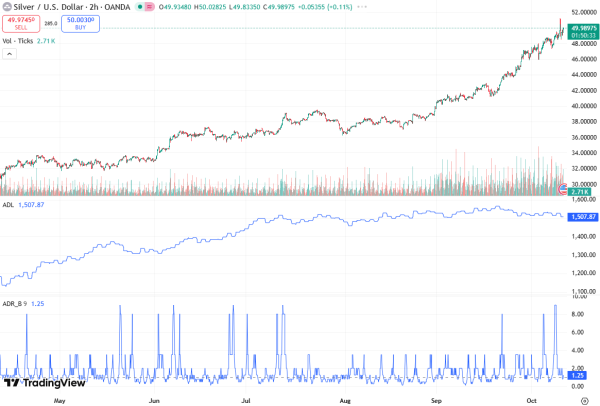

Silver prices (XAG/USD) surged to around $49.70 during Friday’s Asian trading session, holding positive momentum following a strong rally in recent days. The white metal continues to attract safe-haven flows, industrial demand, and market attention amid expectations of a Federal Reserve (Fed) interest rate cut.

This article from Solancie gives readers a clear and well-rounded explanation of the subject.

Silver Extends Gains Amid Market Uncertainty

Silver’s recent performance comes as global markets navigate heightened economic uncertainty, ongoing geopolitical risks, and US domestic fiscal concerns. The US government shutdown, now in its tenth day since October 1 due to Congress failing to agree on a new budget by September 30, has added to investor caution.

The combination of safe-haven demand, industrial use, and a potentially weaker US Dollar (USD) underpins the current XAG/USD rally. Analysts highlight that Silver prices could continue benefiting from market volatility if macroeconomic risks persist.

Fed Rate Cut Bets Fuel Silver Demand

Another key factor supporting Silver is the market’s expectation of lower US interest rates. Traders are currently pricing in nearly 95% odds that the Fed will cut rates by 25 basis points (bps) at its October FOMC meeting.

While the probability of an additional rate reduction in December has slightly declined to 82%, this still indicates a high likelihood of continued monetary easing.

When interest rates decline, the cost of holding assets that don’t generate income, like Silver and Gold, falls. As a result, precious metals become more appealing to investors looking to safeguard wealth during times of economic uncertainty.

The market is closely watching any Fed commentary, particularly from officials like Goolsbee and Musalem, scheduled to speak later on Friday. Their insights on monetary policy and economic outlook could influence XAG/USD volatility in the near term.

Economic Data in Focus

Friday’s preliminary University of Michigan (U-Mich) Consumer Sentiment report is another potential market driver. A stronger-than-expected reading could signal resilient consumer confidence in the US economy, potentially strengthening the USD.

A stronger USD often exerts downward pressure on Silver prices, given that XAG/USD is dollar-denominated. Conversely, a weaker consumer sentiment report could boost safe-haven flows into Silver, further supporting its uptrend.

Investors are therefore balancing macroeconomic data and monetary policy expectations in positioning themselves in the precious metals market.

Technical Outlook: Silver Price Levels to Watch

From a technical perspective, XAG/USD has been holding above $49.50, marking a psychological resistance level for traders. If Silver sustains gains above $49.70, the next key level to monitor is $50.00, which could attract profit-taking as well as additional speculative interest.

The white metal has recently exhibited high volatility, reflecting global economic uncertainty and geopolitical tensions. Traders often use support and resistance levels, alongside moving averages and momentum indicators, to gauge short-term price action in Silver.

Geopolitical and Macro Drivers

Beyond US domestic factors, geopolitical risks continue to bolster Silver demand. Trade tensions, regional conflicts, and uncertain policy outcomes in key global economies often lead investors to seek safety in tangible assets.

Additionally, industrial demand for Silver, driven by its use in electronics, solar panels, and medical equipment, remains a long-term supportive factor. Analysts note that a combination of industrial utilization and monetary policy easing could sustain upward momentum in XAG/USD over the coming weeks.

Conclusion

Silver prices (XAG/USD) are currently benefiting from a confluence of factors that are influencing market dynamics. One key driver is economic uncertainty and growing concerns over a potential US government shutdown, which are encouraging investors to seek more stable assets.

Another factor supporting silver is the expectation of a Federal Reserve interest rate cut. Traders are closely watching Fed signals, as lower rates generally increase the appeal of precious metals like silver.

Additionally, ongoing geopolitical risks are fueling safe-haven flows into silver. During times of tension or instability, investors often turn to metals to preserve value, further supporting demand.

Industrial demand also plays a crucial role, with silver being widely used in manufacturing and technology sectors. Robust demand from these areas provides a strong underlying support for prices.

Finally, markets are looking ahead to key economic releases, including the University of Michigan Consumer Sentiment data and upcoming Fed commentary. These events could impact market sentiment and influence silver’s near-term direction.

Traders are closely monitoring technical levels such as $49.50 and $50.00, while also weighing macroeconomic reports and monetary policy signals. With XAG/USD holding above $49.50, the white metal could continue its upward trajectory, particularly if global uncertainty persists and interest rate cuts materialize.