BlockFi, a cryptocurrency financial services company, recently announced the launch of BlockFi Prime. The bank-like platform manages $15 billion in assets and is bridging the gap between cryptocurrency and traditional finance. What is BlockFi Prime and how will it help the company scale beyond its retail base?

About BlockFi

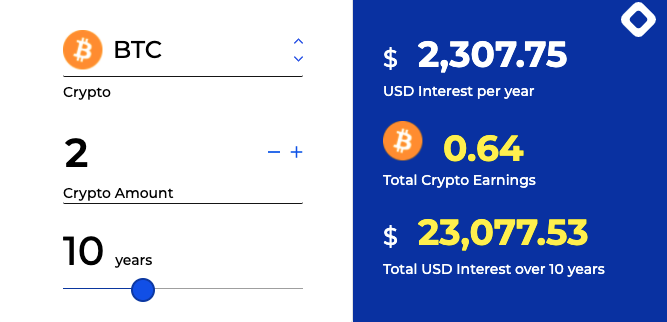

BlockFi is a digital asset management platform that lets people leverage their crypto assets. Users can earn up to 8.6% APY on their digital assets via the BlockFi Interest Account. Unlike traditional banks, BlockFi offers no hidden fees or minimum balances. Interest accrues daily and is paid monthly. Cryptocurrencies such as Bitcoin, Ethereum, Litecoin, PAX, and many others can be used in these interest accounts.

Aside from Interest Accounts, users can borrow cash, buy and sell crypto, and leverage other bank-like services on BlockFi’s platform.

In an era where traditional rates are near 0%, investors have no ability to build wealth via their banking assets. Instead, people have flocked to digital asset markets, where interest-bearing opportunities can be quite lucrative. Unlike traditional fiat, BlockFi has built decentralized infrastructure that lets you “do more with your crypto.”

The software company, which is headquartered in New Jersey but has offices globally, has now generated more than $200 million in interest for its users. While managing more than $15 billion in assets, there is no doubt that BlockFi is conquering the DeFi space when it comes to crypto retail markets. What is the company doing to scale into institutional markets?

BlockFi Prime

According to a recent announcement, BlockFi has launched “BlockFi Prime” for institutional clients. This will be a new integrated trading platform for institutional and sophisticated investors. The new trading capabilities will be an ideal solution for:

- Asset managers

- Family offices

- High net worth individuals

- Hedge funds

- Private equity firms

- Other corporate entities

BlockFi Prime will look to capitalize on the solutions it currently offered institutional clients, such as digital asset borrowing and client service through its OTC trading infrastructure. These enhancements are expected to help traditional fund managers seeking seamless trade flow settlement and reporting.

Excited to officially launch our institutional platform, BlockFi Prime!https://t.co/dxB5EC81rH

— Zac Prince (@BlockFiZac) June 10, 2021

BlockFi Prime is equipped with the following features:

- Real-time streaming quotes

- Via a 24-hour settlement cycle, users can trade up to settlement limits

- Trade and loan history ( term sheets and outstanding balances )

- Built-in exchange calculators

- Seamless trading user interface

- API to leverage BlockFi Prime into different systems

- Custom pricing models to best fit an organization’s needs

Zac Prince, CEO, and co-founder of BlockFi, recently stated that:

“As cryptocurrency investment and adoption becomes even more a part of mainstream financial markets, institutional investors have demanded tools that enable them to pursue traditional investing strategies while navigating trading nuances specific to digital assets. BlockFi Prime is an exciting new tool that provides investors an unparalleled degree of control, insight, and convenience in managing their organization’s crypto assets.”

David Olsson, VP and Global Head of Institutional Distribution at BlockFi, also commented that:

“Developing and launching BlockFi Prime is a natural next step for us as we continue to respond to the evolution of digital assets and institutional investors adjust their trading strategies. Just in the last year, we have added lending, trade execution, private client services and new products in order to help our clients meet their investment goals, and BlockFi Prime gathers all of those resources in one easy-to-use tool.”

Why BlockFi Prime Matters

It is exciting to see all the great solutions that BlockFi is presenting to institutional and sophisticated investors. We must remember that many financial institutions are still using legacy financial infrastructure, which limits their ability to scale into alternative markets. With other roaming concerns around compliance in crypto, companies like BlockFi are helping institutions enter digital asset markets transparently and efficiently.

The “crypto-like bank” has been a go-to solution for retail investors that want to maximize their cryptocurrency holdings. BlockFi has all the necessary tools to create the same narrative in the institutional space. It will be exciting to track the maturation.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however, no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the cryptocurrency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal, or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal, and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.