The cryptocurrency market witnessed its largest-ever liquidation event last Friday, as panic selling and collapsing liquidity triggered a cascade of losses across major tokens. Following the historic wipeout totaling over $19 billion in leveraged positions, traders have shifted aggressively toward the options market, seeking protection against another potential downturn in bitcoin and ether.

Brokers at Orbisolyx analyze the causes of the crash, the market’s response, and the growing demand for hedging instruments amid renewed volatility in digital assets.

Record Liquidations Trigger Market Shock

According to market data, last Friday’s liquidation event dwarfed previous crypto collapses, marking a ninefold increase over the February 2025 crash and 19 times larger than the 2020 pandemic meltdown and the FTX collapse in November 2022. The selloff was sparked by an abrupt geopolitical shock after the U.S. President announced a 100% tariff on Chinese imports and signaled potential export controls on critical software.

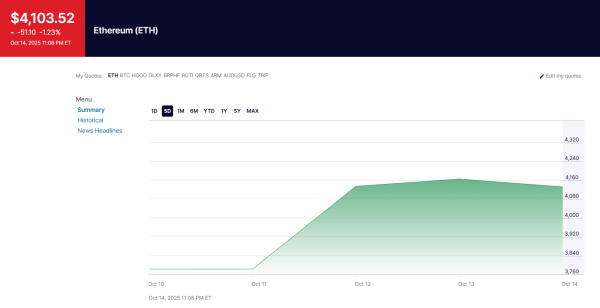

Bitcoin plunged more than 14% from its Friday peak of $122,574.46, dropping as low as $104,782.88 before rebounding slightly to $115,718.13, up 0.6% on the day. Ether, the second-largest cryptocurrency by market capitalization, also tumbled 12.2% to $3,436.29, before recovering to $4,254, a 2.4% daily gain.

Altcoins were hit even harder, with HYPE (-54%), DOGE (-62%), and AVAX (-70%) experiencing dramatic drawdowns before staging modest recoveries over the weekend.

Political Rhetoric Eases, But Volatility Persists

Market sentiment stabilized modestly after U.S. President Biden softened his tone on China, assuring that “it will all be fine” and emphasizing that the U.S. has no intention of hurting China. These conciliatory remarks provided a brief technical rebound across digital assets, though traders remain wary amid lingering geopolitical uncertainty.

According to market analysts, Beijing’s measured response, which included blaming the U.S. for heightening tensions but refraining from any new countermeasures, also helped ease short-term risk aversion. However, underlying volatility indicators remain elevated, suggesting that sentiment could shift quickly if diplomatic progress stalls.

Options Market Activity Signals Bearish Hedging

The most significant development following the crash has been a surge in hedging activity across the crypto options market. Data from Derive.xyz, a leading digital asset derivatives platform, revealed an unprecedented spike in put option purchases for both bitcoin and ether, signaling investor anxiety over further declines.

“Volatility jumped across the board, not only for short-dated but also long-dated maturities,” said Sean Dawson, Head of Research at Derive.xyz in Canberra. “Sentiment has clearly shifted toward protection against downside risk.”

For bitcoin, traders heavily bought puts at $115,000 and $95,000 strike prices for the October 31 expiry, positioning for possible extended weakness. Additionally, Derive.xyz data showed a sharp reversal from call buying to call selling at the $125,000 strike for the October 17 expiry, suggesting a bearish near-term outlook among options participants.

In ether, traders focused on puts at $4,000 and $3,600 strikes for October expiries, and $2,600 puts for the December 26 expiry, reflecting expectations of potential downside through year-end. “These trades are clear evidence that investors are bracing for persistent volatility,” said Nick Forster, co-founder of Derive.xyz.

Technical and Market Outlook

From a technical perspective, Bitcoin is currently navigating a tight trading range, with resistance near $118,000–$120,000 and support anchored around $105,000, marking last week’s post-crash intraday low. Ether shows a similar pattern, with upside momentum capped near $4,300 and strong defensive positioning around the $3,400 level.

Analysts caution that while the recent rebound reflects short-term stabilization, the broader market structure remains fragile. Leverage ratios across major exchanges have reset sharply, and liquidity remains thin, increasing vulnerability to external shocks. If geopolitical tensions escalate or U.S. regulatory sentiment turns more restrictive, another cascade of forced liquidations could materialize in the coming weeks..

Outlook for Digital Assets

The record liquidation serves as a stark reminder of crypto’s inherent leverage-driven fragility. Yet, analysts also note that the market’s ability to recover modestly amid geopolitical uncertainty demonstrates resilient investor participation and institutional involvement in derivatives hedging.

In the near term, volatility premiums are expected to remain elevated, while traders balance risk management strategies with selective exposure to major cryptocurrencies. The coming weeks will test whether digital assets can stabilize above key support levels or whether the recent rout marks the beginning of a deeper correction.

The broader digital asset landscape remains structurally sound, supported by rising institutional adoption, advancements in blockchain infrastructure, and emerging clarity around global regulation. While short-term turbulence may persist, these factors could lay the groundwork for a more sustainable recovery heading into late Q4 2025.