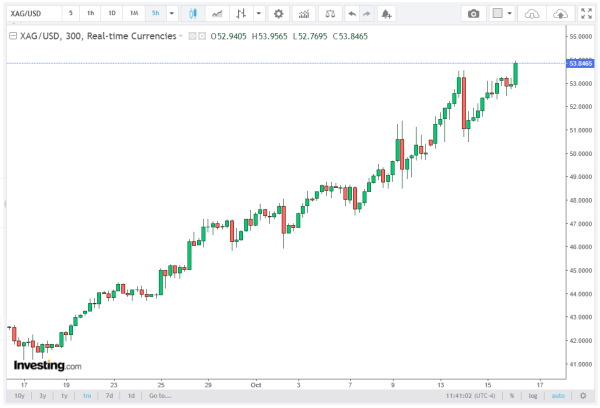

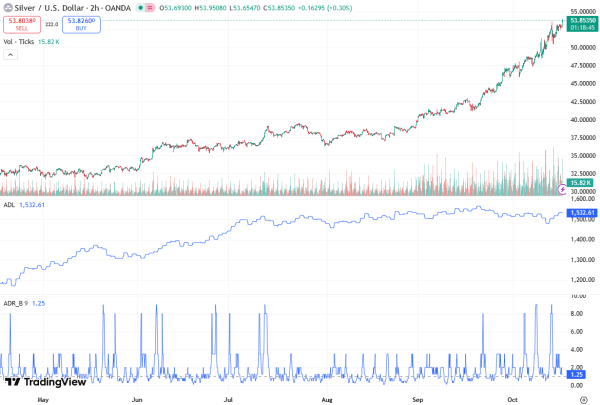

Silver price (XAG/USD) retreated from its all-time high of $54.86 on Thursday, falling to around $53.10 in the Asian trading session. This pullback comes amid profit-taking after a remarkable rally that has pushed the white metal higher by over 80% year-to-date (YTD). Maxime Chartier, one of ProMorion Group’s brokers, offers a comprehensive and structured look at this issue.

Despite the temporary decline, several factors, including expectations of US Federal Reserve (Fed) rate cuts, ongoing geopolitical tensions, and potential safe-haven flows, may provide underlying support for the precious metal.

Silver Pullback After Record High

The XAG/USD pair saw a minor retreat as traders booked profits following an unprecedented surge in recent weeks. The Asian trading session on Thursday recorded silver trading in negative territory, hovering around $53.10. While the pullback may appear significant in the short term, it reflects healthy market consolidation after a rapid ascent from previous support levels.

Profit-taking in silver is common after reaching historical highs, as investors temporarily exit positions to lock in gains. Analysts suggest that this short-term weakness could create buying opportunities, particularly given the supportive macroeconomic environment and ongoing geopolitical risks.

Fed Rate Cut Expectations Support Silver

A key driver of the silver market remains expectations of further interest rate cuts by the US Federal Reserve. Fed Chair Jerome Powell’s dovish comments have intensified market bets on a series of rate reductions, providing a favorable environment for non-yielding assets like silver.

Current pricing indicates a 98% probability of a 25 basis points (bps) rate cut in October, followed by a fully priced-in reduction in December, according to Reuters. Lower interest rates tend to reduce the opportunity cost of holding precious metals, enhancing their appeal to investors seeking inflation hedges and safe-haven assets.

Historically, periods of monetary easing have coincided with bullish trends in silver and gold. As borrowing costs decrease, investors often shift capital from yield-bearing instruments to commodities, supporting the XAG/USD price.

Geopolitical Risks Boost Safe-Haven Demand

Beyond monetary policy, geopolitical tensions are adding to the bullish case for silver. Renewed concerns over a potential US government shutdown and ongoing US-China trade tensions are prompting investors to seek safe-haven assets.

The US President indicated that Washington is considering additional trade restrictions against China following the imposition of port fees on ships carrying cargo between the two nations. Such measures could increase trading costs, disrupt freight flows, and create economic uncertainty, indirectly supporting demand for precious metals.

At the same time, the prospect of a US-China meeting later this month could provide clarity on trade relations. Any signs of easing tensions might temporarily pressure the silver price, but underlying safe-haven demand may continue to offer support.

Technical Analysis of XAG/USD

From a technical perspective, silver’s pullback to $53.10 may represent a short-term correction rather than a trend reversal. Analysts note that the previous high of $54.86 now acts as resistance, while support levels are emerging near $52.50–$53.00.

Momentum indicators such as the Relative Strength Index (RSI) suggest that silver was overbought in the previous sessions, validating the profit-taking phase. Moving averages indicate that short-term bullish momentum remains intact, as the 20-day SMA continues to trend above the 50-day SMA, reflecting overall upward pressure.

Market Outlook and Forecast

Looking ahead, the silver market is likely to remain volatile, influenced by a mix of monetary policy expectations and geopolitical developments. Key factors to monitor include Fed interest rate decisions and statements by Jerome Powell, US-China trade developments and potential tariffs, US government funding and shutdown risks, as well as safe-haven flows amid global economic uncertainty.

Analysts suggest that any temporary dips could be viewed as buying opportunities, especially given silver’s strong YTD performance. XAG/USD may test support near $52.50 before attempting to challenge previous highs above $54.00.

Furthermore, a combination of lower US interest rates, elevated geopolitical risk, and continued investor appetite for precious metals could provide a solid foundation for the XAG/USD rally in the medium term.

Conclusion

In summary, the Silver price (XAG/USD) has retreated slightly to $53.10 following record highs amid profit-taking. Despite this short-term pullback, the dovish stance of the Fed, potential rate cuts, and ongoing geopolitical uncertainties continue to support the precious metal.

Traders should watch for developments in US monetary policy, trade relations with China, and any government shutdown risks in the US, as these factors are likely to influence safe-haven flows and silver price dynamics in the near term.

While short-term corrections are expected, the medium-term outlook for silver remains constructive, providing potential opportunities for strategic traders and long-term investors.