critical holiday shopping period.

Lead financial analysts at Unirock Gestion examine what went wrong and whether management can orchestrate a turnaround before further market share erosion occurs.

The company reported adjusted earnings of $1.85 per share, substantially missing the consensus estimate of $2.29 and declining from $2.10 reported in the prior year period. This represented one of the most significant misses in recent memory for a retailer that historically demonstrated reliable execution. Total revenues reached $25.67 billion, falling short of the $25.91 billion estimate and raising questions about traffic trends.

Traffic Declines Tell Troubling Story

Beyond the headline numbers, underlying metrics painted an even more concerning picture. Customer traffic declined meaningfully during the quarter across both physical stores and digital channels. This represents the retailer’s most fundamental challenge, as attracting shoppers into stores or onto websites forms the foundation for any recovery strategy.

The traffic weakness wasn’t evenly distributed across income demographics. Lower and middle-income consumers pulled back most dramatically as they redirected spending toward essential goods at value-oriented competitors. Affluent shoppers who historically viewed this chain as a preferred destination also reduced visit frequency, suggesting the problem extends beyond just economically stressed households.

Discretionary Categories Collapse

Weakness concentrated heavily in discretionary merchandise categories, including apparel, home goods, and electronics, where the retailer traditionally enjoyed competitive advantages. These segments typically carry higher profit margins than groceries and essentials, making their underperformance particularly damaging to overall profitability.

Apparel sales suffered from merchandising missteps where product selections failed to match consumer preferences. Excess inventory accumulated in certain categories requires aggressive markdowns to clear. These promotions moved merchandise but destroyed margins in the process. The resulting profit compression offset any benefit from moving stale inventory.

Home furnishings and décor categories experienced pronounced weakness as consumers deferred optional purchases for their residences. With elevated mortgage rates keeping housing market activity subdued, related spending on home goods naturally contracted. The retailer’s exposure to these categories created vulnerability that competitors with different merchandise mixes avoided.

Margin Pressure From Multiple Angles

Gross margins compressed substantially compared to prior year periods. Multiple factors contributed, including promotional activity to clear excess inventory, unfavorable product mix shifts toward lower margin categories, and elevated shrinkage from theft. These pressures proved more severe than management had anticipated when providing previous guidance.

The shift toward essential goods purchases versus discretionary items fundamentally altered category mix economics. Groceries and household basics carry substantially lower margins than apparel and home goods. As consumers redirected spending toward necessities, the retailer captured some of those sales but at dramatically lower profitability per dollar of revenue.

Theft and shrinkage reached levels described by management as unsustainable. Organized retail crime networks target the chain’s stores, particularly in urban locations. The company invested in additional security measures, including locked display cases and increased staffing, but these solutions add costs while potentially deterring legitimate shoppers through reduced convenience.

Valuation Presents Complex Picture

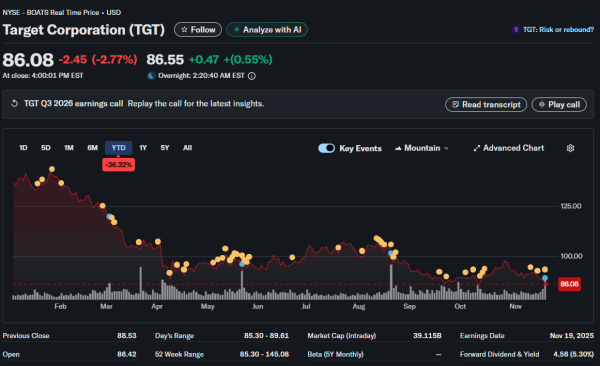

At approximately 11 times forward earnings estimates, the stock trades at a substantial discount to Walmart’s 35 times multiple. This valuation gap reflects dramatically different market assessments of competitive positioning and growth prospects. Some value-oriented investors view current prices as attractive, assuming management can stabilize operations.

However, valuation appears cheap for valid reasons given the deteriorating fundamentals. Declining comparable sales and compressed margins justify lower multiples than competitors, demonstrating strong execution. The question involves whether the current valuation adequately reflects downside risks or has overcorrected, creating an opportunity.

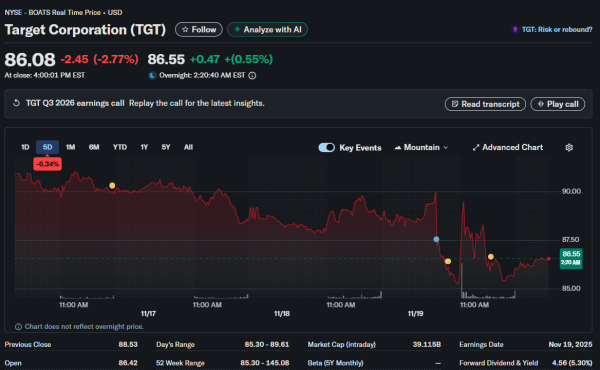

Options markets implied an 8% potential move in either direction following earnings, suggesting elevated uncertainty about results. The actual post-earnings decline exceeded that range, indicating results fell short of even pessimistic expectations. This creates additional technical pressure as stop losses trigger and momentum strategies exit positions.

Institutional ownership declined during recent quarters as professional investors reduced exposure amid deteriorating trends. Further institutional selling could pressure shares regardless of valuation metrics if portfolio managers conclude the turnaround will require longer than initially anticipated. Retail investor sentiment also soured following repeated disappointments.

Path Forward Remains Uncertain

Analysts emphasize that this retailer confronts both cyclical and structural challenges simultaneously. Cyclical pressures from cautious consumer spending will eventually ease as economic conditions normalize.

Structural issues around competitive positioning and merchandising execution require fundamental strategic adjustments, taking considerably longer to address.

The widening performance gap versus Walmart suggests structural problems beyond just temporary economic headwinds. Consumers have options and are voting with their wallets by choosing competitors offering superior value or more compelling product assortments. Reversing these preference shifts demands more than just modest tactical adjustments.