Gilded, a blockchain solutions provider, recently announced the launch of crypto billing with recurring invoices. In a push to help businesses transact in digital assets, Gilded is streamlining the process, and is capitalizing on the lack of scheduling options in the crypto payment markets.

Gilded Blockchain Payments

According to a recent press release, Gilded is bringing recurring invoices to crypto billing. Gilded enables businesses to transact globally with digital currencies, and is building out the proper infrastructure to support a “full crypto subscription solution.” What this means is that businesses will finally have the ability to automate their crypto billing cycles.

Crypto payments continue to gain momentum around the globe, with stablecoin transaction volume hitting record highs in June of this year at $54.9 billion. The problem is that businesses lack scheduling options pertaining to digital assets. Companies doing high volume business simply do not have the time to generate manual crypto invoices. Gilded is changing the narrative, and offering a solution that could have crypto billing on autopilot.

Gilded CEO Gil Hildebrand commented on the announcement stating that:

“Every day, we speak with businesses that are eager to accept crypto but find themselves at a crossroads for one reason or another. Gilded makes it super easy to enjoy the benefits of crypto without having to abandon an entire way of doing business.”

How It Works?

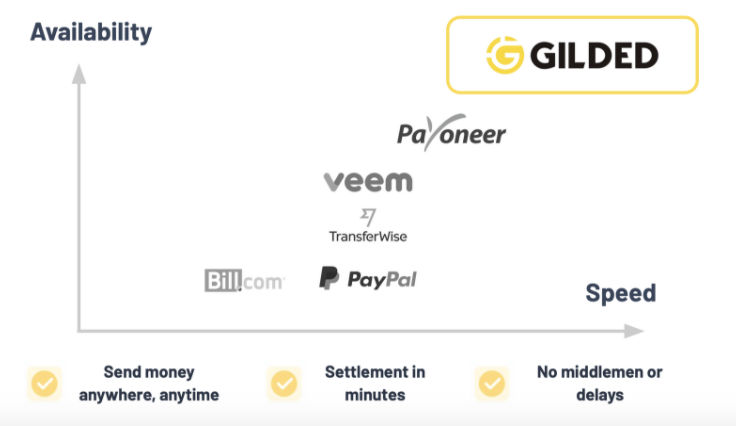

Businesses value recurring payments because it puts billing on autopilot and reduces administrative work on the backend. In traditional finance, PayPal is a popular money transfer service that offers recurring billing.

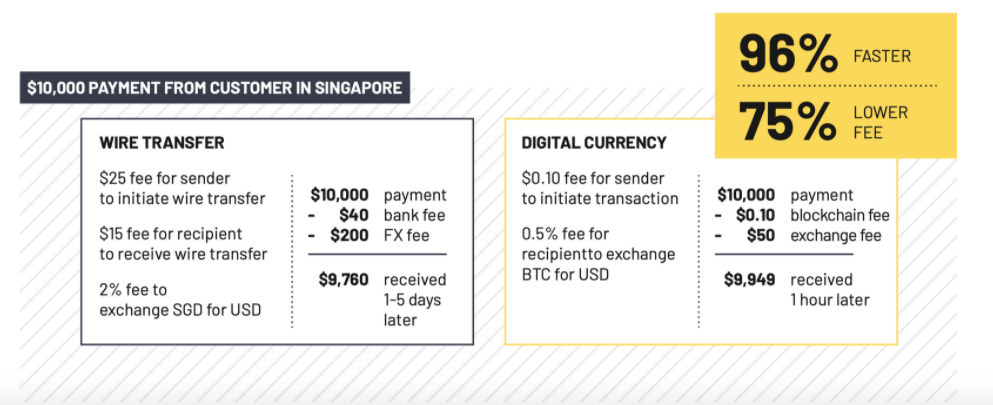

Gilded has brought the recurring invoice feature to crypto. Businesses can finally pay vendors and receive payments in crypto from customers anywhere in the world. Unlike bank payments, settlement with Gilded takes minutes, and incurs a fraction of the cost that is imposed by traditional banks.

How does Gilded stack up against your everyday money transfer services?

Efficiency

Companies that deploy Gilded can establish recurring invoices and even convert an existing invoice. In return, billing can be automated on a daily, weekly, monthly, or annual basis. Aside from crypto, customers can also leverage recurring invoicing with credit cards and wire transfers.

As crypto payments continues to see exponential growth, book-keeping and accounting have never been more important. Gilded understands this and has integrated automated accounting for added transparency. Customers utilizing Gilded for billing can also take advantage of QuickBooks integrations.

As Gilded continues to build out the complete digital asset subscription solution, they have notched partnerships with reputable companies like TrustSwap, Transak, and many other stablecoin issuers. CoinMarketCap, one of the largest crypto data aggregators, is currently using Gilded’s payment solutions. Companies that are looking to try out the service can open up a free account, in which they can process up to $5,000/month in payment volume.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.