The cryptocurrency market is a complex ecosystem, and while Bitcoin often grabs headlines for its price movements, Bitcoin Dominance (BTC.D), the metric that measures Bitcoin’s share of the total crypto market capitalization, can be just as critical for traders and investors.

After a quiet climb over the past year, BTC.D is now approaching 60.86%, a level that carries both technical significance and potential strategic implications for altcoin portfolios. In their latest publication, Solancie experts unpack the essential elements of the topic.

BTC.D’s Ascending Channel: A Methodical Climb

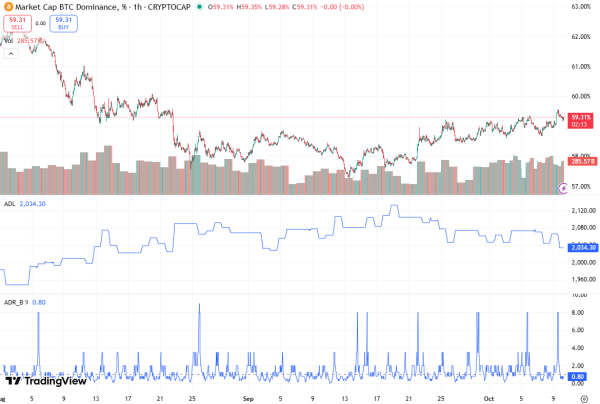

Since bottoming near 40% in late 2022, Bitcoin Dominance has been steadily rising, tracing an ascending channel that has remained remarkably consistent. This channel functions like a staircase, with each step representing periods where Bitcoin slowly regains market share while altcoins remain sidelined. The predictability of this pattern is what makes the current setup so noteworthy.

Currently, BTC.D sits at roughly 59%, inching toward the 60.86% mark, which corresponds to the lower boundary of this multi-year channel. Historically, this boundary has acted as a technical ceiling, containing all major BTC.D swings since 2022.

Analysts and traders often rely on such trendline structures to project potential inflection points, giving the 60.86% target a level of credibility grounded in historical price action.

Why 60.86% Matters

The 60.86% level isn’t arbitrary; it’s a technical milestone that represents a confluence of market history and mathematical projection. When BTC.D approaches a channel resistance, markets often see temporary stalls or reversals. For traders, this is a signal zone: a potential turning point where the balance of power between Bitcoin and altcoins may shift.

A rise to this level suggests that Bitcoin is reasserting dominance, capturing a growing share of total market capitalization. For altcoin holders, this signals caution: extended dominance often correlates with underperformance in smaller-cap tokens, as capital flows concentrate in BTC during periods of perceived safety or market uncertainty.

Implications for Altcoin Investors

While BTC.D climbing toward 60.86% may initially appear bearish for altcoins, the story doesn’t end there. If Bitcoin encounters resistance at this key level, historical trends suggest a potential pullback, a moment when capital may rotate out of BTC and back into alternative cryptocurrencies.

This is the mechanism behind the so-called “alt season”, a period when smaller-cap coins experience a surge in volume and price after Bitcoin’s extended period of market outperformance. During alt season, traders often see rapid rotations, where money doesn’t leave crypto entirely but redistributes, favoring projects with higher risk-reward profiles.

If BTC.D rejects the 60.86% ceiling, we could witness exactly this scenario: Bitcoin consolidates or corrects, while altcoins gain momentum. For investors holding a diversified portfolio, this could be a strategic opportunity to capitalize on sectors previously under pressure.

The Broader Market Context: Beyond Bitcoin

It’s important to remember that Bitcoin Dominance doesn’t operate in isolation. Broader macro factors, such as interest rate shifts, regulatory updates, and institutional inflows, can amplify or dampen BTC.D’s movements.

For instance, periods of market uncertainty often see capital concentrate in Bitcoin, driving dominance higher, while renewed investor confidence in altcoins can trigger a rotation even before technical ceilings are reached. Altcoin investors should therefore combine BTC.D analysis with macro and sentiment indicators to optimize timing and position sizing.

Technical Considerations: The Chart Speaks

The charts indicate that BTC.D’s parallel channel has reliably contained every swing since late 2022. The blue arrow on BTC.D charts often marks potential pullbacks from the 60.86% level, highlighting areas where traders might expect short-term reversals. While nothing is guaranteed in financial markets, technical analysis provides a framework for understanding likely scenarios.

For active traders, watching BTC.D is sometimes more critical than watching Bitcoin’s price alone. Why? Because Bitcoin’s share of the total market often dictates the overall risk appetite for altcoins. A declining BTC.D after hitting a resistance level typically precedes altcoin rallies, while a rising BTC.D signals a period where Bitcoin continues to dominate the market narrative.

Conclusion: The Dominance Indicator Matters

Often, the clearest signal in crypto isn’t Bitcoin’s price itself, but its dominance within the broader market. The BTC Dominance (BTC.D) index, edging closer to 60.86%, provides insight into overall sentiment, where capital is moving, and which altcoins might see growth opportunities.

Traders and investors who pay attention to BTC.D can gain an edge by anticipating rotations and positioning portfolios accordingly. While the exact movement from 60.86% is uncertain, the historical behavior of BTC.D channels suggests that this milestone could be a pivotal moment for altcoins.