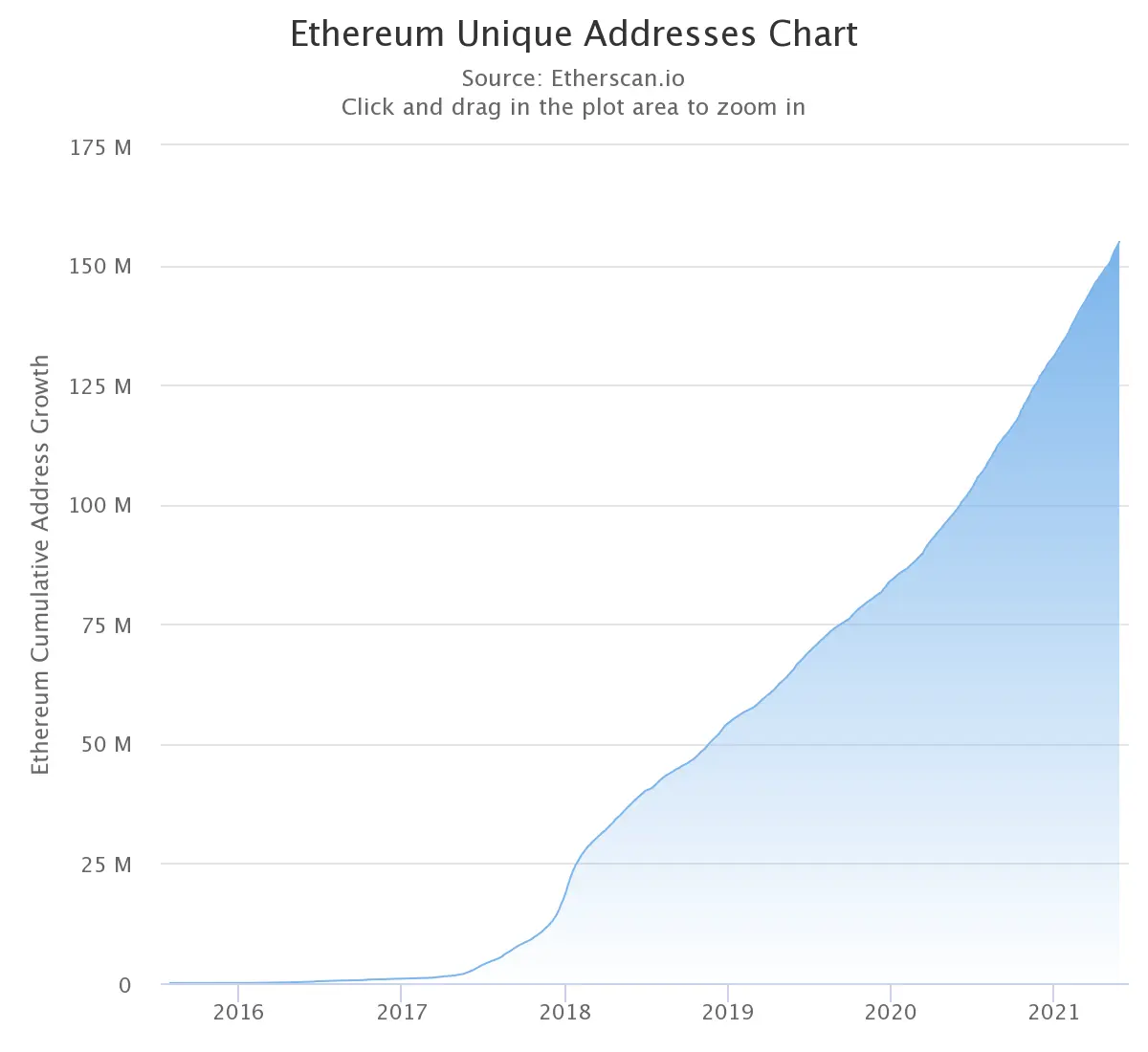

Ethereum’s ecosystem has been a delicate subject for a new user to understand, it has been evolving systematically and creating new opportunities for everyone in many different ways.

Ethereum has reformulated the idea of decentralization, with community governance and no single authority, It has created a robust space of decentralized finance and has created a whole new world in the cryptocurrency industry.

Network congestion has been a major issue with the Ethereum network due to:

- Growing usage

- Increased demand

- More products building on Ethereum

- High transaction volumes.

Decentralized applications and exchanges have set a priority for transactions which eventually lead to higher transactional fees.

Layer 2 solutions have been a popular topic, as many investors believe they could help the network overcome congestion, high gas fees, and lagging transaction speeds. Layer 2 products and updates can arguably take Ethereum to new heights. These solutions run on top of Ethereum’s layer 1 by enabling off-chain transactions.

L2 is estimated to offer 2,000-3,000 transactions per second. This could put Ethereum ahead of the world’s fastest payment medium in VISA, which has 1,700 TPS. Let’s see which L2 solutions are being operated and who is scaling the Ethereum blockchain:

Sidechains: These run parallel to Ethereum’s main chain and have their own consensus mechanism. Sidechains have historically been more vulnerable to attacks due to lower security barriers. Many of today’s popular NFT projects are operating with sidechains. Projects using sidechains are SKALE, POA Network, Matic, etc.

Plasma: These are a type of side-chain that submits a batch of transactions to the main chain at regular intervals. Plasma offers higher security levels and their security mechanism is called “Fraud Proof.” In plasma chains, the data behind the transaction is unsent. Transactions in the plasma block can dispute for up to 7 days. This type of side-chain tends to offer less efficiency in overall speeds. Projects using Plasma are OMG, Gluon, Matic, etc.

Optimistic Rollups: These are similar to Plasma side-chains. When a batch is committed to the mainchain, the transactional data is rolled up and becomes more secure. Projects using Optimistic Rollups are Optimism and Fuel Network.

ZK Rollups: Known as Zero-Knowledge rollups. These are similar to Optimistic Roll-Ups but are more secure. The transactions are not committed to the mainchain until the SNARK proof has been generated. ZK Rollups tend to facilitate faster speeds but lack security. Projects working on this include, Starkware, zk sync, and others.

Eventually, layer 2 solutions are prioritized based on security vs speed. There are very few products that are working on all four L2 solutions.

Many digital asset enthusiasts believe that Ethereum could have more utility than Bitcoin in the long term. L2 solutions and other upgrades should help the ETH blockchain scale to new horizons. Despite high gas fees and slow transaction speeds, demand continues to pour into Ethereum. Imagine a network that directly competes with VISA as the world transitions into DeFi and other forms of digital finance that rely on Ethereum’s blockchain.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however, no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the cryptocurrency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal, or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal, and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.