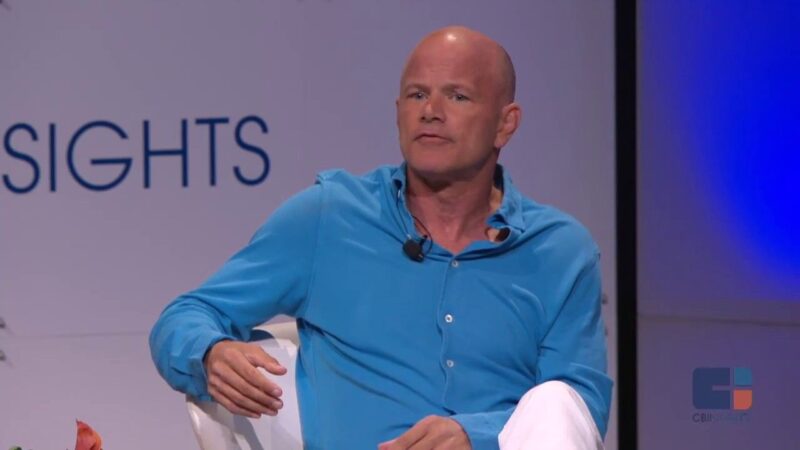

Bitcoin Titan, Mike Novogratz predicted the next move of Bitcoin, the world’s largest cryptocurrency by market capitalization. This move isn’t exciting for the crypto community as he believed Bitcoin could see another 13% fall to USD $6500.

Mike Novogratz is an ex-hedge fund manager, a former Goldman Sachs trader, and the current chief executive officer of Galaxy Digital Holdings Ltd. During an interview with CNBC, Mike says “There’s been a bunch of negative things that have happened recently,” and believed, the crypto industry might witness Bitcoin’s next leg lower. According to him, it will most likely decline by 13% of its current value. Notably, at the time of reporting, Bitcoin fell below $7600 recently. It is holding the current market capitalization of $135,218,709,844 with a brief surge of 0.46 percent within the past 24Hrs.

Mike Novogratz seemingly thinks for a longer term as he said;

“I’m hoping it holds here. $6,500 would be the next downside…I think you got to get back through $8,200 first and if it gets back through $8,200 we’re then back at the $8,000-$10,000 range. It’s going to need new energy to really make the big move,”

In his continuous talk, he also added that” Bitcoin will need new energy” to turn its way back to the $8000 range. Mike further believes that the harsh decision of the U.S Security and Exchange Commission (SEC) towards Telegram’s upcoming cryptocurrency has also adversely affected the largest cryptocurrency, Bitcoin. He stressed, “That was a kick in the stomach to the overall crypto ecosystem”.

Although his prediction of Bitcoin’s next move is quite depressing for the entire crypto community, he revealed his plan of launching a Bitcoin fund that is designed to serve custodial solutions for the crypto assets.

“It’s just a bitcoin fund that takes care of custody it, takes care of pricing it…It’s got one-week liquidity. So it just allows people to invest in bitcoin without setting up a Coinbase account, without worrying that their phone is going to get lost.”

While he thinks few negative sentiments pushed leg over Bitcoin’s growth, he also revealed few attempts that could create positive vibes. He said, ICE-backed bitcoin futures exchange, Bakkt is one such catalyst that might bring potential in the crypto industry again. As Bakkt attracts institutional traders, Analyst Mati Greenspan also echoed a similar concern and emphasized Bakkt’s all-time highest volume. In his words;

Not that $4.8 million is a lot of money on Wall Street but it’s good to see these contracts gaining traction on a volatile trading day.

Image Source – Youtube

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice. This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.