Tripadvisor (NASDAQ: TRIP) garnered renewed market attention this week after receiving an analyst upgrade to a Zacks Rank #2 (Buy), following a series of upward earnings estimate revisions and recognition of its attractive valuation metrics. The development underscores a growing sense of investor optimism surrounding the company’s improving fundamentals and strategic positioning within the evolving online travel sector.

This article by Orbisolyx examines the key drivers behind the upgrade, its implications for investor sentiment, and Tripadvisor’s broader investment outlook.

Analyst Upgrade Reflects Strengthening Fundamentals

The upgrade to a Zacks Rank #2 (Buy) follows recent adjustments to Tripadvisor’s earnings outlook, as analysts raised their forecasts to reflect stronger-than-expected operational performance and consistent revenue growth. The company’s forward price-to-earnings ratio remains below the industry average, positioning Tripadvisor as an attractive value play among travel and hospitality peers.

Zacks analysts cited Tripadvisor’s track record of earnings surprises and disciplined cost management as central reasons for the improved rating. The stock’s valuation appeal has resonated with value-focused investors, contributing to renewed buying interest and stabilizing near-term momentum.

Upward Earnings Revisions Support Bullish Sentiment

Earnings estimate revisions are among the most influential indicators of investor confidence, often signaling a meaningful shift in how both institutional and retail participants view a company’s growth trajectory. In Tripadvisor’s case, the recent upward revisions underscore renewed optimism surrounding its revenue resilience and margin expansion potential, particularly within its Experiences and Dining divisions, two segments central to the company’s transformation into a higher-margin, experience-driven platform.

The company’s strong Q2 2025 performance further validated this sentiment, with notable year-over-year gains in both sales and net income. This momentum has strengthened bullish sentiment and reaffirmed investor belief that Tripadvisor’s strategic pivot toward diversified monetization and cost efficiency is gaining traction.

Together, these factors suggest that Tripadvisor is positioning itself for sustainable earnings growth, even amid ongoing competition and evolving travel industry dynamics.

Strategic Transition to Higher-Margin Segments

Tripadvisor’s long-term investment narrative centers on its transition from a traditional travel-booking platform toward higher-margin experience-based offerings. This strategic pivot is designed to enhance profitability, reduce reliance on paid traffic channels, and capture a larger share of the global travel experience market.

However, Orbisolyx analysts note that sustaining organic traffic growth remains one of Tripadvisor’s most pressing challenges, particularly as digital advertising costs rise and competition intensifies from both established travel platforms and nimble, mobile-first entrants. The company’s ability to counter these pressures through ongoing product innovation, strategic partnerships, and enhanced customer engagement will be essential to maintaining its current earnings momentum..

Long-Term Outlook and Financial Projections

According to the latest narrative projections, Tripadvisor (NASDAQ: TRIP) is forecast to generate approximately $2.3 billion in revenue and $144.6 million in earnings by 2028, implying a 7.1% annualized revenue growth rate and an earnings increase of roughly $79.6 million from current levels. These projections reflect expectations of continued recovery in global travel activity, as well as Tripadvisor’s ability to strengthen its monetization channels through Tripadvisor Plus, Viator, and TheFork.

While the targets appear achievable under supportive macroeconomic conditions, execution risks remain, particularly if travel sentiment weakens due to economic uncertainty or intensified competition from online travel agencies. Nevertheless, Tripadvisor’s diversified business model, robust user engagement, and recognized global brand provide a solid foundation to sustain growth and navigate cyclical slowdowns over the medium term.

Market Perspective and Technical Context

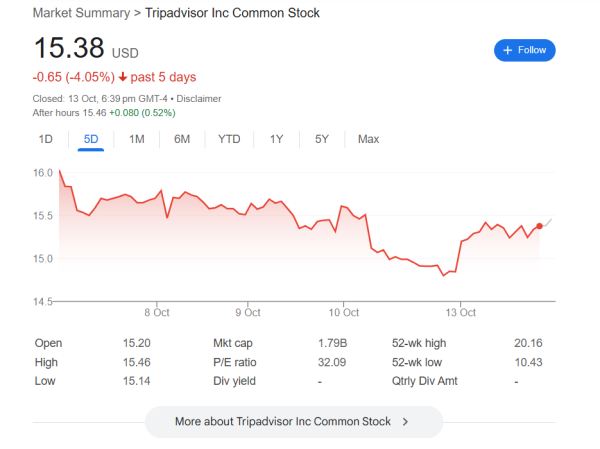

From a broader market perspective, Tripadvisor’s recent analyst upgrade may serve as a short-term catalyst, prompting renewed investor interest in the stock. Traders and institutions alike will be watching closely to see whether these upward earnings revisions can translate into sustained price momentum beyond the initial reaction phase.

Technically, the stock appears to be stabilizing, with support forming near recent consolidation zones, suggesting limited downside risk in the near term. Improved earnings visibility and fundamental re-rating potential could drive additional institutional inflows if sentiment continues to strengthen.

However, the tug-of-war between valuation optimism and structural challenges in traffic acquisition and monetization efficiency will likely shape Tripadvisor’s performance trajectory through the remainder of 2025, determining whether the rally matures into a longer-term trend or remains a transient rebound.

Conclusion

In summary, Tripadvisor’s analyst upgrade and earnings estimate revisions mark a constructive turn in the company’s investment outlook. The combination of stronger fundamentals, favorable valuation metrics, and a strategic shift toward high-margin segments supports a cautiously optimistic stance among investors.

While competitive pressures and marketing costs remain ongoing risks, Tripadvisor’s operational resilience and positive earnings momentum provide a foundation for potential long-term value creation.