Silver prices (XAG/USD) have surged to new record highs, extending their winning streak for the fourth consecutive session. During Asian trading hours on Monday, XAG/USD touched an all-time high of $51.69, reflecting heightened investor demand amid expectations of further US Federal Reserve (Fed) rate cuts by year-end. Arbitics professionals outline the most important details of the topic with clarity and precision.

The non-interest-bearing nature of Silver makes it particularly sensitive to monetary policy shifts, and the market is increasingly pricing in dovish measures from the Fed. The CME FedWatch Tool currently points to a 96% chance of a 25-basis-point rate cut in October and an 87% probability of another cut in December, reflecting strong market confidence in monetary easing.

Investors are also responding to the broader macroeconomic backdrop, including signs of slower economic momentum in the US. The combination of weakened consumer sentiment, low inflation pressures, and geopolitical uncertainty is creating favorable conditions for precious metals like Silver to continue their upward trajectory.

US Consumer Sentiment Supports Silver Gains

Recent data show that US consumer confidence has softened slightly, reinforcing speculative bets on Fed easing. The preliminary University of Michigan Consumer Sentiment Index declined marginally to 55.0 in October, down from 55.1 in September.

Although the drop is modest, it suggests that household spending may be slowing, which could reduce economic growth momentum. This dynamic increases the likelihood that the Federal Open Market Committee (FOMC) will implement further monetary accommodation to support the US economy.

The September FOMC Minutes indicated that policymakers are leaning toward additional rate cuts, reflecting a cautious stance aimed at balancing growth objectives and inflation management.

Fed Officials Highlight Flexibility in Policy

Several Federal Reserve officials have reinforced the expectation of continued monetary easing, which supports the bullish case for Silver. Federal Reserve Bank of St. Louis President Alberto Musalem noted that signs of potential labor market weakness suggest that a balanced approach is necessary, provided that inflation expectations remain anchored.

Meanwhile, San Francisco Fed President Mary Daly emphasized that inflation has come in lower than initially feared, further increasing the probability of rate cuts. Daly highlighted that the Fed is prepared to make additional adjustments as part of its risk management strategy, signaling ongoing support for non-yielding assets like Silver.

These statements underscore the Fed’s flexibility in monetary policy and reinforce market expectations that XAG/USD will continue to benefit from easing measures. Traders are increasingly viewing Silver not only as a safe-haven asset but also as a strategic hedge against potential monetary easing-related currency depreciation.

Safe-Haven Demand Driven by Geopolitical Risks

Renewed US-China trade tensions have added to safe-haven demand for Silver, providing additional support for XAG/USD. The US President recently stated that a meeting with China’s President at the upcoming South Korea summit may not be necessary, while also threatening to impose 100% tariffs on Chinese imports.

Although the US President later clarified via Truth Social that China’s economy “will be fine” and that the US seeks to help China rather than harm it, the market remains cautious.

The uncertainty surrounding trade negotiations continues to increase risk aversion, prompting investors to allocate funds to precious metals, including Silver, as a hedge against geopolitical and economic risks.

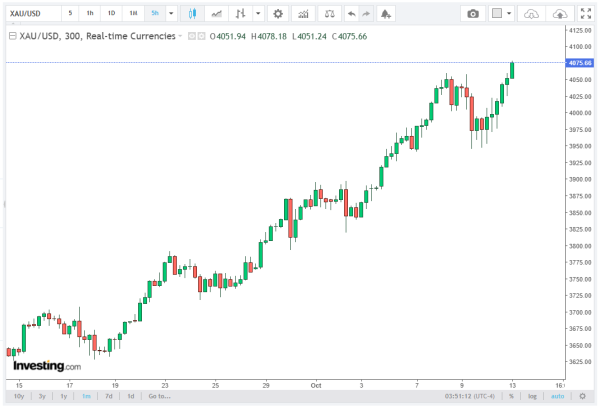

Technical Outlook for XAG/USD

From a technical perspective, XAG/USD has broken through critical resistance levels above $51.50, signaling robust bullish momentum. Traders are closely monitoring support levels at $50.75 and $50.00, which could act as key retracement zones in case of short-term profit-taking. On the upside, resistance around $52.50 may come into focus if the bullish trend persists.

Volatility is expected to remain elevated, reflecting market reactions to upcoming Fed decisions, economic data releases, and ongoing US-China trade developments. Short-term price movements are likely to be influenced by a combination of speculative positioning, safe-haven demand, and technical breakout dynamics.

Conclusion

In conclusion, Silver prices (XAG/USD) are hitting historic highs, driven by a combination of anticipated US rate cuts, weaker consumer confidence, and renewed safe-haven buying amid geopolitical risks. The CME FedWatch Tool shows a high probability of an interest rate cut in October, while Federal Reserve officials continue to emphasize flexibility in monetary policy.

As investors navigate these dynamics, Silver remains a preferred asset for both hedging and speculative strategies. The metal’s sensitivity to monetary policy, coupled with geopolitical uncertainties, ensures that XAG/USD will continue to attract market attention in the near term.

For traders and analysts, monitoring FOMC updates, consumer sentiment indices, and US-China trade developments will be critical to assessing Silver’s price trajectory. With technical momentum strong, Silver could extend its gains further, while key support levels guide for managing short-term risk.