A struggling semiconductor company just executed a dramatic corporate restructuring that sent shares soaring over 329% year-to-date, but the rally masks a complex bankruptcy proceeding that fundamentally altered shareholder ownership. A lead financial expert at Axstera breaks down whether this reorganization represents genuine recovery potential or simply a debt restructuring that benefits creditors at the existing shareholders’ expense.

The Mechanics of Reincorporation

The company shifted its legal domicile from North Carolina to Delaware, specifically to access more favorable Chapter 11 bankruptcy provisions. Delaware’s well-established bankruptcy framework offers companies greater flexibility in restructuring negotiations and benefits from decades of legal precedent that expedites the process.

The restructuring involved issuing new stock to satisfy debt obligations, with existing shareholders receiving a maximum of 5% of the newly issued shares. This massive dilution explains why the stock price surge doesn’t translate to wealth creation for original investors; their ownership stakes were essentially wiped out to satisfy creditors.

A History of Value Destruction

The performance record reveals persistent struggles. Since listing in 1993 as Cree, the company has never reported annual profits. Over the past decade, revenues declined at a negative 7.39% compound annual growth rate, representing systematic value destruction rather than temporary setbacks.

Recent quarterly results continued this pattern. Revenues fell 1.8% year-over-year to $197 million while net losses ballooned to $669.3 million from $174.9 million in the prior-year period. On a per-share basis, losses narrowed to $0.77 from $0.89, but still missed consensus estimates calling for a $0.70 loss.

The balance sheet situation appears particularly concerning. The company closed its fiscal year with $955.4 million in cash, down dramatically from $2.2 billion the previous year. This cash position sits far below $6.5 billion in short-term debt, creating an obvious solvency crisis that necessitated the bankruptcy filing.

Cash used in operating activities reached $711.7 million for the fiscal year, nearly matching the prior year’s $725.6 million burn rate. This persistent cash consumption without corresponding revenue growth or paths to profitability made the restructuring inevitable.

The Strategic Asset Underneath

Despite financial mismanagement and crushing debt loads, the company owns a valuable strategic asset: one of the few operational silicon carbide factories in the United States. This manufacturing capacity positions it to benefit from surging demand for SiC semiconductors, driven primarily by electric vehicles and data center applications.

Market projections estimate the SiC device market will reach between $11 billion and $14 billion by 2030, with approximately 70% of demand coming from EV manufacturers. These wide-bandgap materials offer superior performance for power electronics compared to traditional silicon, making them increasingly essential for electric drivetrains and charging infrastructure.

The company recently achieved a significant operational milestone by rolling out its 200mm silicon carbide wafer portfolio. This represents a substantial upgrade from the previous 150mm standard. Larger wafers enable more devices per wafer, theoretically reducing per-unit production costs and improving manufacturing yields.

John Palmour Manufacturing Center in Chatham County, North Carolina, is nearing completion and is expected to become one of the world’s largest 200mm SiC wafer fabrication facilities. Simultaneously, upgrades at the existing Marcy, New York, device fab should boost output by approximately 30%, supporting long-term production targets.

Competitive Pressures and Market Reality

The silicon carbide sector faces intensifying competition that complicates recovery prospects. Public competitors like STMicroelectronics and ON Semiconductor are aggressively scaling their own 200mm capabilities, while Chinese manufacturers are rapidly building domestic SiC production capacity.

The bankruptcy filing by Japanese player JS Foundry earlier this year serves as a cautionary tale. While strategic errors contributed to that failure, it demonstrates that technological capabilities alone don’t guarantee commercial success in this capital-intensive industry.

The company faces a classic turnaround challenge: it possesses valuable technology and manufacturing assets but lacks the financial resources to compete effectively against better-capitalized rivals. The restructuring addressed immediate solvency concerns but didn’t resolve fundamental competitive disadvantages.

The shift to 200mm wafer production, while significant, merely brings the company to parity with competitors rather than establishing differentiation. First-mover advantages in SiC manufacturing have largely dissipated as established semiconductor firms entered the market with deeper pockets and more diversified revenue streams.

Wall Street’s Mixed Assessment

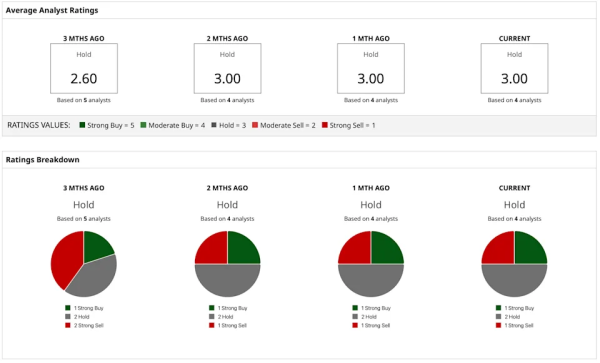

Analysts have assigned a consensus “Hold” rating with a mean price target of $3.75 and a high target of $6, both levels already exceeded by the post-restructuring rally. Among four analysts covering the stock, one rates it “Strong Buy,” two say “Hold,” and one maintains a “Strong Sell” recommendation.

This dispersion reveals fundamental disagreement about valuation. Bulls focus on strategic asset value and market growth potential, while bears emphasize the decades-long profitability failure and competitive headwinds.

The most favorable outcome for stakeholders would be acquisition by a larger semiconductor manufacturer. A company like Texas Instruments, Analog Devices, or even an international player could integrate the SiC capabilities into existing operations, potentially extracting value that the standalone entity cannot achieve.

Acquisition interest would likely focus on manufacturing capacity rather than the company as a going concern. Bidders would evaluate whether purchasing distressed assets provides better value than building greenfield facilities, considering construction timelines and capital requirements.