We take a look at Bitcoin price, Ethereum price, and XRP price for the week of January 29, 2021. Aside from fundamentals, we rely heavily on technical analysis to assess overall sentiment. This is achieved by identifying key support and resistance levels that traders and investors will be watching in the short term.

Bitcoin Price

At the time of this report, Bitcoin is currently trading at $33,471. Over the last week, Bitcoin has seen slight growth at ~ 1.6%. The largest digital asset by market cap held up well this week, especially after falling ~ 14% the prior week ( week of 1/22 ). Following a couple of weeks of strong selling pressures, BTC got a boost this week after Elon Musk changed his Twitter bio to “#bitcoin.” This came following the unprecedented moves by traditional brokerages to halt retail trading on stocks like Gamestop, AMC, and others due to extreme volatility.

Prominent figures like Musk and others were disturbed by Wall Streets’ decision to halt retail trading and supposedly help Hedge funds that were getting crushed on their short positions. The traditional markets saw all sorts of criticism this week, which strengthened the value prop of decentralized markets like BTC that are driven by the individual as opposed to centralized parties.

Bitcoin Technical Analysis

In our recent Bitcoin analysis, it was believed that BTC would see some upward momentum in the short-term if $29,300 support was not rejected. This played out perfectly, and we saw that slight gain over the last 7 days. As we can see from the chart below, BTC almost rejected that key support, but ended up using it as a buffer to build upward momentum. This is why we had outlined it as a strong support level to watch.

We still maintain the theory that BTC will continue to build upward momentum as long as $29,300 support is not rejected. BTC is trying to crack $35,000 resistance right now. If this happens, look for BTC to retest all-time highs in the short term. On the contrary, look for a sharp sell-off if BTC ended up rejecting that support at $29,300.

Ethereum Price

At the time of this report, Ethereum is currently trading at $1,339. Over the last week, ETH has rallied ~ 8%. The second-largest digital asset by market cap has now surged ~ 77% over the last month. As mentioned for the last 3 weeks, ETH continues to be our highest conviction pick in the short term. ETH has closed above $1,000 for 25+ days now and continues to build bullish sentiment.

Ethereum Technical Analysis

In previous Ethereum analysis, it was believed that ETH would continue its uptrend if $1,187 support was not rejected. ETH ended up holding this level the last 7 days which propelled it higher. Due to recent price action, we have moved the key support level to $1,210. As long as ETH holds this support, we believe all-time highs will be retested in the short-term. ETH’s ROC ( rate of change ) indicator is flashing bullish. Bullish momentum continues to flow in. Keep ETH on watch going into next week.

XRP Price

At the time of this report, XRP is currently trading at $0.288. Over the last week, the fifth-largest digital asset by market cap has grown ~ 5.6%. Following the massive sell-off in December after the Ripple / SEC lawsuit announcement, XRP has recovered with a ~ 36% rally over the last month. We still believe XRP offers some of the largest potential upside in the market right now, but that comes with added risk. The lawsuit between Ripple & the SEC will be an ongoing issue to monitor. Ripple continues to argue that XRP is not a security. According to a recent announcement, Ripple filed their preliminary legal response. The fintech company argues XRP is not a security because:

- XRP is a virtual currency that is outside the SEC’s jurisdiction

- Ripple has never entered into an investment contract with XRP holders

- Ripple never held an IPO

- Ripple’s XRP sales amounted to far less than 1% of the massive XRP market that has grown for years

