Nvidia, the semiconductor giant, reported results that topped Wall Street projections on Wednesday evening. Markets responded with relief as concerns about artificial intelligence valuations had been mounting. Lead brokers at Unirock Gestion analyze what these numbers signal for investors navigating the AI investment landscape.

Revenue climbed 62% compared to last year, reaching $57 billion for the quarter ending in October. Analysts had forecast $54.9 billion, making the beat meaningful rather than marginal.

This performance demonstrates that corporate appetite for AI computing power continues expanding despite questions about eventual payback from these investments. The company’s bottom line showed $31.9 billion in net income, representing 65% growth year over year.

Data Center Business Drives Growth

Computing infrastructure for enterprises generated $51.2 billion in quarterly revenue. Wall Street expected $49.3 billion from this segment. The division now accounts for the overwhelming majority of total sales, illustrating how thoroughly the company has transformed from its gaming roots into an AI infrastructure provider.

The data center performance reflects sustained spending by cloud computing giants building out capacity. These hyperscalers continue placing orders for graphics processing units despite economic headwinds affecting other technology sectors. This resilience suggests AI investments occupy a protected status in corporate budgets.

Gaming operations produced $4.3 billion against expectations of $4.4 billion. While missing slightly, this segment maintains respectable performance even as it represents a shrinking portion of overall business. The gaming franchise provides diversification benefits should AI spending ever contract unexpectedly.

Looking ahead, management guided fourth quarter revenue to approximately $65 billion. This forecast exceeded the $62 billion consensus estimate by a comfortable margin.

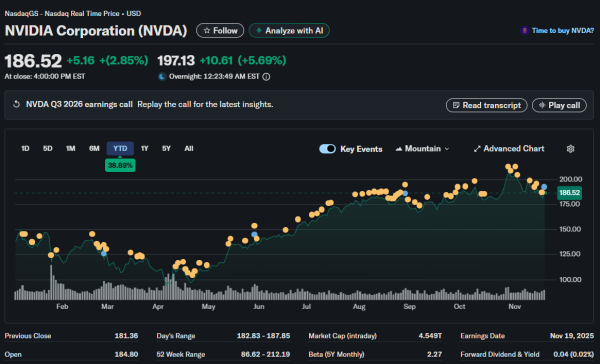

Shares jumped over 5% in extended hours trading as investors processed the optimistic outlook. The CEO noted that Blackwell architecture sales are exceeding internal projections while cloud GPU inventory remains depleted.

This forward guidance suggests sequential acceleration rather than deceleration. Revenue would climb substantially from already elevated third-quarter levels if the forecast materializes. Such a trajectory contradicts predictions from skeptics who anticipated that AI infrastructure spending would moderate as economic uncertainty increased.

Market Reaction Shows Relief

The stock price surge in after-hours sessions rippled across technology sectors. Competitors developing AI chips saw their shares rise in sympathy.

Major cloud providers, including Amazon, Alphabet, Meta, and Microsoft, have also gained ground. This reaction demonstrates how thoroughly Nvidia’s performance functions as a barometer for broader AI investment trends.

Semiconductor equipment manufacturers and memory chip producers participated in the rally. Investors interpreted the results as confirmation that AI buildouts will sustain demand across an entire supply chain. The validation extends beyond one company to encompass an ecosystem of firms supporting artificial intelligence infrastructure.

Wall Street analysts had projected earnings per share of $1.26 on the $55.2 billion revenue estimate. Actual results came in at $1.30 per share on $57.01 billion in sales. Compared to the prior year period, it reveals dramatic expansion, with EPS of just $0.81 and revenue of $35.1 billion twelve months earlier. Few enterprises of comparable scale achieve such rapid growth rates.

Bubble Concerns Persist Despite Beat

Critics point to financing arrangements between chipmakers and AI developers as potential red flags. A commitment involving $100 billion directed toward OpenAI in return for hardware purchases raised eyebrows when disclosed in September. Such deals blur lines between organic demand and financially engineered order books.

Another AI laboratory recently pledged $30 billion for cloud computing services powered by these graphics processors. The commitment came alongside equity investments from cloud providers, creating circular relationships. These complex interdependencies complicate efforts to gauge genuine underlying appetite for AI hardware versus demand manufactured through financial structuring.

Company leadership has consistently dismissed bubble characterizations. At a recent industry conference, the CEO argued that customer willingness to pay premium prices for AI capabilities demonstrates commercial viability. He contends that revenue reinvestment into additional infrastructure represents rational capital allocation rather than speculative excess.

Long-term Picture Remains Unclear

Finance experts emphasize that one exceptional quarter doesn’t settle fundamental debates about investment sustainability. The order book reportedly contains $500 billion in commitments for next-generation architectures extending through 2026. These figures provide revenue visibility while simultaneously highlighting unprecedented capital deployment across the technology sector.

The critical question involves whether corporations purchasing this infrastructure can generate sufficient returns to justify continued spending at current magnitudes. The industry wagered enormous sums on artificial intelligence reshaping business models and creating new revenue opportunities. Results thus far suggest the bet appears sound based on order momentum and forward bookings.

Validation over longer time horizons requires demonstrating actual productivity improvements and revenue growth attributable to AI implementations. Companies must show concrete return on investment from AI spending to rationalize ongoing capital allocation at these levels.

The chip maker delivered precisely what markets needed to see this reporting period. The more challenging question concerns whether this trajectory persists through 2026 and beyond as scrutiny on AI returns intensifies across the investment community.