Major US equity benchmarks reached new all-time highs before Federal Reserve Chair Jerome Powell’s surprisingly firm remarks triggered abrupt selloffs. His cautionary message about December policy uncertainty revealed the shaky foundation beneath recent market gains.

The volatile session demonstrated how heavily stocks depend on expectations for ongoing monetary support from the central bank. A lead financial expert at LFTrade analyzes why Powell’s unexpected tone shift matters and what it means for investors.

Early Enthusiasm Fades Fast

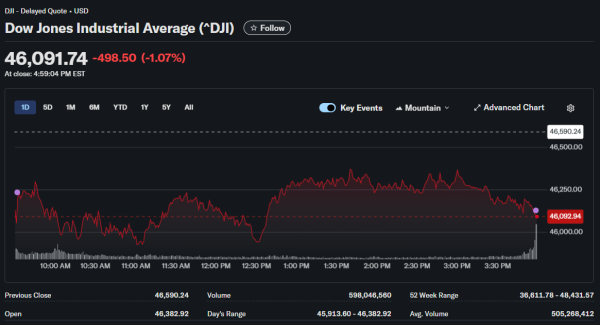

The session opened on an optimistic note as the Fed delivered its expected quarter-percentage-point interest rate cut bringing rates to 3.75%-4%. The Dow Jones climbed to intraday highs while the S&P 500 briefly pushed through recent milestones. Nvidia’s breakthrough past a $5 trillion valuation added fuel to technology sector gains.

The Nasdaq Composite led morning advances as traders cheered the chip maker’s historic market capitalization achievement. Confidence in the artificial intelligence investment thesis stayed strong through early trading hours. However, sentiment shifted abruptly once Powell began his scheduled media briefing following the policy announcement.

His opening statement contained surprisingly hawkish language that caught market participants off guard. The direct wording compelled instant recalibration of expectations about additional rate reduction timing. Price action reversed sharply as traders hastily adjusted positions.

Fed Chief Issues Frank Warning

Powell made clear that another December interest rate cut isn’t guaranteed by any means. He explained that central bank officials hold starkly different views regarding appropriate next moves. A growing contingent within the committee favors waiting at least one meeting before enacting further reductions.

This messaging represented a notable shift from the Fed’s September session when policymakers indicated three total rate cuts throughout 2025. Traders had grown accustomed to assuming December would naturally bring the third reduction. Powell’s blunt phrasing demolished that comfortable assumption investors had adopted.

The Fed leader revealed significant internal disagreement about balancing inflation risks against employment worries. Some officials prioritize avoiding labor market weakness while others stress inflation remaining above the target rate. This core disagreement makes projecting a unified policy path challenging.

Indexes Give Back Gains

The Dow finished lower by 74 points or 0.2% at 47,632 after touching peaks earlier in the day. The S&P 500 ended essentially flat at 6,891, erasing its morning advance. Only the Nasdaq managed to close higher, gaining 0.55% to reach 23,958, propped up entirely by Nvidia’s continued strength.

Treasury yields jumped sharply as bond traders adjusted to reduced rate cut prospects. The benchmark 10-year note yield climbed to 4.07% from 3.98% in a matter of hours. This represented one of the biggest single-day increases seen in recent months.

Derivative markets showed traders dramatically cut December rate cut odds to 60% from 90% earlier. Futures pricing now reflects meaningful probability the Fed keeps rates steady through year-end. This marked a substantial reassessment occurring within mere hours of Powell’s comments.

Committee Split Widens

The 10-2 vote approving the rate reduction masked considerable disagreement among committee members. Governor Stephen Miran dissented by advocating a larger half-point cut to provide stronger employment support. Kansas City Fed President Jeffrey Schmid dissented from the opposite angle, preferring no rate cut at all.

These opposing dissenting votes highlight genuine uncertainty about proper policy given mixed economic data. Powell acknowledged some officials worry most about labor market risks while others focus on persistent inflation threats. Having only one main policy lever available, the Fed cannot address both concerns simultaneously.

This level of internal division appears unusual and suggests prolonged uncertainty about future moves. Past episodes of Fed disagreement have often preceded periods of market volatility.

Missing Data Creates Problems

The ongoing government shutdown blocks release of critical economic reports including October jobs and inflation data. This forces the Fed to make policy using incomplete information about current conditions. Powell compared the predicament to driving in fog and emphasized the need for extra caution.

He stressed that private sector reports cannot fully replace official government statistics from federal agencies. These figures represent the gold standard for measuring economic health accurately. If the shutdown continues much longer, the Fed may need to delay policy decisions until better data becomes available.

This creates a situation where political gridlock directly limits monetary policy flexibility. The Fed typically prefers making decisions based on comprehensive information rather than scattered data points.

Challenging Period Ahead

Markets must navigate substantially reduced clarity about Fed policy heading into year-end. December might bring another rate cut but odds have fallen dramatically. Any additional hawkish signals during November could reduce expectations further.

Economic data releases will face intense scrutiny once the government eventually reopens. October jobs and inflation reports will prove crucial for shaping December’s policy decision. Corporate earnings from major tech companies will test whether AI growth optimism is justified.

The combination of Fed uncertainty, market concentration, and mixed economic signals creates genuinely challenging conditions for investors. Indexes sit at record levels but the foundation supporting these heights looks increasingly fragile. Any significant negative surprise could trigger volatility that narrow breadth would magnify substantially.