Market participants concentrated on the imminent meeting between the US President and China’s Xi Jinping planned for the coming days. Conversations are anticipated to tackle persistent friction over tariffs and rare earth export limitations. Commercial optimism has buoyed sentiment lately notwithstanding occasional reversals.

A senior analyst at LFTrade investigates what hangs in the balance during these crucial negotiations.

Anticipation Intensifies

The gathering marks the most significant diplomatic contact between American and Chinese leadership in several months. Both nations have signaled readiness to discover mutual understanding on commercial disputes that have unsettled financial markets. Earlier negotiating sessions yielded minimal substantial advancement, heightening importance for this encounter.

Equity prices have climbed anticipating possible achievements. Market participants seem ready to disregard aggressive language and concentrate on ultimate bargained resolutions. This hopefulness continues notwithstanding letdowns from earlier discussion cycles.

The conference unfolds amid rising strains across numerous domains. Tariffs, technology barriers, and rare earth resources all demand settlement. Securing consensus across multiple disputed matters concurrently poses immense diplomatic obstacles.

Import Duties Stay Primary

Levies implemented by both nations keep interfering with commerce movements and elevating expenses. American duties on Chinese merchandise have touched meaningful heights throughout various product groupings. China has countered with its own levies on American farming and manufacturing goods.

These charges have generated difficulty points for enterprises and households in both territories. American corporations have grappled with elevated input expenses from duty-affected Chinese parts. Chinese producers have forfeited entry to the substantial American buyer market for specific items.

Settling duty disagreements necessitates mutual compromises. America desires improved entry to Chinese markets and more robust intellectual property safeguards. China pursues elimination of technology barriers and acknowledgment of its advancement approach.

Strategic Minerals Standoff

China’s latest declaration of limitations on rare earth mineral shipments contributed urgency to the conference. These substances prove vital for chip production and defense uses. China furnishes roughly 70% of worldwide rare earth output, granting it substantial negotiating power.

The limitations endanger disrupting supply networks for essential technologies. American and partner corporations rely on these substances for sophisticated electronics production. Constructing substitute supply origins will require years even with forceful funding.

China executed these limitations responding to American technology shipment regulations. The reciprocal intensification heightens worries about additional fragmentation of worldwide supply networks. Discovering a reciprocally satisfactory structure for administering strategic substances has grown critical.

Historical Meeting Results

Earlier prominent conferences between American and Chinese leadership have yielded inconsistent outcomes. Opening declarations frequently sound encouraging but execution regularly underwhelms. Markets have acquired caution staying carefully hopeful instead of presuming achievement agreements will emerge.

The most fruitful earlier conferences formed task forces to tackle particular matters. This gradual methodology permits advancement on limited subjects while postponing harder difficulties. Nevertheless, it likewise signifies thorough resolutions stay distant.

Both leadership confront internal political forces that restrict their adaptability. The US President must fulfill groups worried about China’s commercial conduct. Xi encounters pressure from Chinese patriots resisting making surrenders. These political limitations challenge securing meaningful settlement.

Investment Positioning

Investors have arranged holdings foreseeing favorable results from the conference. Technology equities especially vulnerable to US-China connections have climbed lately. Options markets display diminished protective activity, implying reduced worry about catastrophic situations.

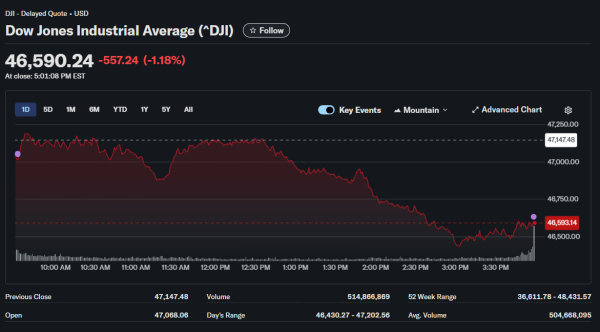

This hopeful arrangement generates danger if the conference frustrates. Markets could undergo abrupt selloffs if discussions collapse without advancement. The earlier decrease when duty dangers strengthened showed how rapidly attitude can turn around.

Alternatively, any meaningful consensus could activate considerable rallies. Elimination of duty ambiguity would profit various sectors from technology to farming. Enhanced commercial connections could likewise bolster worldwide economic expansion more extensively.

Chip Sector Sensitivity

The semiconductor sector confronts specific vulnerability to conference results. Chip corporations require entry to Chinese markets while likewise demanding dependable supply networks. Present limitations generate operational obstacles for American chip producers.

China has been funding substantially in domestic semiconductor abilities. Nevertheless, sophisticated chip production demands gear and substances frequently regulated by American or partner corporations. Discovering a structure permitting genuine technology business while tackling security worries proves essential.

Corporations like Nvidia have confronted limitations on vending sophisticated AI chips to China. These shipment regulations restrict reachable markets but mirror national security priorities. Any relaxation of limitations would tangibly profit impacted corporations.

Plausible Results

Most experts anticipate gradual advancement instead of thorough achievement at the conference. Forming task forces to tackle particular matters constitutes a more practical result. This would permit both parties to assert achievement while postponing challenging choices.

Duty decreases on specific merchandise groupings might be declared. These representative motions would indicate goodwill without demanding basic policy modifications. Farming acquisitions might be augmented to supply concrete advantages to American cultivators.

The crucial gauge for market response will be manners and declared dedication to persistent involvement. Markets desire assurance that connections are enhancing instead of declining. Even modest advancement surpasses persistent intensification of strains.