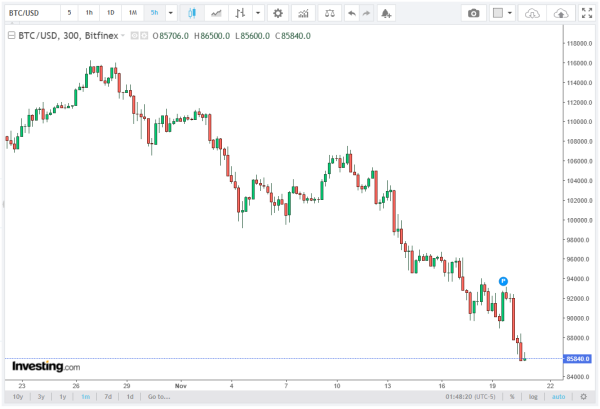

The BTC/USD pair continued its persistent sell-off in early Thursday trading, weighed down by a combination of macroeconomic uncertainty and shifting risk sentiment in global markets. Bitcoin traded around $91,300, just slightly above this week’s low of $88,930, underscoring heightened volatility and investor caution. The Arbitics team presents a well-structured and informative breakdown of this matter.

This downturn followed two major catalysts: the Federal Reserve’s minutes from its latest monetary policy meeting and Nvidia’s upbeat earnings report. Despite Nvidia igniting a broader risk-on sentiment, Bitcoin struggled to attract sustained bids as traders remained focused on monetary policy expectations.

Fed Minutes: Rate-Cut Doubts Pressure BTC/USD

Bitcoin’s reaction to the Fed minutes highlighted the importance of interest rate expectations in driving cryptocurrency markets. The minutes cast significant doubt on whether the Federal Reserve will move forward with its anticipated December rate cut.

Officials were shown to be deeply divided over cutting rates as early as October. Several members expressed persistent concerns about inflation, which continues to hover above the Fed’s 2% target. This uncertainty caused the BTC/USD pair to weaken, as crypto assets are typically sensitive to changes in the rate-cut narrative.

Market Sentiment: Polymarket Data Shows Rising Rate-Cut Expectations

Despite the tone of the Fed minutes, derivatives platforms such as Polymarket provide a more optimistic outlook. According to the latest data, 67% of traders now believe the Fed will cut rates in December, a sharp rise from 50% just a few days earlier.

This shift indicates that traders still anticipate a policy pivot that could boost risk sentiment and provide support for assets such as Bitcoin, equities, and emerging-market currencies. A confirmed rate cut could ease financial conditions, encourage speculative flows, and potentially fuel a relief rally in the BTC/USD pair.

Nvidia Earnings: Strong Tech Sentiment Fails to Lift Bitcoin

The latest Nvidia earnings release injected fresh optimism into U.S. equity markets. The chipmaker projects over $65 billion in Q4 revenue, well above the $63 billion consensus forecast. Additionally, revenue for the most recent quarter surged 62% to $57 billion, surpassing the expected $55.2 billion.

CEO Jensen Huang emphasized that he does not foresee an AI bubble, reassuring investors who have grown wary of stretched valuations in the tech sector. As a result, Nasdaq 100 futures climbed sharply, rising 385 points in early Thursday trading.

ETF Outflows: Continued Pressure on BTC/USD

Another drag on the cryptocurrency came from persistent ETF outflows. Data shows that crypto-related ETFs experienced over $740 million in outflows this week alone. While cumulative Bitcoin ETF inflows still stand around $58 billion, they have fallen from the peak of $65 billion, signaling wavering institutional conviction.

Large outflows often reflect portfolio de-risking among major asset managers and can contribute to downward pressure on BTC/USD, especially during periods of macro uncertainty.

Bearish Structure Dominates Daily Chart

A close examination of the daily timeframe chart reveals that BTC/USD has remained locked in a strong downward trend throughout the month. Even after a brief recovery attempt on Wednesday, bullish momentum quickly faded, and the pair dropped back toward 88,930, marking its lowest level since April 25.

Crucially, Bitcoin is trading below the Supertrend indicator, reinforcing the prevailing bearish outlook. At the same time, the charts show the formation of a death cross, a widely monitored bearish technical pattern. This occurs when the 50-day Exponential Moving Average (EMA) crosses below the 200-day EMA, indicating weakening long-term momentum.

Oversold Conditions: RSI Signals a Possible Bounce

The Relative Strength Index (RSI) has fallen to 30, entering oversold territory. Historically, Bitcoin often experiences short-term relief rallies when momentum indicators become deeply stretched.

While macro headwinds persist, oversold conditions combined with improving risk sentiment from Nvidia’s results could encourage speculative buyers to re-enter the market. This opens the door for a potential reversal or relief rally in the coming sessions.

Upside Targets and Downside Risks

Should Bitcoin attract renewed buying volume, the first significant upside target sits near the psychological level of $95,000. This region also aligns with prior support-turned-resistance levels, making it a critical test area for bulls.

However, a decisive drop below 88,930, the current weekly low, would invalidate the bullish scenario and expose Bitcoin to deeper downside pressure. In such a case, further liquidation from ETFs or risk-off positioning could accelerate losses.

Conclusion

The BTC/USD pair is navigating a pivotal phase marked by oversold technical readings, wavering sentiment around Fed rate cuts, and mixed signals from broader risk markets. While the macro backdrop remains uncertain, strong Nvidia earnings and rising expectations for a December rate cut could strengthen the case for a short-term relief rally. However, Bitcoin must hold above the week’s low to maintain any bullish momentum.