The past six months have been unusually dramatic for Tilray Brands, a stock long associated with hype cycles, regulatory speculation, and unpredictable market sentiment. Once viewed as one of the most promising cannabis companies in North America, the business has spent recent years grappling with slowing growth, shrinking margins, and persistent competitive pressures in Canada’s saturated market.

Yet despite these well-known challenges, Tilray’s shares stunned investors by surging 110 %, driven largely by renewed optimism around potential U.S. marijuana reform. Brokers from Nexdi note that while this impressive rally captured headlines, the forces behind it are far from stable.

A Six-Month Rally Fueled by Policy Hopes

Tilray Brands has become one of the most reactive stocks in the cannabis ecosystem whenever political developments hint at reform. Historically, the stock has soared during periods of enthusiasm about potential legalization, only to retreat once legislative momentum stalls.

This dynamic resurfaced in late September when the U.S. President shared a video on his Truth Social platform highlighting potential health benefits of cannabidiol for seniors. The post was interpreted as an informal endorsement of cannabis-derived wellness products. Combined with speculation that marijuana might be reclassified from Schedule I to Schedule III, the industry saw a burst of optimism.

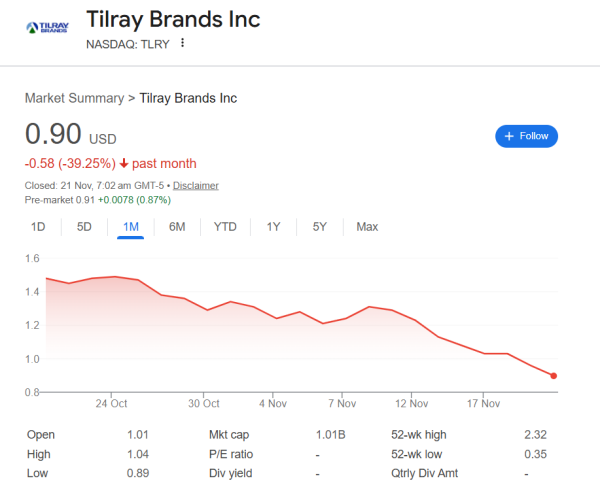

Tilray’s stock rapidly climbed, hitting a 52-week high of 2.32 on Oct. 9, marking one of its sharpest moves in recent memory. Investors hoped the company would finally gain a clearer regulatory path into the U.S. market, where opportunities dwarfed those available in Canada or Europe.

But as has happened many times before, the momentum proved fragile.

Regulatory Winds Shift in the Wrong Direction

Not only did U.S. cannabis reform fail to advance after September, but new developments have sent sentiment sharply in the opposite direction.

According to the U.S. Attorney’s office, individuals found using or possessing marijuana on federal lands will now face rigorous prosecution, reversing the more lenient guidance previously in place. This immediately dampened hopes that the federal government was moving toward a softer stance.

Even more concerning was the passing of a government bill that will ban the vast majority of hemp-derived products. Tilray, like many cannabis companies, has relied on hemp-based beverages, edibles, and wellness items as a workaround to penetrate the U.S. market without violating marijuana restrictions. If these products disappear from shelves next year, a key revenue opportunity evaporates.

Unsurprisingly, Tilray’s stock quickly gave back a large portion of its gains. It is now down over 50 % from its 52-week high, raising questions about whether residual optimism can survive mounting policy setbacks.

Tilray’s Core Business Remains Fragile

The volatility in Tilray’s stock reflects more than shifting regulations. The underlying business continues to face significant structural challenges.

The Canadian cannabis market remains highly fragmented, oversupplied, and dominated by intense price competition. Margins for licensed producers are thin, and scaling profitably has proven difficult for even the most established players. Despite diversifying into alcohol through acquisitions, Tilray is still burning cash while growth slows.

The company’s long-term success heavily depends on access to the U.S. market, which remains restricted. International markets offer some expansion opportunities, but none are large enough to materially reshape the company’s trajectory.

For these reasons, analysts stress that Tilray is not positioned as a stable, predictable business. Instead, it functions more like a speculative instrument tied to news cycles rather than fundamentals.

A Rally That May Not Be Sustainable

While Tilray’s 110 % surge captured attention, the company’s vulnerabilities raise questions about whether the rally can continue. Much of the recent momentum was driven by sentiment rather than core performance. Without tangible regulatory progress, the stock remains exposed to sharp reversals.

The market has already delivered its verdict. As federal policy signals moved in the opposite direction, investors rushed to reassess the company’s immediate prospects. With uncertainty rising rather than falling, bullish projections have weakened.

Should Investors Consider Tilray Today?

Tilray Brands offers upside potential only for investors willing to embrace high levels of risk. The business continues to face:

- Limited profitability

- Slow or inconsistent revenue growth

- Reliance on unpredictable regulatory changes

- A difficult competitive landscape in Canada

While legalization in the U.S. could unlock significant opportunities, there is no clear timeline, and recent government actions suggest progress may be stalling rather than accelerating.

For most investors, the risk-reward profile appears unbalanced. Tilray’s stock may still experience sharp rallies driven by political headlines, but equally dramatic pullbacks are likely. Unless an investor is specifically targeting speculative cannabis exposure, the safer approach may be to avoid the stock until conditions stabilize.