Biptap expands to Africa with a landmark partnership in the Central African Republic, marking a major step toward redefining financial access across the continent. The deal, signed between Biptap CEO Jonathan Low and President Faustin-Archange Touadéra, introduces modern, secure, and inclusive banking services for more than 5.5 million people.

This milestone marks the beginning of Biptap’s Africa expansion, with the Central African Republic taking the lead in adopting Biptap’s transformative infrastructure. By connecting millions of citizens to borderless and accessible financial systems, the company positions itself not just as a platform but as a catalyst for a continent-wide financial revolution.

A New Era of Financial Inclusion as Biptap Expands to Africa

The Central African Republic has emerged as a bold leader in financial innovation. Through this deal, Biptap will provide access to banking for millions of unbanked individuals, delivering solutions that connect them to global financial systems while preserving privacy, security, and inclusivity.

Biptap CEO Jonathan Low emphasized that this agreement with President Touadéra goes far beyond traditional banking. He noted that the partnership is designed to empower citizens by providing them with tools that deliver freedom, access, and opportunity—marking only the beginning of a larger mission to bring Africa the modern financial infrastructure it deserves.

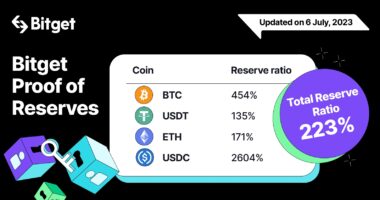

Blockchain, Digital Assets, and the Future of Banking

Africa is rapidly embracing blockchain technology, digital assets, and crypto adoption. With Biptap’s advanced financial technology combined with President Touadéra’s visionary leadership, this partnership accelerates the region’s shift toward secure digital banking and financial independence.

This collaboration extends its impact well past national borders – it unlocks opportunities for millions across the continent and strengthens ties with the African diaspora worldwide. From remittances and cross-border payments to wealth creation through digital assets, Biptap is redefining how financial independence can be achieved in emerging markets, empowering citizens to participate in the global economy.

Building the Foundation for Regional Growth

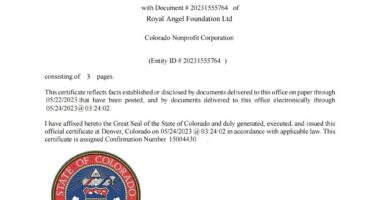

Beyond the Central African Republic, Biptap is in advanced discussions with government officials, regulators, and policymakers across multiple African nations, laying the groundwork for a unified, future-proof financial ecosystem.

This initiative reflects Biptap’s long-term mission to redefine how financial systems operate at scale. With modern infrastructure designed for both growth and inclusivity, Biptap ensures that individuals, businesses, and governments alike gain access to secure, transparent, and innovative banking tools.

What’s Next: Biptap Expands to Africa Beyond CAR

The Central African Republic is only the first step in Biptap’s African journey. With this launch, the company is preparing to extend its reach across the continent, bringing secure, inclusive, and future-ready banking solutions to millions more individuals, businesses, and governments.

From empowering local communities to enabling cross-border trade and diaspora connectivity, the ripple effects of this expansion will reshape how financial services are delivered and experienced.

With the Central African Republic as the launchpad point, Biptap’s mission to create the most comprehensive financial ecosystem the world has ever seen is now underway across Africa, setting a precedent for the future of global banking.

About Biptap

Biptap is a banking infrastructure that combines the reliability of traditional finance with the innovation of blockchain technology. Designed for both Web2 enterprises and Web3 innovators, we provide crypto and fiat transaction management with top-tier security, scalability, and accessibility.

Our solutions include virtual and physical cards, offramp services, offshore banking, payment processing, and Whitelabel business solutions. Trusted by over 200,000 users since 2021, Biptap processes over $120 million in monthly transactions, ensuring global banking anytime, anywhere.

-

Website: http://biptap.com/

-

Twitter: https://x.com/biptapofficial

-

Instagram: https://www.instagram.com/biptap.official

-

Discord: https://discord.com/invite/biptap

-

LinkedIn: https://www.linkedin.com/company/biptap/

This press release was originally published on this site