Gold (XAU/USD) started Thursday’s European session with modest intraday losses, maintaining a cautious tone as traders await the delayed release of the US Nonfarm Payrolls (NFP) report. The USD remains resilient, buoyed by reduced expectations of another Federal Reserve (Fed) interest rate cut.

This dynamic exerts downward pressure on non-yielding Gold, which traditionally underperforms when the greenback strengthens. The Fimatron team provides readers with a comprehensive and thoughtfully organized breakdown.

The Fed’s hawkish stance, highlighted in the minutes of the October 28-29 FOMC meeting, revealed a split among policymakers. While some members favored lowering the federal funds rate, others warned against further cuts due to the risk of entrenched inflation.

As a result, market participants have scaled back bets for an imminent rate reduction, lifting the USD to its highest level since late May during the Asian session and putting additional pressure on XAU/USD.

Risk-On Mood Weakens Gold’s Safe-Haven Appeal

Aside from monetary policy expectations, the prevailing risk-on sentiment has also weighed on Gold. Optimism in global equity markets and geopolitical developments can reduce demand for safe-haven assets like Gold.

In particular, reports suggesting progress in the Russia-Ukraine peace talks, including a 28-point plan reportedly approved by the US President, contributed to risk appetite. News of a rare US delegation visit to Kyiv to discuss concessions and military reductions in Ukraine also fueled bullish sentiment in risk assets, indirectly pressuring Gold.

However, persistent concerns over US economic momentum, especially following the longest-ever US government shutdown, continue to provide a floor for Gold prices. Investors remain alert to any softening in US labor market data, which could revive demand for XAU/USD as a hedge against economic uncertainty.

Focus Shifts to US Nonfarm Payrolls

Traders are now eyeing the US Nonfarm Payrolls (NFP) report, scheduled for release later today. This key economic indicator is expected to offer fresh insights into the US labor market, providing a directional cue for both the USD and Gold.

Signs of slowing job growth could pressure the USD lower, potentially giving Gold a short-term boost. Conversely, a stronger-than-expected NFP reading may reinforce USD strength, prolonging Gold’s intraday losses.

Given the current market backdrop, traders are advised to exercise caution and avoid overcommitting positions ahead of this crucial report. The reaction to the NFP data is likely to dictate the next meaningful directional move in XAU/USD.

How the US Dollar Strength Impacts Gold Prices

The recent strengthening of the US Dollar (USD) has emerged as a significant factor weighing on Gold (XAU/USD). As the USD index (DXY) climbs to multi-month highs, Gold’s appeal as a safe-haven asset diminishes, given its non-yielding nature. Traders often sell Gold when the greenback gains traction, as it becomes more expensive for holders of other currencies.

This inverse relationship highlights why reduced Fed rate cut expectations and persistent USD buying pressure are key drivers of Gold’s intraday performance, setting the stage for the market reaction once the US Nonfarm Payrolls (NFP) data is released.

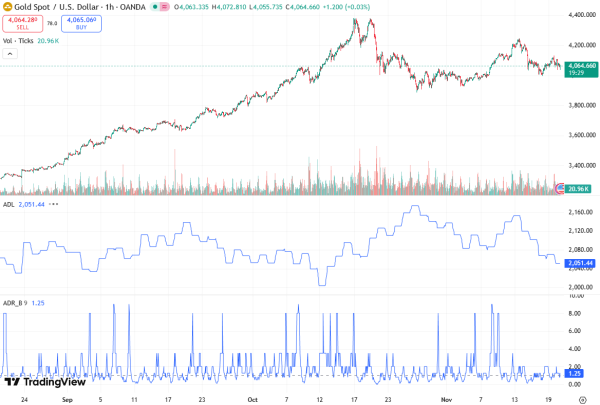

Technical Outlook: Key Support and Resistance Levels

From a technical perspective, Gold is holding above critical support levels, but pressure persists near the 200-period Exponential Moving Average (EMA) on the H4 chart, currently around $4,018.

Should XAU/USD breach this zone, the next support level is the psychological $4,000 mark, followed by $3,931, where further downside acceleration could occur. A deeper test may target the late October swing low near $3,886.

On the upside, resistance near the Asian session high around $4,110 could impede immediate gains. A decisive break above the overnight swing high at approximately $4,120 may trigger bullish momentum, potentially lifting Gold toward the $4,152–$4,155 region. If buyers maintain control, a retest of the $4,200 round figure is conceivable, signaling renewed bullish interest.

Market Sentiment and Strategic Implications

The current market scenario highlights the delicate balance between Fed policy expectations, risk-on sentiment, and economic uncertainty. While USD strength and reduced rate cut bets keep Gold under pressure, any signs of US labor market weakness from the NFP report could support XAU/USD and limit further losses.

Technical traders should monitor EMA levels, psychological barriers, and recent swing highs/lows to identify potential entry and exit points. Fundamental traders, meanwhile, will focus on macro developments, including geopolitical events, US economic data, and Fed commentary, to gauge near-term Gold trends.

Conclusion

In summary, Gold’s modest intraday losses reflect a market navigating USD strength, reduced Fed rate cut expectations, and a cautiously optimistic risk-on environment. While short-term declines are limited by underlying US economic worries, the Nonfarm Payrolls report is set to provide fresh impetus for the XAU/USD pair, potentially dictating the next leg of its directional move.