Despite a global pandemic this year, Bitcoin has continued to see exponential growth, surging 46% YTD. Various Bitcoin predictions have surfaced to close out this year, but what about the long term outlook? A prominent Tesla investor recently predicted that Bitcoins market cap could grow $1-5 trillion in the next 5-10 years. If this happened, what would Bitcoins price look like, and what are some of the hurdles BTC needs to overcome to potentially get there?

Growing Investment In Bitcoin

Aside from retail investors, various institutional investors have invested in Bitcoin this year as a potential hedge against inflation. A prominent Tesla investor believes that this type of sentiment could drive Bitcoins market capitalization to $1-5 trillion in the next 5-10 years.

Bullish Prediction on Bitcoin Market Cap

According to a report published by Yassine Elmandjra, the director of research at Ark Invest, Bitcoins market cap could grow $1 – 5 trillion in the next five to ten years. As a result, investors should not ignore Bitcoin as an asset class. Ark Invest is well known for its overly optimistic prediction about the price of Tesla stock, a prediction that paid out bigly. Thus far, the price of Tesla stock has grown fourfold.

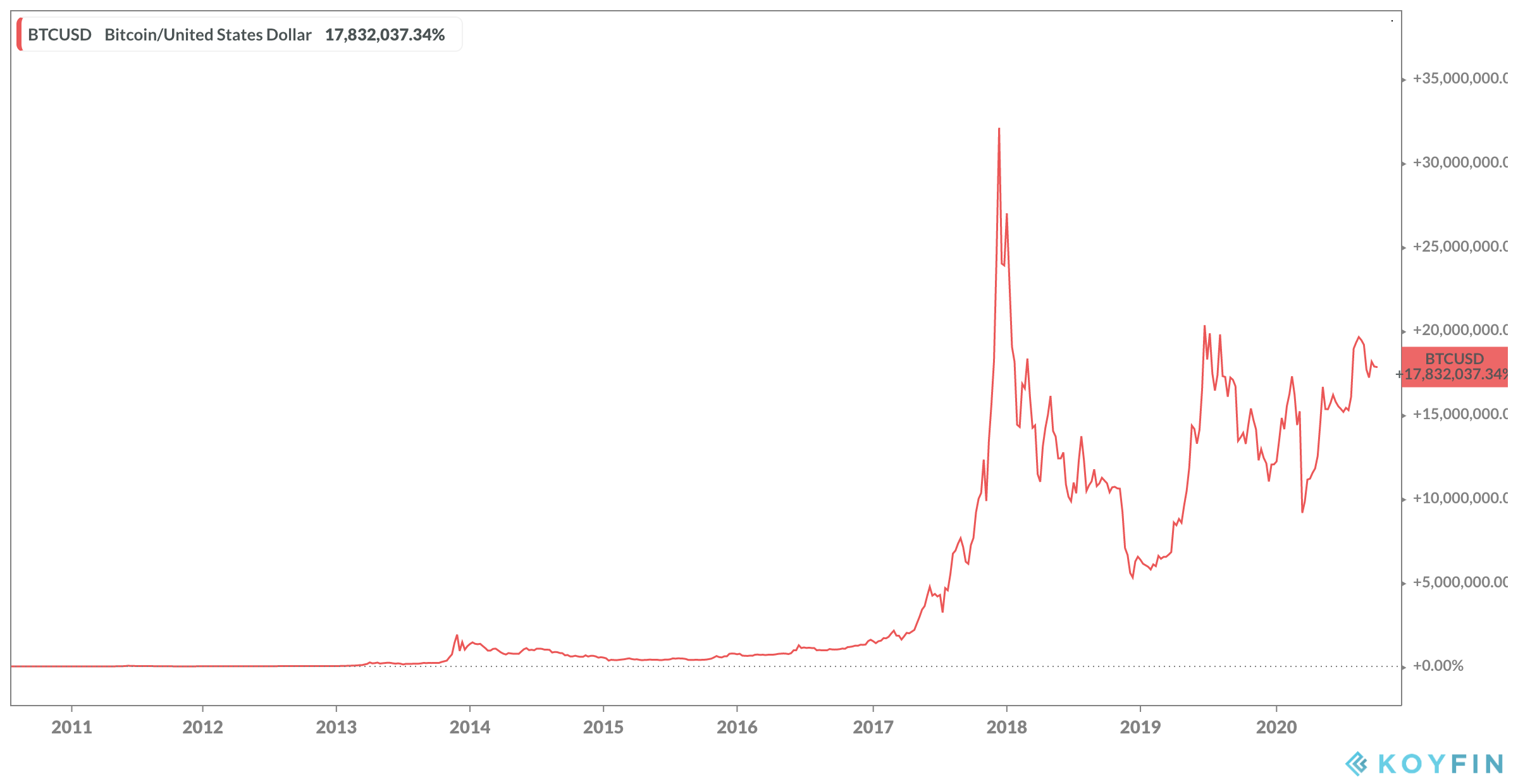

Bitcoin is the best-performing asset during the last decade, with its price surging from $0 to an all-time high around $20,000. Since the all-time high was accomplished in 2017, Bitcoins price has fallen to a current level of $10,700. Ark invest is still quite optimistic about the next five to ten years for Bitcoin. The report claims that analysis on Bitcoin has shown it being on an early path to monetization, which carries massive potential for appreciation.

Bitcoin Predictions – What They Mean

At the time of this report, Bitcoin currently trades at $10,700 with a market capitalization of $198 billion. If Ark Invest is right on their long term predictions, this is what Bitcoins price could look like in the foreseeable future ( estimated figures that would depend on the year, circulating supply in existence, etc. Figures below are fairly conservative, if one is assessing Bitcoins price off 19M circulating supply ).

- Bitcoins price at $1 trillion market cap = $52,631

- Bitcoins price at $2 trillion market cap = $105,263

- Bitcoins price at $3 trillion market cap = $157,894

- Bitcoins price at $4 trillion market cap = $210,526

- Bitcoins price at $5 trillion market cap = $263,157

The Analysts Advise Caution

By 2025, the Bitcoin market cap could hit $3 trillion. However, the analysts are cautious. They detail various risks that could derail the growth of Bitcoin. One of them is uncertainty in the law. Other issues that could derail the success of Bitcoin are the technical problems that come with holding large amounts of Bitcoin and over institutionalization.

On the issue of over institutionalization, Elmandjra warns that it could lead to a few centralized parties controlling transactions. The result is that it would erode the main value proposition of Bitcoin, which is decentralization. According to Elmandjra, all of these issues need to be addressed for Bitcoin to achieve its full potential.

Ark Has Been Bullish on Bitcoin For A While

Ark has been bullish on Bitcoin for a while now. They first made a solid commitment to the crypto coin when it bought shares in the Bitcoin Investment Trust that was created by Grayscale in 2015. In 2018, Ark cashed out their investment in what they called a complicated decision. According to company officials, they were forced to cash out due to tax and regulatory concerns and not because of the merits of Bitcoin itself. At the start of 2020, Ark described Bitcoin as a contender for the first global digital money. They were echoing sentiments expressed by Elon Musk, the Tesla CEO.

Whether Bitcoin hits five trillion or not is a waiting game. However, the report created by Elmandjra helps to show some of the weak points of Bitcoin that keep it from achieving its full potential. As these issues are resolved, it could help to achieve the predicted growth trajectory, which would be of epic proportion if the metrics did indeed come to fruition.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.