Line, a major Japanese social network with over 700 million users, recently announced that it would begin trading its digital currency, LINK, in Japan starting in April 2020. This is a major development since Line has over 700 million users globally.

History of LINK

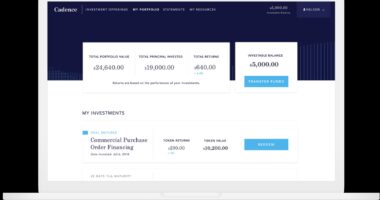

The LINK digital currency has been available since 2018. However, it was not allowed in Japan due to regulatory hurdles. It is also still not available to users in the US. Line already has a crypto exchange called BITBOX, which lets users outside of the US and Japan buy and sell crypto. Despite the social media company’s massive success, has not managed to break into the top 100 cryptocurrency exchanges list. Data on CoinMarketCap shows that it is ranked at 291. Most of the trading on the exchange is between ETH and BTC. In 2019, the Line platform launched Bitmax, a crypto exchange built into the Line app.

2020 the Year of Success?

It appears that line has finally met the strict conditions of the Japan Virtual Currency Exchange Association that will allow the LINK digital asset to trade in Japan. Very few details are known about the deal thus far. However, the press release indicates that it will launch in April.

Social Media & List of Failed Cryptocurrencies

There has been a major push by social media companies to launch digital currencies. Thus far, most of those efforts have not gone down well. A good example is Telegram, which has faced numerous legal problems around its TON token. The company raised over a billion dollars but it has been unable to utilize those funds to launch the TON token. Various reports indicate that Telegram has abandoned efforts to launch the TON tokens within Telegram. Instead, the company will launch a separate app for TON.

Another social media firm that has tried to launch a digital currency is Facebook. Since then, the company has faced a lot of opposition from regulators. Some have even called for the plans to be shelved. Despite these problems, Facebook plans to launch its digital currency at some point this year. One social media giant that has not hopped onto the digital currency bandwagon is Twitter. The company has ruled out any possibility of launching a digital currency. This is even though its CEO is one of the most famous proponents of crypto in the world.

Line is winning

Line appears to be handling the launch of a digital currency quite well. It does not seem to be facing the problems plaguing other social media giants. Perhaps they could all borrow a leaf from the company on how to get a digital currency launch right.

However, it is not clear whether its launch of a digital currency will have any positive impact on its popularity. It is worth noting that Japan has a well-developed crypto market and this could help to boost the popularity of LINK. Line will probably embark on creating new users cases for LINK in Japan after the launch.

List of Popular Japanese Cryptocurrency

Japan is one of the global leaders in blockchain development. Japan became one of the first countries to regulate cryptocurrencies activities, as its evident by now that they want to be a global leader in the space long-term. The LINK digital currency will join a list of popular Japanese cryptocurrency such as Monacoin, NEM, Ethereum, and Ripple.

Image Source: Pixabay

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice. This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.