The market for payment systems and payments is shifting right in front of our eyes. What was futuristic ten years ago is now ordinary practice. Electronic payments (also known as digital payments or non-cash payments) have invaded practically everyone’s life and will shape future technologies throughout the next decade.

Already today, payment systems allow you to make transactions online using services and applications, and transfers have become something commonplace and very fast. Many countries have systems in place that allow firms to automatically handle bulk payment processing such as salaries, pensions, automatic debits, and transfers between bank accounts. So in the UK, BACS is considered the main one and many companies can carry out bacs transfer using specialized services. But given that technology is developing every day, most likely in 10 years most of these operations will be carried out automatically, or will reach a different level. What technologies await us in the near future? We’ll talk about this below.

What shapes the future of payments

Online payments are developing in response to two main demands made by users – both individuals and companies: the convenience of the process and customization to solve specific user pain points. Over the past few years, the first requirement has given rise to such convenient payments as contactless payment technology, where saving a few minutes on entering card data has resulted in a significant increase in conversion to purchases. Customization has led to the emergence of smart payment systems that suggest the user’s next steps based on behavior on the site and motivate him to make a purchase.

Biometric payments

Technology has given a strong impetus to simplifying payment transactions. The past two decades have seen significant development in this area, including the introduction of various tools and infrastructure.

Cardless biometric payments will likely become the norm faster than many expect. They will probably exist in parallel with the already familiar digital payments. In this article, we will look at the prospects for the development of cardless biometric payments and their impact on various participants in the payment ecosystem – from issuers and card networks to acquirers and end consumers.

Impact of biometric payments on application processing

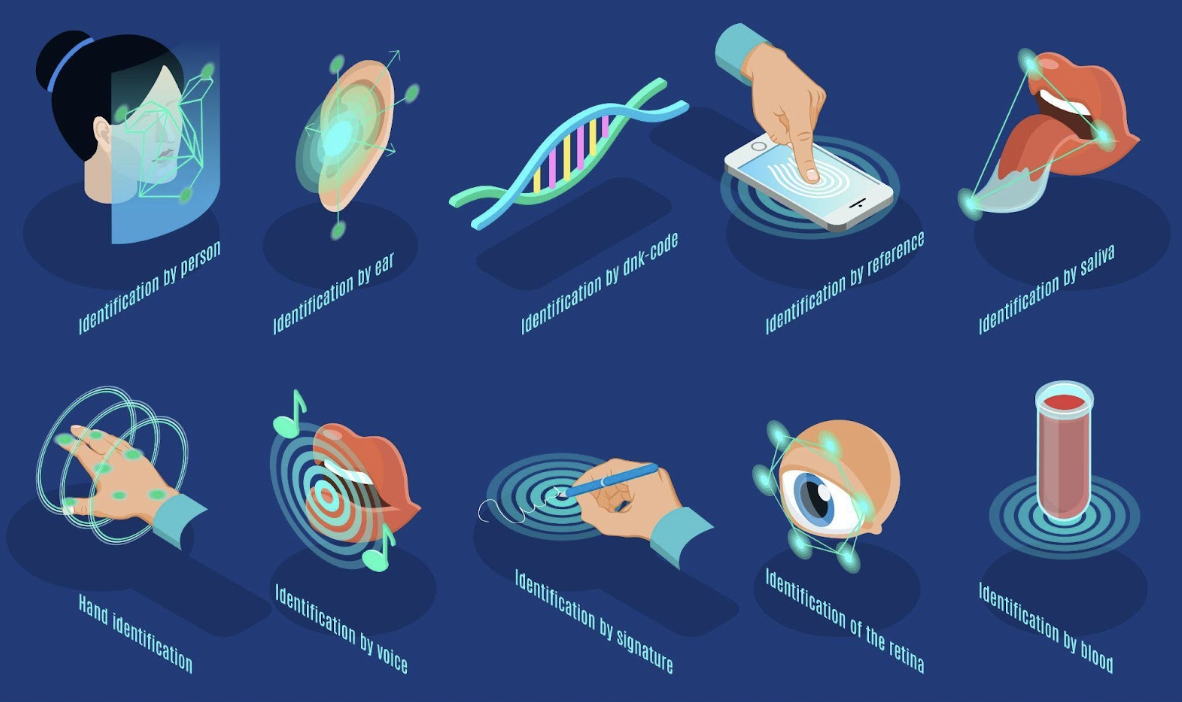

In the era of biometrics, current application processing processes do not change. Simply, for approved applications, an additional layer of authentication is created: biometric information in the form of fingerprints, iris scans, or voice characteristics, which is collected and stored in a bank database.

After this step, a virtual card number is created associated with the client’s bank account. This biometric pattern is associated with both the account number and the virtual card number.

After completing the setup, the virtual card number becomes available for performing transactions through a mobile application or online banking.

Simplifying the biometric payment process

To be able to accept biometric payments, merchants must have the appropriate infrastructure installed, including a card number entry terminal and a biometric scanning device.

A client wishing to make a purchase must enter a virtual card number at the terminal and undergo a biometric authentication procedure.

The system will determine the payment card network based on the number entered, and then information about the card number, biometric data, and transaction details will be sent to the bank for confirmation and approval of the transaction.

Biometric transaction confirmation: mechanisms and difficulties

Transaction authentication is divided into two stages. First, the client goes through an authentication procedure, during which the biometric data obtained during the transaction is compared with samples stored in the database.

If authentication is successful, the second stage begins—transaction authorization. Here, various parameters are checked, including the availability of funds in the account, card expiration date, established limits, and so on. Based on this data, a decision is made to approve or reject the operation.

While the process may seem straightforward, implementing biometric payments requires significant technology and infrastructure investment from all parties involved—card issuers, payment processors, and acquirers.

A look into the future

Despite all these difficulties and financial costs, overcoming these problems is only a matter of time. Once the necessary infrastructure is in place, all market participants will be able to take full advantage of instant and secure biometric payments.

This innovative way of conducting transactions will open up new horizons for customers and businesses, offering greater levels of convenience and data security. Biometric payments promise to change the way we think about payment transactions, making them instant, intuitive, and secure. While some see such changes as revolutionary, others see them as a natural progression.

This notice states that the information provided is not an offer or solicitation to buy or sell securities, and its accuracy or completeness is not guaranteed. The authors may own the discussed cryptocurrency. The content, which is subject to change, is for informational purposes only and should not be considered investment, tax, legal, or accounting advice. Readers are advised to consult professional advisors before any transaction. Visionary Financial does not endorse the content and was compensated for this article. Please review their privacy policy, disclaimer, and terms and conditions for more details.