We take a look at Bitcoin prices as of May 21, 2022. Aside from fundamentals, we rely heavily on technical analysis to assess overall sentiment. This is achieved by identifying key support and resistance levels that traders and investors will be watching in the short term. Based on historical price action, Bitcoin could be flirting with one of the most important support levels in 5 years.

Bitcoin Price

At the time of this analysis, Bitcoin is currently trading at $29,357. The largest cryptocurrency by market cap has fallen ~ 30% over the last month. This price action has caught the attention of many investors that were looking to Bitcoin as a hedge against traditional markets. With ongoing uncertainty around inflation, interest rates, and geopolitical, the traditional stock market has experienced some of the highest carnage since 2001. This has ultimately resulted in the S&P 500 falling for 7 weeks in a row.

In the earlier days of Bitcoin, many investors argued that Bitcoin was a traditional market “hedge.” Further analysis showed that Bitcoin had periods of high inverse correlation to stocks. Some digital asset visionaries believed this inverse correlation was a leading indicator of Bitcoin becoming a “global hedge asset.”

As investors are experiencing a different market cycle due to inflation and rising interest rates, Bitcoin’s inverse correlation has faded quite quickly. Bitcoin surfaced during a time of economic expansion and low-interest rates. Like many other “growth” opportunities in the market, these assets benefitted from the cost of capital being so low.

Bitcoin thrived in a “risk-on” environment — but we now have to assess how it performs in a “risk-off” environment before labeling it as any form of “market hedge.” According to a recent Twitter post by Visionary Financial, Bitcoin was experiencing some of the highest correlations to traditional markets ever. Again, this is extremely important to look at in a “risk-off” environment.

#Bitcoin has fallen -33% year-to-date. When comparing $BTC to some of the largest #tech stocks by MC, it has trailed $AAPL, $MSFT, $GOOGL, and $TSLA.

It has outperformed $AMZN, $FB, and $NVDA. #BTC is hitting one of the highest correlations to #SPY in history. pic.twitter.com/9yFL7a2dtH

— Visionary Financial (@VisionaryFinanc) May 9, 2022

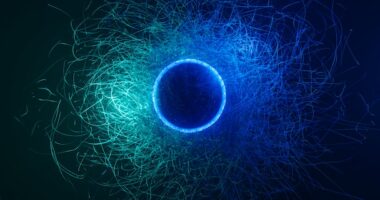

Bitcoin Technical Analysis

If we look at Bitcoin TA over a longer period, we are quickly noticing that Bitcoin prices are flirting with important support levels. The chart below looks at BTC in the 5-year timeframe.

Based on long-term price action, it is concerning to see BTC hovering around the $27,800 support level. This support has not been rejected over the last half-decade. If Bitcoin rejects this level, we could see high amounts of turmoil in the near future. This could ultimately lead to BTC falling to $18,700 levels. At the time of this analysis, we do not see a true reverse in sentiment until BTC re-tests the $35K levels.

As discussed above, the added risk to Bitcoin right now is its high correlation to traditional markets. If we continue to see this “risk-off” approach in global markets, it could put significant pressure on BTC in the short term. Given the high amounts of volatility YTD, we have not seen any BTC price action that gives us a high conviction that BTC will thrive in the “risk-off” environment. We are sold on the fact that Bitcoin can outperform in a “risk-on” environment, but as rates continue to rise, those days seem to be over.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however, no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the cryptocurrency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal, or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal, and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article. Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.