Tide Capital’s latest research reveals Bitcoin and Ethereum are redefining institutional finance frameworks. BTC shattered records above $120,000, while ETH’s structural scarcity drives fundamental revaluation. Converging macro policy shifts and institutional adoption are forging a new crypto investment paradigm.

Institutional Capital Fuels Historic Bitcoin Breakthrough

Bitcoin’s $2.4 trillion market cap – surpassing Amazon as the world’s fifth-largest asset – reflects deepening institutional conviction. Tide Capital confirms spot Bitcoin ETFs absorbed $10+ billion net inflows over two months, driven by allocations from Goldman Sachs, Morgan Stanley, and the Michigan Retirement System.

A pivotal stress test occurred when markets digested an 80,000 BTC ($10 billion) whale sell-off with only a 2.5% dip to $117,000. This demonstrated unprecedented structural resilience compared to prior cycles.

Source: TradingView

Tide Capital analysts directly attribute this stability to Bitcoin’s institutionalization: “The 30% year-to-date gain amid global uncertainty and its fixed 21 million supply cap now position BTC as a core non-sovereign reserve asset.”

Macro Tailwinds Ignite Cross-Asset Rotation

CME FedWatch data shows a 98% probability of ≥50bps Fed cuts by December 2025, unleashing capital into risk markets. Tide Capital documents how the Nasdaq’s historic 20,980-point high in July 2025 ignited a “U.S. equities → risk appetite → crypto” capital transmission chain.

Source: TradingView

Simultaneously, sovereign debt risks amplify Bitcoin’s appeal – IMF projects global government debt/GDP will hit 95% in 2025, with 38 nations exceeding 100%. This accelerates Bitcoin’s transition from theory to institutional portfolio reality.

Ethereum’s Triple Engine: Institutions, Scarcity, Value Capture

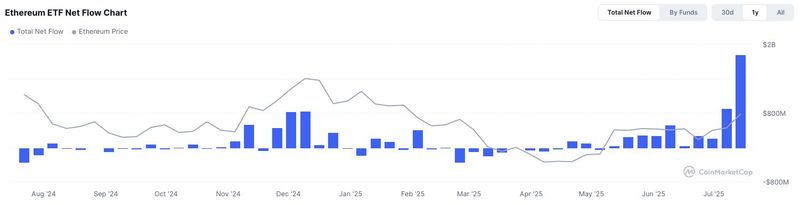

Institutional adoption reached an inflection point with 10 consecutive weeks of $5 billion ETH ETF inflows. Tide Capital highlights Standard Chartered’s landmark launch of ETH spot trading on July 15, 2025 – the first Global Systemically Important Bank to offer such services.

Source: CoinMarketCap

Network mechanics now enforce structural scarcity: 36 million ETH ($130 billion) is staked, consuming 30% of circulating supply – double pre-Shanghai upgrade levels. Critically, over 50% flows through compliant custodians (Coinbase, Kraken), signaling long-term institutional commitment.

Ethereum further dominates the $251 billion stablecoin market with $140 billion (56%) hosted on its network. Based on Tide Capital’s research, the stablecoin growth directly fuels ETH value capture through transaction fee burns and ecosystem expansion.

Corporate Treasuries Redefine Capital Strategy with ETH

Public companies are revolutionizing treasury management by adopting ETH as a yield-bearing reserve asset. A growing number of firms now designate ETH as a primary treasury reserve, accumulating significant holdings with nearly all tokens actively staked to generate yield.

Source: Strategic ETH Reserve

“Their collective momentum creates a powerful cluster effect: growing institutional participation enhances ETH’s liquidity, reduces volatility, and solidifies its status as an investable asset—accelerating further adoption,” noted Tide Capital.

Synergistic Assets Reshape Institutional Portfolios

According to Tide Capital, Bitcoin and Ethereum now deliver complementary value: BTC serves as a systemic hedge and monetary reserve, while ETH powers productive on-chain economies through DeFi, tokenization, and stablecoins.

Tide Capital concludes this synergy is expanding global finance’s architectural possibilities. Macro tailwinds and institutional adoption are irreversible accelerants, with $120,000 BTC and yield-generating ETH treasuries marking an inaugural phase of institutional crypto integration.

Disclaimer: The information provided in this press release is not a solicitation for investment, nor is it intended as investment advice, financial advice, or trading advice. It is strongly recommended you practice due diligence, including consultation with a professional financial advisor, before investing in or trading cryptocurrency and securities.

This press release was originally published on this site