Hacking of crypto exchanges has become quite prevalent. Even large exchanges that can afford a quality security system have been hacked. While the industry has become better at dealing with insecurity, another hack is usually always around the corner. However, there is an exchange that is aiming to change all that. The Nash crypto exchange will not require users to give up control of the funds until just before they make a trade.

The Effects of Insecurity in the Crypto Industry

One of the most obvious effects is that it causes people to leave the sector and discourages others from joining. For instance, with reports of billions of dollars being stolen from crypto exchanges in just months, it is unlikely that an institution such as a hedge fund would risk its funds in the crypto world. It also causes governments to take a harsher stance on crypto exchanges. Governments must protect their citizens and if crypto exchanges cause them to lose money, they will just ban them.

How Nash will Secure Funds

In the past, a crypto exchange would take over custody of any crypto deposited with them. This strategy has proven to be quite attractive to hackers since even a single lucky hack could lead to a payday worth hundreds of millions of dollars. With Nash, users will maintain custody of their coins. This will deter any hackers since they know there will likely not be any meaningful amounts of funds at the exchange’s crypto wallet.

Using State Channel Smart Contracts

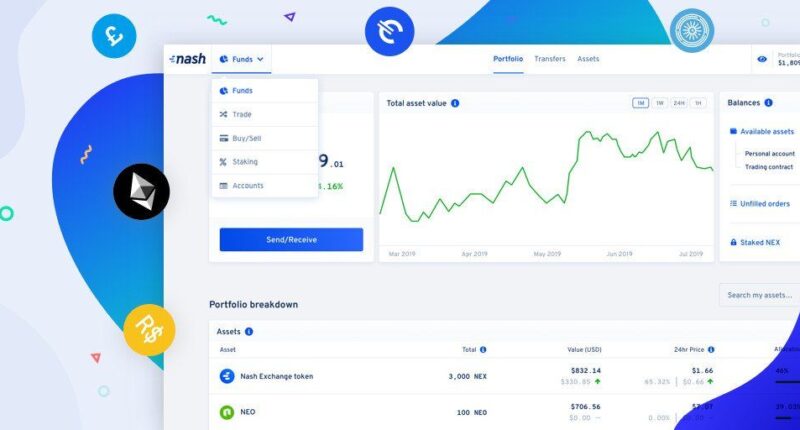

To handle trading, Nash relies on state channel smart contracts. The exchange is expected to add BTC support soon. Currently, its focus is on the NEO-ETH market. To make transactions possible, the exchange using a technical trick where two parties place funds in a 2-of-2 multsig address. A valid transaction is then created from the address to the personal addresses of the two parties. None of the transactions generated through this process are sent to the blockchain. Only transactions at the end when both parties leave the payment channel go to the blockchain. While decentralized exchanges have been around for years, a major benefit of state channels is that transfer can happen instantly.

It is impossible to steal customers’ fund but hackers could still push malicious software into the devices of Nash clients. Despite this, the exchange offers a lot of security to traders. The entire exchange relies on the integrity of smart contracts. However, various vulnerabilities have been revealed in smart contracts.

This non-custodial solution is being investigated by various projects. Besides the exchange, Nash plans to launch a mobile wallet soon, payment-processing service for merchants, and a browser extension. While some BTC developers have expressed fears that the coin itself could fail one day, the Nash exchange and other similar projects are a welcome development. It will help to boost the security of the crypto industry and get more people to launch the digital currency space. Besides that, this type of technology makes it impossible to impose a ban on digital currencies, which some governments would love to see happen.

Image Source: Nash Twitter

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice. This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.