Financial markets worldwide experienced severe turbulence as major equity benchmarks tumbled amid heightened economic uncertainty and evolving monetary policy concerns. The synchronized selloff impacted stocks, fixed income securities, and raw materials concurrently, demonstrating profound doubt about near-term economic prospects.

Capital rushed toward traditionally safer assets as market volatility measures surged to heights unseen in recent months. A senior market analyst at Tarillium investigates the catalysts behind this market disruption and its significance for portfolio positioning.

Widespread Equity Declines

Leading stock indexes suffered substantial percentage losses as relentless selling intensified across trading hours. Technology-focused benchmarks experienced particularly sharp drops, declining more severely than diversified market measures. Innovation-driven companies faced especially harsh treatment as participants reconsidered valuations against shifting interest rate assumptions.

Banking and financial services shares encountered fierce selling waves tied to asset quality worries and lending portfolio concerns. Smaller regional banking institutions saw dramatically pronounced weakness, reviving anxieties about earlier sector difficulties. The spreading apprehension that materialized pressured even substantially larger, better-capitalized financial enterprises.

Energy sector equities couldn’t avoid the broad downdraft notwithstanding relatively steady petroleum pricing. The comprehensive selling spanning all sectors implied macroeconomic worries trumping individual business fundamentals. Even historically stable defensive areas including essential services and household products registered declines.

Fixed Income Volatility Emerges

Government bond yields displayed erratic trading behavior as capital sought refuge in sovereign debt instruments. The standard 10-year maturity yield initially retreated as money entered safe-haven positions. Nevertheless, yields subsequently jumped higher as pricing pressure concerns reemerged and central bank policy ambiguity lingered.

Corporate credit risk premiums expanded meaningfully, signaling mounting worry about business creditworthiness. Investment-quality company bonds witnessed premiums widen versus comparable government securities. Lower-rated debt experienced substantially more dramatic premium expansion as risk aversion strengthened.

The interest rate term structure shifted repeatedly throughout trading, mirroring contradictory market interpretations about expansion and inflation trajectories. Certain observers construed the instability as proof of participant bewilderment regarding Federal Reserve probable actions.

Foreign Exchange Responses

The greenback gauge demonstrated inconsistent results versus peer currencies as traders evaluated opposing considerations. Early dollar firmness reflected protective demand during equity liquidation. However, uncertainties about American economic robustness and Fed direction later undermined the currency.

Continental European currencies confronted distinct obstacles amid questions about regional economic outlook. The shared currency struggled against the dollar notwithstanding Europe’s comparatively steady economic readings. Sterling similarly experienced weakness as Britain-specific concerns supplemented broader market nervousness.

Developing nation currencies absorbed meaningful pressure as investment flows reversed direction. Participants extracted capital from higher-risk emerging territories, pursuing safety in developed economies. This capital repatriation generated supplementary strain for nations dependent on foreign funding.

Fear Measures Spike

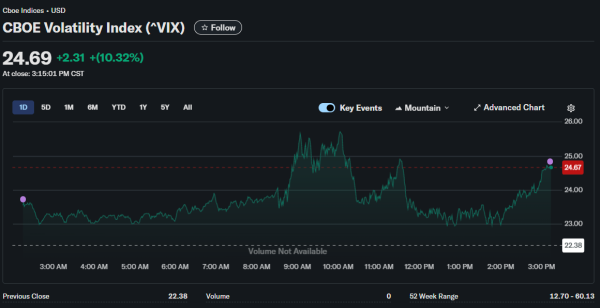

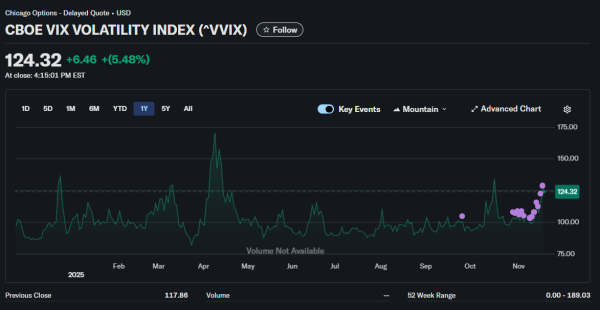

Market anxiety indicators jumped dramatically as liquidation gathered force. The VIX, frequently termed the fear barometer, leaped to multi-month peak levels. Derivatives markets reflected surging appetite for downside hedging as participants rushed protecting portfolios.

Transaction volumes climbed substantially beyond recent norms, demonstrating extensive involvement in the selloff instead of shallow market circumstances. The amplified activity implied authentic positioning adjustments rather than liquidity-shortage-driven price action. Intermediaries encountered obstacles sustaining orderly trading amid fierce selling intensity.

Within-day volatility touched extreme territories with leading indexes oscillating through broad price spans. These violent fluctuations created complications for computerized trading frameworks and trend-following approaches. Multiple circuit breakers and trading pauses activated on particular securities experiencing exceptional turbulence.

Industry Group Variation

While most industries declined, loss magnitude varied considerably across sectors. Technology and consumer spending-sensitive areas spearheaded the downturn, falling sharpest. These expansion-responsive segments proved most exposed to evolving rate assumptions and economic worries.

Medical care equities exhibited comparative steadiness, declining less than comprehensive market gauges. Participants regarded the sector’s protective qualities as appealing amid uncertainty. Medication producers and healthcare delivery organizations demonstrated noteworthy strength within the category.

Communication offerings posted varied outcomes depending on particular company situations. Entertainment and media enterprises struggled while telecommunications service providers held firmer. The contrast reflected differing vulnerability to business cycles.

Raw Materials Weakness

Commodity markets mirrored the risk-avoidance attitude dominating financial markets comprehensively. Industrial metals including copper and aluminum tumbled sharply on demand worries. These economically responsive materials frequently function as forward indicators of manufacturing momentum.

Valuable metals displayed conflicting performance as competing influences clashed. Gold initially rallied on protective demand but later retreated as the dollar strengthened. Silver, given its industrial uses, declined more dramatically reflecting expansion concerns.

Farm commodities experienced distinct dynamics based on particular supply-demand fundamentals. Weather conditions, planting advancement, and worldwide trade patterns shaped pricing. Energy commodities stayed comparatively steady notwithstanding broader market chaos.

Uncertain Trajectory

The route ahead for markets hinges on numerous developing elements encompassing economic statistics, business earnings, and policy choices. Immediate uncertainty seems elevated given contradictory indicators. Participants confront positioning portfolio challenges amid authentic ambiguity about likely results.

Certain observers regard the selloff as generating appealing entry opportunities for extended-horizon participants. Alternative voices advise additional deterioration may transpire before circumstances steady. The reality probably depends on fundamental condition evolution across approaching weeks.