BigBear.ai (BBAI) reported a profit of $2.5 million in its latest quarter, even as revenue fell 20% to $33.1 million. This unusual combination has left investors wondering how a company can post a profit while top-line sales decline. The key lies in non-operating items, particularly swings in the fair value of derivatives, which can significantly affect the bottom line without reflecting core business performance.

Brokers from Aurudium analyze the results to separate temporary accounting gains from underlying trends, helping investors determine whether BigBear’s stock has the potential for sustainable growth or if its volatility signals caution in today’s uncertain AI market.

What Happened With BigBear’s Bottom Line?

BigBear.ai’s third-quarter results, covering the period ending September 30, showed revenue of $33.1 million, down 20% from $41.5 million in the same period last year. The drop was largely due to a decline in demand for Army-related programs, the company’s primary government customer segment. This follows a similar trend from previous quarters, suggesting that BigBear’s top-line growth remains inconsistent.

Despite the revenue decline, BigBear posted net income of $2.5 million, a notable improvement from a $15.1 million loss a year ago. This boost came from a $26.1 million decrease in the fair value of derivatives, including warrant revaluations.

These are non-operating items, meaning they do not reflect the core operating performance of the business. In fact, the previous quarter saw a massive $135.8 million increase in derivatives, which contributed to a $228.6 million net loss, more than double the company’s $90.3 million operating loss.

Many analysts emphasize that investors should focus on operating income to gauge the company’s real performance, as swings in derivative valuations can make BigBear’s financials appear significantly better or worse than they are.

The Growth Challenge

BigBear.ai continues to be a high-risk tech investment. The company reported $9.6 million in cash burn from operating activities last quarter, highlighting its reliance on investor capital to fund day-to-day operations. For growth-focused investors, this is a red flag, as long-term viability depends on consistent top-line growth to offset operating losses.

Without a clear trajectory of revenue expansion, it may be difficult for BigBear to convince growth investors that the business is progressing. While the company has experienced periods of revenue growth, its performance has been inconsistent and heavily dependent on government contracts, particularly Army programs, which are not currently showing robust demand.

What This Means for Investors

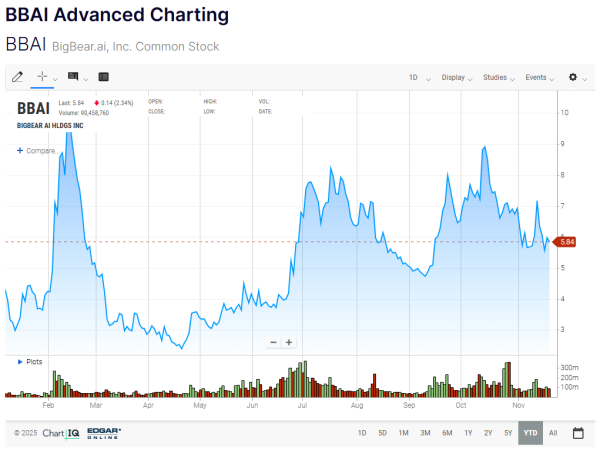

BigBear’s stock has experienced volatility over the past year, ranging from a low of $1.70 to a peak of $10.36, and currently trades around $6. The company’s modest market capitalization of $2.8 billion has caught the attention of some investors looking for potential upside in the AI sector. However, financial experts caution that without consistent revenue growth, the stock carries significant risk.

Investors must weigh the non-operating gains from derivatives against the reality of declining sales and operating losses. While the positive net income may appear attractive at first glance, the swings in derivatives do not reflect sustainable business performance. BigBear’s reliance on government spending adds another layer of uncertainty, as federal demand can fluctuate based on budgetary priorities and program timelines.

Should You Buy BigBear.ai Stock?

Given the company’s current financial profile, many analysts suggest a watch-and-wait approach. BigBear.ai may offer speculative upside for investors willing to accept high volatility, but its inconsistent growth, operating losses, and dependence on non-operating items make it a risky investment in the current environment.

For investors seeking exposure to AI, there are other companies with stronger revenue growth and more predictable earnings, making them potentially safer choices. BigBear’s recent earnings demonstrate the company’s ability to post short-term profits through accounting adjustments, but its fundamental growth story remains uncertain.

Conclusion

In summary, BigBear.ai’s Q3 results illustrate a company with volatile financials, a shrinking revenue base, and temporary accounting-driven profits. While the stock has delivered some short-term gains this year, its reliance on government contracts and non-operating items makes it a high-risk choice for long-term investors.

Investors interested in BigBear.ai should monitor operating income, cash burn, and government contract trends closely. For now, many financial experts stated that the company may be better suited for speculative, risk-tolerant portfolios rather than mainstream growth-focused investment strategies. The most prudent approach may be to keep BigBear on a watch list and await more consistent growth signals before committing significant capital.