CrossTower, a multi-asset crypto exchange has announced record trading volume in October. Since the exchanges launch 5 months ago, the platform has processed $150MM in total volume.

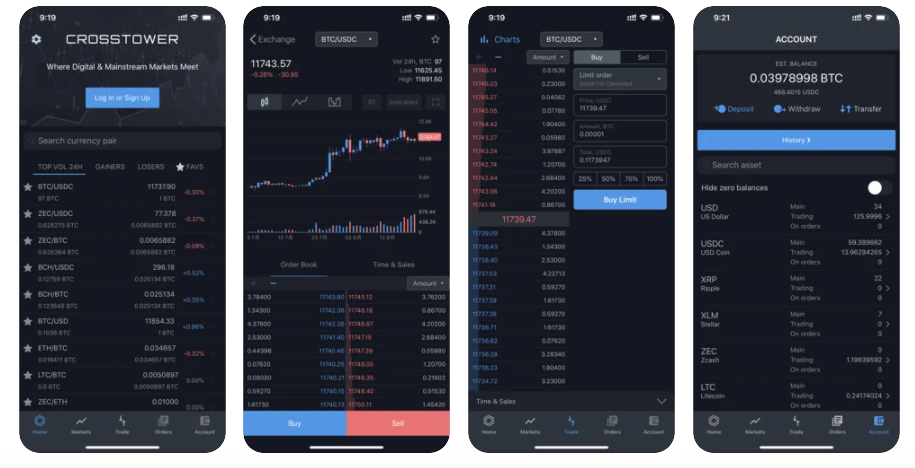

CrossTower Exchange

CrossTower, a one-stop digital asset exchange for institutions and individuals, recently announced milestone growth metrics. The digital asset platform launched just 5 months ago and has already overseen $150MM in total volume. With $60MM in volume last month, October was the exchange’s best month since inception. CrossTower offers support for some of the most popular digital assets such as Bitcoin, Ether, Litecoin, USDC, Bitcoin Cash, XRP, Stellar, Chainlink, BAT, ZCash, Ox, MKR, and DAI.

Kapil Rathi, the CEO of CrossTower stated that:

“The rapid rise of our trading volumes is a testament to our leadership in building a credible exchange and our commitment to compliance. Our bench strength and the rigor of our platform put us in a unique position to play a vital role in today’s evolving market structure, and demonstrate the reality that participants are shifting towards exchanges with a regulatory focus.”

In a push to create one of the most seamless experiences for institutional and individual traders, CrossTower is building out its infrastructure around the following qualities:

Institutional Experience

CrossTower has focused on bringing traditional experience to the digital asset space. The company believes its leadership is in a great position to bridge the gap between traditional and digital asset markets. CrossTower has attracted top talent from digital asset companies like Kraken, and Galaxy Digital. In a push to commingle traditional market experience, the company has inked previous executives from Legg Mason. It is important to note that Legg Mason is a division of Franklin Templeton Investments.

Low-Cost Trading

While offering a competitive pricing model compared to other digital asset exchanges, users also leverage free mobile solutions that give traders the ability to process advanced order types. Unlike many other mobile solutions, CrossTower focuses on user experience and also offers analytical tools for active investors.

Liquidity Solutions

One of the main concerns with trading cryptocurrencies can be the spreads involved. If the spread is wide, investors will not get the best deal on the buy or sell side. According to CrossTower’s website, the company has cracked partnerships with various market makers. In doing so, users have access to tight spreads, deep order books, efficient execution, and risk management protocols.

Security

CrossTower’s security stack revolves around solutions for custody, cybersecurity, compliance, and AML/KYC. One of the practices deployed to protect the exchange is the platform being hosted in an Equinix data center. This avails SOC 2 Type III, ISO 27001, and PCI compliance.

Technology

Institutions and individuals are actively looking for exchanges that can process quick trades for efficiency. CrossTower’s infrastructure offers a matching engine that supports many different order types. Additionally, the use of co-location services gives the exchange a competitive advantage with extremely fast trading speeds.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.