Gold (XAU/USD) traded with a mild negative bias during the Asian session on Monday, slipping toward the daily lows and hovering just below the $4,050 level. The metal is down roughly 0.50% intraday as a persistent risk-on sentiment continues to erode safe-haven demand. This article from VentraTrade broker Rohit Sinha offers readers a clear and detailed explanation of the subject.

Interestingly, the US Dollar (USD) has eased off last week’s multi-month high, limiting deeper losses for the commodity and offering a modest counterbalance amid broader macro uncertainty.

The inability of the USD to extend its strong upward move, previously testing levels not seen since late May, comes as markets digest mixed messaging from Federal Reserve (Fed) officials. This ambiguity has created a choppy backdrop for rate-sensitive assets such as gold, with traders recalibrating expectations surrounding the Fed’s upcoming policy path.

At the same time, geopolitical tensions, particularly those linked to the intensified Russia-Ukraine conflict and renewed instability in the Middle East, continue to lend an underlying cushion to gold prices.

Yet, the positive tone across global equity markets limits safe-haven inflows, keeping XAU/USD contained ahead of this week’s crucial US macro releases, including US Q3 GDP (preliminary) and the PCE Price Index, the Fed’s preferred inflation gauge.

Fed Rate-Cut Bets Rise, but Hawkish Voices Keep USD Supported

Comments from New York Fed President John Williams introduced renewed volatility on Friday. Williams described current monetary policy as “modestly restrictive” and signaled that the Fed may have scope to lower interest rates in the near term. Markets reacted swiftly: futures pricing now indicates roughly a 67% probability of a December rate cut, injecting fresh optimism into risk-oriented assets.

However, the dovish tilt from Williams was met with contrasting views from other Fed officials. Dallas Fed President Lorie Logan reiterated the need to keep rates on hold, emphasizing caution amid still-sticky inflation components. This hawkish counterbalance helped the USD retain a large portion of last week’s gains and acted as a mild headwind for gold prices in early Monday trading.

Geopolitics Remain a Key Variable Supporting Gold

The geopolitical landscape remains a significant contributor to gold’s resilience despite broader risk-taking behavior. Over the weekend, Ukraine launched a large-scale drone attack on a key heat and power infrastructure site in the Moscow region. In turn, Russia reported the capture of three additional villages in eastern Ukraine, signaling an escalation in hostilities.

Adding to the political pressure, the US President issued a deadline of November 27 for Ukraine to approve a 28-point peace proposal, which reportedly demands sweeping concessions in favor of Russia to conclude the nearly four-year conflict. Ukraine is actively seeking modifications to the plan, unwilling to accept several hardline provisions.

Market participants now focus on a dense US economic calendar this week. Tuesday brings the delayed Producer Price Index (PPI), Retail Sales, and the Consumer Confidence Index from the Conference Board. Wednesday follows with the crucial Q3 GDP (preliminary) and the PCE Price Index, which will play a vital role in shaping expectations for the Fed’s future rate-cut trajectory and influencing the USD’s near-term direction.

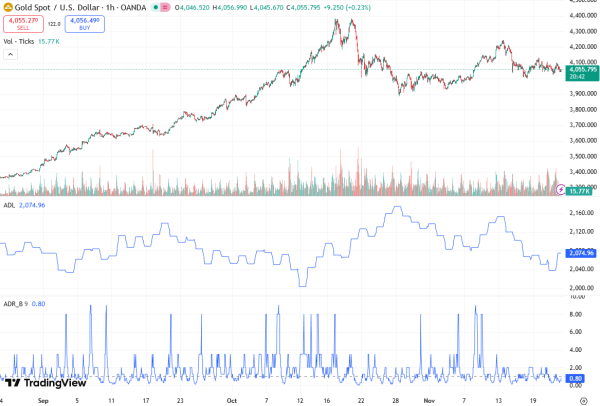

Technical Outlook: Gold Approaches Key $4,030 Confluence Support

From a technical analysis standpoint, XAU/USD has so far managed to defend a critical upward-sloping trendline established in late October. This rising support aligns closely with the 200-period Exponential Moving Average (EMA) on the 4-hour chart, both converging around the $4,030 level, now a crucial confluence support zone.

A decisive break below this region could expose gold to further downside, with initial targets set at the $4,000 psychological barrier. Below this threshold, sellers may push toward last week’s swing low in the $3,968–3,967 range. Continued bearish momentum could extend the decline toward the $3,931 technical support, ultimately revisiting the late-October swing low near $3,886.

On the upside, the $4,080 supply area emerges as the immediate resistance. A clean break above $4,100 would signal renewed bullish interest, potentially opening the door to the next technical barrier in the $4,152–4,155 region. Sustained momentum above this zone could help gold retest the $4,200 round figure, a level that may determine whether the broader medium-term bullish structure remains intact.

Conclusion

Gold’s struggle near daily lows reflects a complex interplay of factors: a softening USD, shifting Fed expectations, rising geopolitical tensions, and an increasingly risk-friendly market profile.

While the metal retains some support from safe-haven flows and uncertainty surrounding monetary policy, strong equity market sentiment and mixed Fed signals continue to restrain upside traction. This week’s US data, particularly GDP and PCE, will likely set the tone for the next major directional move in XAU/USD.