The cryptocurrency market meltdown intensified Wednesday as the leading digital asset tumbled to levels unseen since April. The flagship token dropped as low as $88,522 during volatile trading sessions, extending losses that have eliminated more than $1 trillion in total crypto market value. Junior brokers at Unirock Gestion dissect the factors driving this collapse and evaluate what lies ahead for digital currency investors.

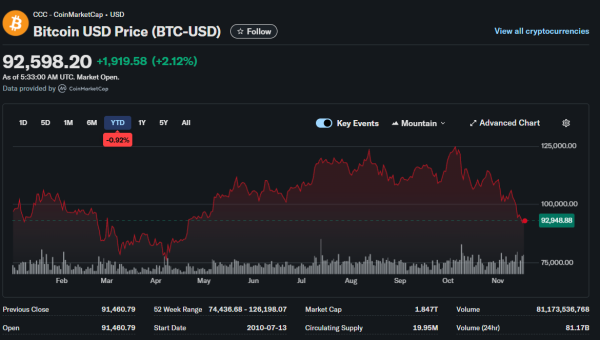

Trading activity shows Bitcoin hovering near $88,965, declining roughly 4.8% over 24 hours. Price swings ranged from approximately $88,800 to $93,500 intraday, highlighting persistent volatility following Tuesday’s liquidation cascade. From the all-time peak near $126,000 achieved in early October, the cryptocurrency has surrendered close to 30% of its value in a remarkably short timeframe.

ETF Outflows Tell the Story

Among the clearest catalysts behind price deterioration is activity within U.S. spot Bitcoin exchange-traded funds. Tuesday witnessed the largest single fund experiencing investor withdrawals, approaching $523 million in one trading session. This marked the most substantial outflow since the product launched in January 2024, signaling a meaningful shift in institutional sentiment.

The exodus wasn’t isolated to one investment vehicle. Throughout the spot Bitcoin ETF ecosystem, investors extracted billions from crypto exposure as appetite for risk assets evaporated globally. Bitcoin briefly penetrated $90,000, approximating the average purchase price across all ETF inflows since inception. This technical level means that typical ETF participants found themselves holding underwater positions, at least momentarily.

Liquidations exceeded $1 billion in leveraged cryptocurrency positions within a 24-hour window. More than 180,000 traders experienced forced position closures according to derivatives market data. Multiple analyses characterize this as a textbook leverage washout, with concentrated long positions established near the October summit now being systematically eliminated through margin calls.

The forced selling created a feedback loop as declining prices triggered additional liquidations. This dynamic accelerated downward momentum beyond what fundamental factors alone might have produced.

Derivatives markets showed heavy skew toward bullish positions entering November, leaving the complex vulnerable to cascading liquidations once prices breached key technical support levels.

Broader Market Weakness Compounds Pain

Bitcoin’s descent doesn’t occur in isolation from traditional financial markets. U.S. equity indexes have experienced turbulence for consecutive sessions as investors question whether artificial intelligence-linked mega cap valuations reflect sustainable fundamentals. Particular attention centers on major technology earnings reports that could validate or challenge current market assumptions.

Media outlets highlighted shifting expectations around U.S. monetary policy direction. Diminishing hopes for December Federal Reserve rate reductions tend to damage speculative asset classes like cryptocurrencies. A major investment bank’s basket tracking unprofitable technology stocks declined nearly 20% since mid-October, signaling high beta growth-oriented trades face systematic de-risking across portfolios.

Financial publications explicitly connect Bitcoin weakness to this broader risk-off rotation. They document the cryptocurrency sliding roughly 30% from record highs as capital managers exit riskier market segments. This encompasses both digital currencies and artificial intelligence-related equities, experiencing simultaneous pressure from changing risk preferences.

What Happened to the Moon Mission

For many participants, 2025 was supposed to represent cryptocurrency’s mainstream breakthrough year. A sympathetic White House administration, new regulatory frameworks enabling exchange-traded fund launches across multiple tokens, and surging institutional capital inflows seemingly validated digital assets securing permanent standing in traditional finance.

Instead, investors who purchased near peaks confront a familiar narrative of euphoria followed by sharp retracements.

The asset once promoted as destined to “go to the moon” now struggles to match returns from conventional Treasury securities. Bitcoin declined nearly 30% from 2025 highs, trailing performance across asset classes from technology equities to short-term government bills.

Originally marketed as a high-growth vehicle, an inflation protection mechanism, and a portfolio diversification tool, the world’s largest cryptocurrency now confronts the prospect of finishing the calendar year with negative returns.

Institutional Buyers Still Active

Despite the selloff, select institutional participants continue accumulating positions. A prominent corporate holder purchased 8,178 additional coins between November 10 and 16 at average prices near $102,171 per token. The company deployed approximately $835.6 million total, demonstrating conviction amid widespread selling pressure from retail participants.

Harvard University expanded its Bitcoin ETF allocation threefold to $443 million through a major fund manager’s product, reflecting institutional confidence despite market turbulence. Some advocates argue that volatility naturally eliminates participants lacking deep conviction about long-term value propositions and cultural commitment to the cryptocurrency movement.

Support Levels in Focus

Finance analysts emphasize that Bitcoin’s behavior near the $90,000 threshold will prove decisive for the near-term trajectory. Should this zone provide durable support, it could represent the inflection point where digital assets begin leading risk sentiment recovery rather than lagging broader market moves. However, with long-term holders continuing to distribute coins, additional downside exposure persists if short-term holders capitulate further.

While support may exist above $95,000 based on technical analysis, few immediate catalysts appear capable of reversing sentiment. Historical precedent demonstrates that Bitcoin can recover dramatically from severe drawdowns.

Across longer measurement periods, returns remain impressive relative to traditional assets. Yet current positioning reflects defensive postures as participants brace for potential additional weakness.