We take a look at Bitcoin price as of July 5th, 2021. Aside from fundamentals, we rely heavily on technical analysis to assess overall sentiment. This is achieved by identifying key support and resistance levels that traders and investors will be watching in the short term. Based on the current price action, what is the sentiment going into this week?

Bitcoin Price

At the time of this report, Bitcoin price is currently hovering around $33,966. The largest cryptocurrency by market cap is down ~ 1.7% over the last week. Bitcoin has also seen a ~ 7.7% drawdown over the last month. Aside from shorter-term price action, BTC is still up ~ 272% over the last year.

Bitcoin Mining Difficulty

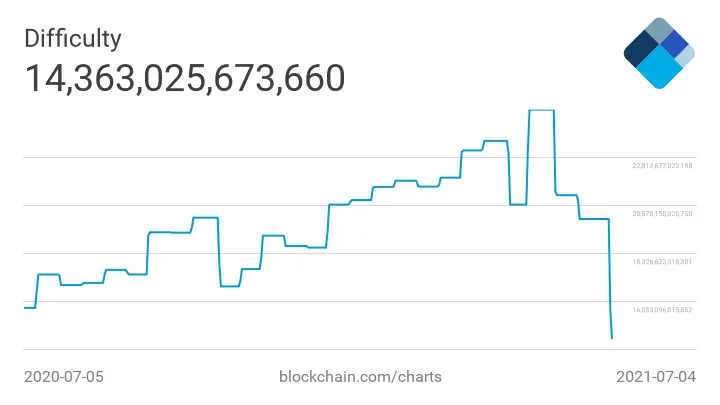

Following China’s strict ban on cryptocurrency mining & activities, the Bitcoin blockchain has seen a drastic shift in mining difficulties. Network difficulty has dropped to levels not seen in over a year. As China continues to push miners out of the country, this has forced miners to drop off the network. In this type of environment, block times and mining difficulty have tanked.

Upon the recent China developments, many investors believe that current blockchain fundamentals will be a short-lived issue. China’s crackdown put significant pressure on Bitcoin miners, especially since the region used to account for more than 60% of total hash power. The Bitcoin algorithm has been programmed to navigate issues like these where the market sees a large drop in mining machines.

Bitcoin Technical Analysis

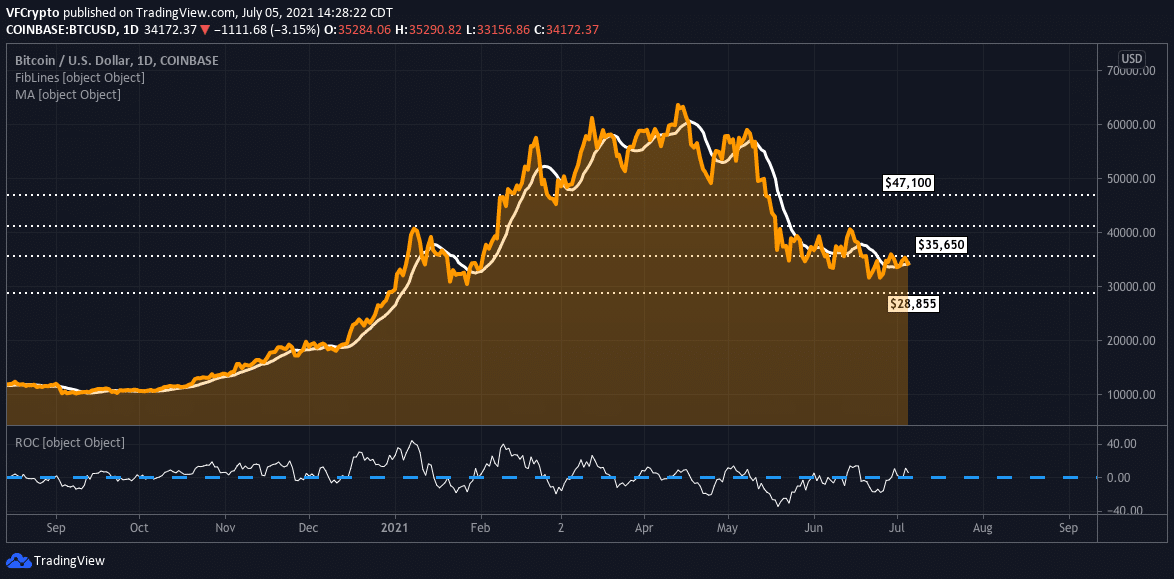

In our previous Bitcoin analysis, it was believed that BTC would remain neutral/bearish unless $35,650 resistance was slashed. As we can quickly see from the chart below, this theory has held up pretty well. Bitcoin price has failed to power through this resistance over the last week. With this being said, our key support and resistance levels have remained unchanged.

BTC has continued to consolidate under the $35,650 resistance level we outlined last week. We still believe that strong resistance remains at $35,650. If price can power through this level, we believe that investors/traders could push it to $40,000+ in the short term. If we compare ROC ( rate of change ) levels to last week’s analysis, we can see that there has definitely been a bullish shift accumulating. Sentiment last week was below 0.00, which denotes bearish momentum. With ROC now hovering above 0.00, it will be interesting to see if BTC can crack $35,650 resistance this week.

On the contrary, we will remain bearish unless $35,650 resistance is surpassed.

If BTC fails to do so, it could be eyeing $28,855 support in the short term. We have continued to see a consolidation since June 30th or so. With this type of price action, it is extremely important to identify your key support and resistance levels. The reason we say this is because historically speaking, the longer the consolidation, the larger the price move in the short term.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however, no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the cryptocurrency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal, or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal, and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.