- XRP holders are not affiliated with Ripples revenue/profits

- XRP operates on the XRP ledger which is completely decentralized

XRP Technical Analysis

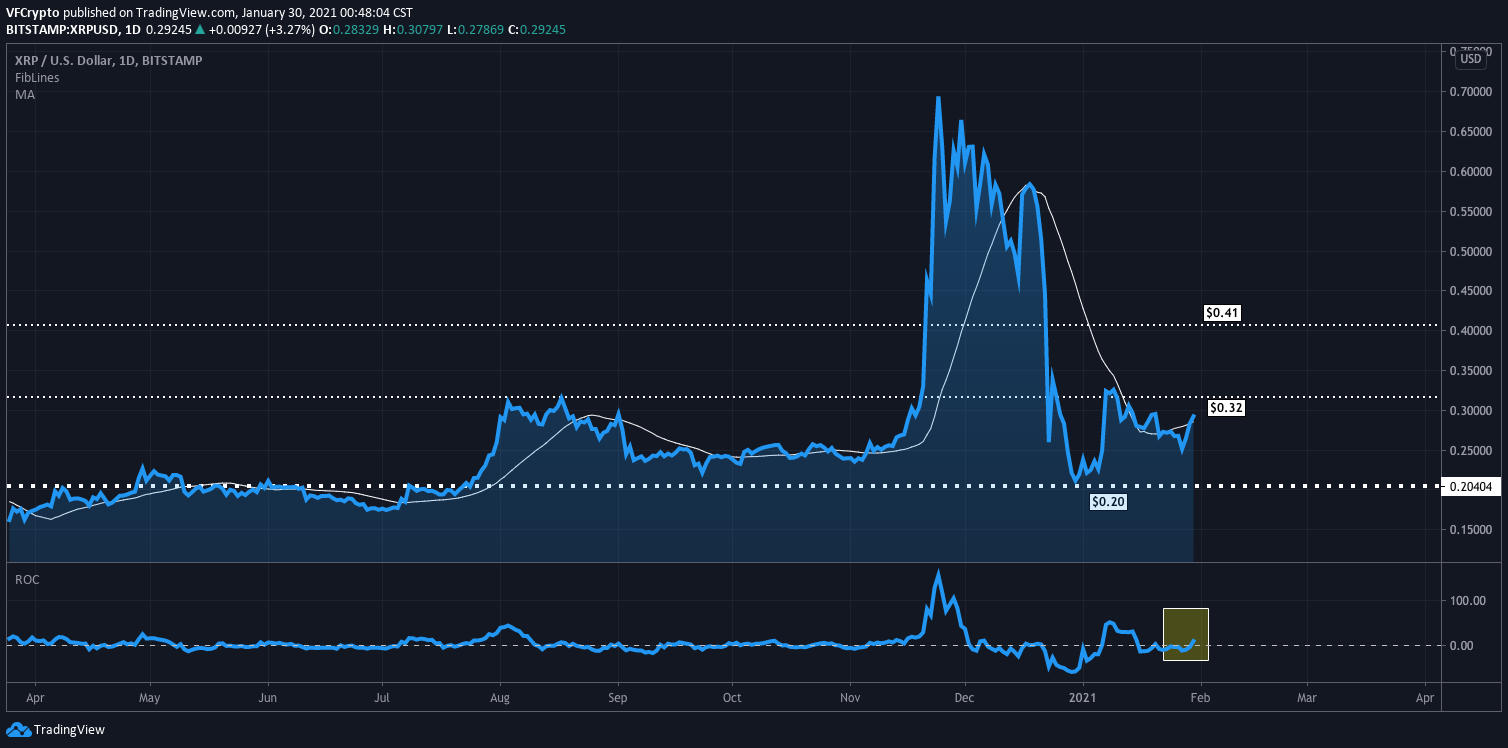

In previous XRP analysis, it was believed that upward momentum would continue to amass as long as XRP did not reject $0.20 support. This theory was accurate, as XRP did not reject support and continued to see upward momentum.

Based on recent price action, we have kept key support levels at $0.20. We still believe that XRP bulls will maintain control as long as the price stays above. XRP is now inching closer to $0.32 resistance. Watch for this level to be accepted going into next week. If this happens, watch for a strong push to $0.40 levels in the short-term. On the flip side, if XRP ended up rejecting $0.20 support, it will most likely see heavy selling pressures.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.