Equity markets throughout Asia posted gains during trading as technology stocks rallied amid ongoing excitement about artificial intelligence prospects. Regional indexes paid little attention to Federal Reserve Chair Jerome Powell’s careful stance on upcoming rate decisions. Market participants focused instead on the imminent meeting between the US President and China’s President happening later this week.

A financial analyst at LFTrade examines why Asian bourses show such strength despite conflicting messages from US monetary officials.

Tech Sector Drives Performance

Futures contracts tied to American equities rose 0.4% during overnight Asian hours after the prior day’s inconclusive US session. Benchmark regional gauges added 0.3% with technology firms providing the strongest contributions. Chipmakers delivered especially strong showings after Samsung Electronics reported earnings that soundly beat analyst projections.

The MSCI Asia Pacific technology gauge substantially outpaced broader measures as leading US semiconductor companies posted encouraging quarterly figures. Nvidia’s unprecedented ascent to a $5 trillion valuation generated favorable sentiment for Asian chip manufacturers. Enterprises across the intricate semiconductor production network gained from revived confidence in AI infrastructure buildout.

Japan and South Korea’s main exchanges both touched fresh all-time peaks despite some worrying internal market characteristics. Notably, falling stocks outnumbered rising ones in both the Nikkei 225 and Kospi benchmarks. This concerning narrow leadership pattern echoes troubling trends recently observed in US trading.

Fed Chief’s Caution Gets Dismissed

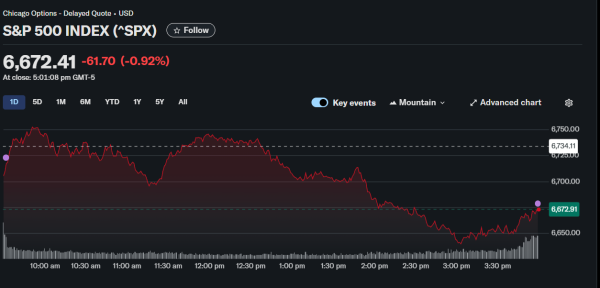

America’s central bank lowered its key lending rate by 25 basis points to 3.75%-4% matching widespread market expectations perfectly. Powell then cautioned that an additional December decrease isn’t necessarily forthcoming. His remarks initially weighed on US equities during late New York hours.

Trading activity across Asia indicated regional investors are focusing beyond immediate Fed policy toward larger strategic considerations. Powell explicitly acknowledged that committee members maintain starkly different opinions regarding appropriate monetary policy moves ahead. His candid assessment cut December rate cut odds to 60% from previously assumed 90% probability.

Yet Asian market participants showed considerable patience with American monetary authorities despite this hawkish shift. The Fed confronts legitimate obstacles given the US government impasse blocking crucial economic data from publication. Crafting sound policy without access to vital employment and inflation metrics presents genuine challenges.

China Summit Draws Attention

Investor interest has pivoted firmly toward the planned discussion between the US President and Chinese President scheduled for the coming days. Observers anticipate the dialogue will tackle lingering disputes over tariffs and rare earth export controls recently implemented. Optimism regarding trade relations has lifted sentiment lately notwithstanding occasional harsh exchanges.

The S&P 500 dropped a sharp 2.71% earlier this month when the US President announced potential major tariff increases on Chinese goods. Indexes have subsequently erased those declines entirely plus added gains, showing impressive resilience. Market participants appear ready to dismiss temporary political posturing while concentrating on ultimate negotiated settlements.

China lately unveiled contentious requirements mandating export permits for rare earth materials effective December 1. These rules impact resources where China controls approximately 70% of worldwide supply. While this move temporarily heightened friction, it hasn’t seriously undermined expectations that the presidential meeting will yield progress.

Samsung Figures Boost Confidence

Samsung Electronics announced quarterly profits exceeding forecasts, offering meaningful support for technology sector enthusiasm generally. The Korean giant’s numbers pointed to impressively healthy demand for memory semiconductors and display screens across its portfolio. These vital components are indispensable for gadgets and computing facilities enabling AI applications worldwide.

The significant upside surprise validated prevailing views that AI-driven demand stays strong notwithstanding various economic uncertainties present. Companies strategically situated throughout the semiconductor fabrication ecosystem keep deriving substantial benefits from infrastructure spending. Cloud operators and AI creators desperately need these parts for their quickly expanding deployments globally.

Samsung’s solid showing stands in stark contrast to genuine struggles facing some other technology enterprises lately. The pronounced difference highlights how AI expenditures create clear winners and losers even within the technology umbrella. Businesses directly connected to AI infrastructure are decidedly prospering while others encounter much harder conditions.

Regional Assessment Remains Positive

Various Asian markets confront genuinely distinct circumstances from China’s continuing real estate struggles to Japan’s challenging population dynamics. Southeast Asian countries keep carefully balancing between American and Chinese economic gravitational pulls. Despite these diverse situations, the region displays notable correlation with American technology sector results overall.

This unmistakably reflects both the core significance of chip industries to Asian economies and the US tech sector complete global leadership. The capacity of Asian markets to climb despite Fed uncertainty shows underlying resilience. However, durability depends substantially on persistent US technology sector strength sustaining momentum going forward.

Markets look reasonably well set for further advances if trade talks yield genuinely constructive results and corporate profits stay solid. The mixture of generally supportive central bank positions and decent corporate outcomes backs risk assets. Any major adverse surprises could swiftly reverse recent gains given concentrated market breadth problems continuing.