In recent internal discussions, brokers from Nexdi have been closely analyzing which major dividend payer is most likely to ascend into the prestigious ranks of Dividend Kings within the next two years. Their attention has zeroed in on Medtronic, a healthcare technology leader whose consistent dividend strength stands out across the market.

With almost half a century of uninterrupted dividend growth, a robust financial foundation, and a strategic roadmap for expansion, Medtronic’s profile is increasingly compelling. It’s 48 consecutive years of dividend increases, positioning it at the doorstep of an elite category reserved for only the most stable and shareholder-friendly companies.

Approaching the Dividend Throne

Dividend Kings are a rare breed. Only 56 companies currently hold the title, each having raised dividends for 50 straight years. In the view of many financial experts, a select few candidates are closing in on their crowning moment, but Medtronic stands out as one of the strongest contenders.

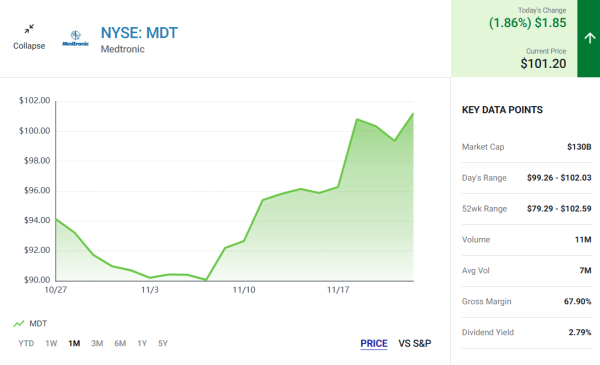

After announcing another dividend increase this May, Medtronic pushed its streak to 48 consecutive years. The new quarterly payout of $0.71 per share marks yet another incremental rise, bringing the annualized dividend to $2.84. At today’s prices, this translates into a yield of 2.9 %, more than double the broader S&P 500’s 1.2 %.

This consistency is not only impressive but also central to why analysts expect the company to achieve Dividend King status within just two years.

Strong Cash Generation Supports Continued Growth

Brokers emphasize that one of Medtronic’s greatest advantages is its ability to consistently generate strong cash flow, providing the fuel needed to support both ongoing operations and shareholder returns. In its 2025 fiscal year, the company produced $5.2 billion in free cash flow, easily covering its roughly $3.6 billion dividend commitment. This healthy surplus gives Medtronic significant room to maneuver, whether by funding strategic initiatives or continuing its long-running pattern of dividend increases.

Even as it rewards shareholders, Medtronic maintains an aggressive investment posture aimed at future growth. The company allocated $2.7 billion to research and development, ensuring a steady pipeline of innovations across its medical technology portfolio.

It also invested $1.9 billion in capital expenditures, strengthening manufacturing capabilities and operational infrastructure. Remarkably, these sizable investments did not strain its financial capacity. Instead, Medtronic preserved strong free cash flow, underscoring the durability and efficiency of its business model.

Balance Sheet Stability Strengthens the Case

Financial health goes beyond cash flow. Medtronic maintains a solid A/A3 bond rating, supported by $2.2 billion in cash, $6.7 billion in investments, and $25.6 billion in long-term debt. This balance sheet strength has given the company room to execute more shareholder-friendly actions, including meaningful stock buybacks.

Last year, Medtronic repurchased $3.2 billion of its own shares. Because its share count declined significantly, the total cash paid in dividends actually fell from nearly $3.7 billion to under $3.6 billion, despite the rise in per-share payout. That efficiency is a hallmark of sustained dividend performers.

Current Performance and Future Outlook

From an operational standpoint, Medtronic is demonstrating the momentum needed to keep raising dividends. In its second quarter of fiscal 2026, the company reported:

- 6.6 % revenue growth

- 8 % EPS growth

- Upgraded full-year guidance, projecting 5.5 % revenue growth and 4.5 % EPS growth

These results reflect healthy demand across key product segments and the impact of ongoing strategic improvements.

The company is also positioning its operations for stronger long-term performance. One of the most notable moves is the planned separation of its diabetes business.

The transaction could involve an IPO followed by a split-off, with proceeds intended for additional share repurchases. Critically, the company has emphasized that the separation will not affect its dividend policy.

In parallel, Medtronic created a new growth committee to steer acquisition strategy, R and D decisions, and potential future divestitures. This targeted approach underscores its commitment to accelerated expansion in the years ahead.

On Track for the Crown

With nearly five decades of dividend raises, strong fundamentals, and a clear long-term growth plan, Medtronic appears firmly on the path to becoming the next Dividend King. The brokers reviewing its trajectory note that the company’s combination of cash flow stability, financial discipline, and strategic agility align perfectly with the traits that define elite dividend performers.

For income-focused investors, the company’s steadily rising payout, healthy balance sheet, and ongoing efforts to enhance profitability make it a compelling consideration. If Medtronic maintains its current pace, it should achieve the coveted Dividend King milestone in just two years.