Brokers from Servelius dive into the latest developments at Firefly Aerospace, examining whether recent earnings growth and a strategic acquisition position the space company as a potential buying opportunity. After months of trading like a broken IPO, Firefly’s stock has rebounded sharply, fueled by strong quarterly performance and the completion of its acquisition of defense contractor SciTec.

Firefly surprised investors with Q3 2025 sales of $30.8 million, representing a 98% increase from Q2 2025 and a 38% increase compared with Q3 2024. This growth was driven by NASA contracts, including an additional $10 million payment for the Blue Ghost lunar mission and a fourth Blue Ghost mission scheduled for 2029, valued at $176.7 million.

The company also signed an agreement to explore Alpha rocket launches from Japan, signaling potential international revenue expansion.

Firefly Raises Full-Year Guidance

Management raised full-year guidance, projecting total fiscal 2025 sales between $150 million and $158 million, surpassing Wall Street estimates of $135.5 million. The strong performance and raised guidance highlight Firefly’s accelerated growth trajectory, renewing investor confidence in the stock.

Stock Performance and Market Reaction

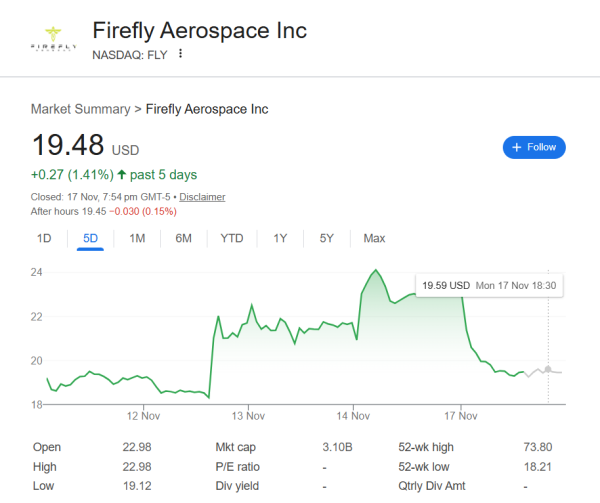

Following the earnings announcement, Firefly stock surged, gaining 17% on Thursday, 7% on Friday, and additional gains in after-hours trading, reaching nearly $23 per share. This rally comes after a challenging period, with the stock down 75% from its high and trading 60% below its IPO price, reflecting the volatility of newly public space companies.

Despite this rebound, shares still trade at only 51% of the IPO offer price, suggesting both opportunity and caution for investors.

Profitability and Expenses

Although revenue growth was impressive, Firefly remains unprofitable. Operating losses increased by 82% year over year, and net losses more than tripled to $133.4 million. Rising costs contributed significantly, with the cost of sales increasing 53%, research and development spending up 63%, and selling, general, and administrative expenses more than doubling.

However, per-share losses fell to $1.50, down more than 50% from the prior year, due to the post-IPO increase in shares outstanding to 93.8 million. This significant dilution spreads losses across more shares, reducing the impact on current shareholders while still highlighting the company’s path toward profitability.

Impact of SciTec Acquisition on Valuation

The acquisition of defense contractor SciTec has significantly altered Firefly’s valuation picture. Previously, the company traded at a market capitalization of approximately $7.2 billion, with expected 2025 sales of $145 million, resulting in a price-to-sales ratio of nearly 50.

Post-acquisition, Firefly’s market capitalization has dropped almost 50%, while combined revenue potential for 2026 is now projected at $446 million, yielding a P/S ratio of roughly 7.3. This represents a far more attractive valuation, even for a high-growth space company.

Analyst Caution and Risk Factors

Despite recent optimism, brokers from Servelius emphasize that risks remain. Firefly continues to operate at a loss, and integrating SciTec presents execution challenges. However, the combination of NASA contracts, international launch agreements, and an expanded revenue base positions the company for potential growth and accelerated progress toward profitability.

The post-IPO volatility also underscores the need for careful monitoring, as investor sentiment can shift rapidly. Investors should watch for the first earnings report after the SciTec merger, which will provide insight into the combined company’s performance and its potential to generate profits.

Shift in Investor Sentiment

Investor sentiment has noticeably shifted following Firefly Aerospace’s earnings beat and strategic developments. Both traders and long-term investors are reassessing the stock’s potential, encouraged by the company’s strong revenue growth, expanded guidance, and more attractive valuation.

Investment Opportunities and Strategic Developments

The recent rally offers an opportunity for investors to gain exposure to a company with multiple high-value NASA contracts and promising international expansion, including planned Alpha rocket launches from Japan.

Firefly’s acquisition of defense contractor SciTec further strengthens its revenue base and positions the company for accelerated growth, signaling a potential turning point after a challenging IPO period.

With a projected price-to-sales ratio of 7.3 for 2026, the stock now appears materially cheaper than pre-earnings levels, although risks remain in the form of ongoing operating losses and integration challenges. For investors willing to navigate near-term volatility, Firefly presents a compelling, cautiously optimistic investment case in the growing space sector.

Outlook and Recommendations

For investors able to tolerate near-term volatility, Firefly offers exposure to a growing space company with diversified revenue streams and strong institutional contracts. Many analysts recommend close monitoring of post-merger results and continued evaluation of revenue growth and profitability metrics.

The upcoming earnings report will be a critical milestone in determining whether Firefly’s trajectory can sustain its recent momentum and justify long-term investment.