Celsius has announced that its democratized interest income and lending platform has paid out more than $250M in crypto rewards to 415,000+ users since mid-2018. Celsius continues to be one of the fastest-growing finance companies that disrupts legacy banking and financial services.

Celsius Since Inception

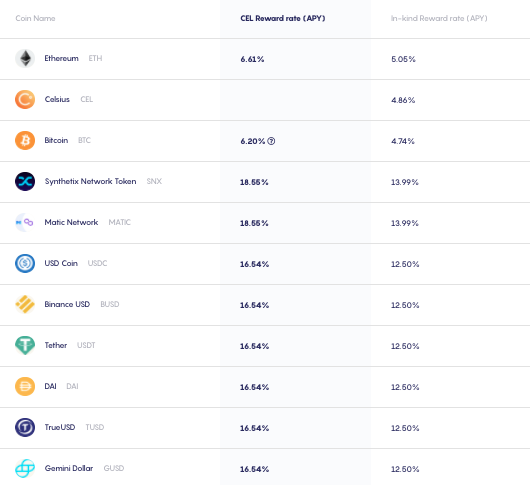

Celsius Network, one of the most popular crypto lending platforms, recently announced a milestone. According to the company, they have paid out $250M in crypto rewards to 415,000+ users since mid-2018. By simply holding digital assets in a Celsius Wallet, investors can earn up to 18.5% APY on 40 different digital assets. Celsius offers 25% higher yields if users leverage the companies CEL utility token.

Unlike traditional banking, Celsius has built their business model around sharing 80% of revenues with loyal customers. These incentives have drawn the attention of many investors who earn close to 0% on their assets at traditional banks. With interest rates near historic lows, banks can’t encourage “saving” in the current environment. Companies like Celsius have taken full advantage of these inefficiencies, and now manage over $8 billion in cryptocurrency assets.

What Leadership Said

Alex Mashinsky, the CEO of Celsius, stated that:

“Celsius was built to act in the best interest of the community, and we have consistently delivered honest, transparent, and rewarding financial services. That’s why Celsius stands alone among the other crypto players in the space, and that’s why Celsius continues to achieve unparalleled success.”

Explosive Growth Since Last Year

Back in November 2020, it was reported that Celsius had surpassed $2.2B in assets under management. At the time, the platform also noted that 215,000+ users were taking advantage of financial services on the platform. If we fast forward to today, Celsius just mentioned that 415,000+ users have been linked to crypto rewards. This represents a +100% surge in userbase since November 2020.

In 2020 alone, it was announced that Celsius saw a 10X growth in total crypto asset inventory. This metric was announced on January 2021 and the company was overseeing about $5.3B in assets at the time. With the most recent press release mentioning $8+ billion in total crypto assets, it is safe to say that Celsius is starting the year extremely strong.

CEL Token

CEL Token is Celsius’s native utility token that boosts platform rewards. If a user is looking to earn money on their crypto in the form of yield, collecting the rewards in CEL Tokens will increase the yield. For example, if you deposit your Tether holdings on Celsius and choose to take your weekly rewards in CEL, you will be eligible for 16.54% APY. Celsius offers different rates based on the deposited assets. You can see the full lineup here.

Additionally, if users are looking to leverage their crypto assets to borrow money, interest rates applied to loans will be reduced up to ~ 30% if CEL Tokens are used to make interest payments. More information on CEL Tokens can be found on its explainer page.

More On The Network

Founded in 2017, Celsius is competing with traditional banking by offering alternative solutions that promote income equality, financial freedom, and economic opportunity. By cutting out centralized finance, Celsius offers banking solutions that focus on maximizing a user’s financial standing. Opposed to traditional fiat, individuals leverage digital assets to take advantage of various financial services. Using cryptocurrency as collateral avails liquidity and the ability to retain digital asset ownership. Aside from borrowing, the platform lets users earn passive income on many different crypto holdings.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.