Gold (XAU/USD) retreated slightly from a fresh all-time high during the Asian session on Thursday, yet maintains a positive bias for the fifth consecutive day. The recent pullback appears limited, underpinned by a combination of fundamental and technical factors. Duke Sterling, a broker at ProMorion Group, unpacks the essential elements of this topic in his latest analysis.

As investors digest US-China trade tensions, a potential US government shutdown, and geopolitical risks, the safe-haven precious metal continues to attract interest. Coupled with dovish Federal Reserve expectations and a weakening US Dollar (USD), the environment suggests that the path of least resistance for Gold remains upwards.

Supportive Fundamental Backdrop Drives Gold

Gold’s record-setting run has been bolstered by several key drivers. Fresh US-China trade tensions continue to support the safe-haven appeal of the yellow metal.

Recent tit-for-tat port fees and discussions of potential trade retaliation measures have heightened investor caution. The geopolitical front, including tensions surrounding Ukraine and Russia, also reinforces the demand for Gold.

In addition, the US government shutdown, now entering its third week, weighs on economic confidence. A Treasury official indicated that the closure could cost the US economy $15 billion per week, highlighting potential macroeconomic headwinds. These uncertainties encourage market participants to retain exposure to non-yielding but reliable assets like Gold.

Fed Dovishness and USD Weakness Boost Gold

The Federal Reserve has struck a dovish tone, reinforcing market bets on rate cuts later this year. Chair Jerome Powell highlighted that the labor market remains subdued, sustaining expectations for 25-basis-point reductions at both the October and December meetings.

As a result, the US Dollar has extended its downtrend, reaching a one-week low during Thursday’s Asian session. A weaker USD reduces the opportunity cost of holding Gold, supporting its near-term upside potential. Market attention now turns to speeches from FOMC members, which could provide further rate-cut cues and influence XAU/USD dynamics.

Technical Outlook: Uptrend Remains Intact

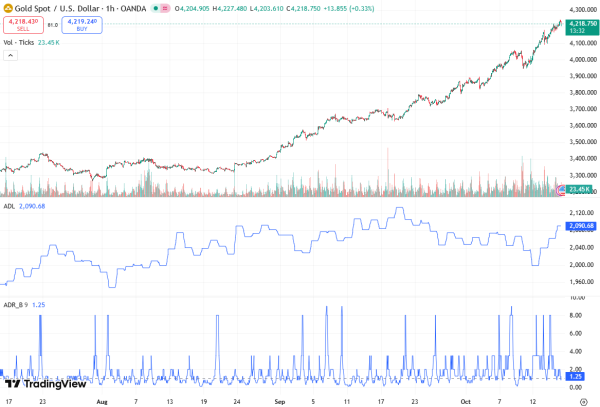

The XAU/USD pair has consistently respected an upward-sloping trend line over the past month. The recent break above the $4,200 round figure represents a critical bullish trigger, attracting momentum buyers.

However, technical indicators such as the daily Relative Strength Index (RSI) suggest that Gold is extremely overbought, indicating potential short-term corrective moves. These pullbacks may serve as buying opportunities, particularly near the $4,200 support zone.

Limited Downside: Key Support Levels

Despite the slight correction, the downside potential appears limited. Immediate support lies near $4,180-4,175, with further levels at $4,135-4,130 and $4,100. A decisive break below $4,055-4,060 could indicate a near-term top, but current fundamental drivers suggest such a scenario is unlikely.

Resistance levels remain anchored around the all-time high, with momentum indicators pointing to continued bullish pressure if the USD remains weak and geopolitical and trade uncertainties persist.

Market Movers and Investor Sentiment

Investor sentiment remains cautiously bullish. Recent profit-taking has caused minor consolidation, but the broader trend stays intact. Traders are closely monitoring US-China trade developments, potential US government funding resolutions, and geopolitical escalations.

Meanwhile, technical traders are eyeing trend-line support and key Fibonacci retracements, while fundamental analysts emphasize the role of Fed policy and USD performance in dictating Gold’s near-term trajectory.

Gold Outlook Amid Rising Global Uncertainties

Looking ahead, Gold prices are likely to remain supported by a combination of geopolitical tensions, trade disputes, and macroeconomic uncertainties. Escalating US-China trade conflicts, ongoing Middle East unrest, and potential disruptions in global supply chains continue to underpin the safe-haven demand for XAU/USD.

Additionally, persistent inflationary pressures and market volatility could encourage investors to hedge risks with Gold, further reinforcing its bullish trend. Analysts suggest that even if short-term corrections occur, fundamentals remain constructive, pointing to limited downside potential and opportunities for strategic accumulation.

Why Investors Continue to Favor Gold as a Safe-Haven Asset

Investors are increasingly turning to Gold as a safe-haven asset amid market uncertainty and economic risks. The ongoing US government shutdown, coupled with fears of a global trade slowdown, has reinforced bullish sentiment for the non-yielding yellow metal.

Moreover, expectations of Fed rate cuts and a weaker US Dollar provide additional support for Gold, making XAU/USD attractive for both short-term traders and long-term investors. With technical indicators still signaling strength, any corrective dips could present strategic buying opportunities, ensuring that the overall upside potential for Gold remains intact.

Conclusion: Gold’s Path Forward

In summary, Gold’s recent slight correction from its all-time peak reflects healthy profit-taking rather than a reversal of the bullish trend. The metal’s safe-haven appeal, reinforced by trade tensions, geopolitical risks, and a dovish Fed, supports continued upside potential. Technical indicators suggest limited downside, with corrective pullbacks providing potential entry points near the $4,200 region.