XRP price looks like it could be setting up for a +32% rally in the near term based on historical price action. We take a look at technical analysis on the one year chart to outline key support and resistance levels that will be on watch this week.

XRP Price

At the time of this reporting, XRP is currently trading at $0.245212. Over the last 24hr, XRP has followed Bitcoins momentum to the upside, gaining +2.1%. XRP is up +2.5% over the last week, but is still down -13% during the last two weeks.

Cryptocurrency 7 Day Performance

- Bitcoin: +4.2%

- Ethereum: +6.7%

- XRP: +2.5%

- Polkadot: +12.8%

- Chainlink: -5.1%

- Binance Coin: +31.8%

XRP Technical Analysis

On the chart below, we take a look at XRP on the one year chart. After testing the 1 year high around $0.33 in February, XRP was unable to sustain the levels and experienced a sell-off, similar to other top cryptocurrencies by market capitalization. In July, XRP had similar price action to February, and looked like it was going to retest the yearly highs put in earlier this year. After it was all said and done, the rally was weaker than expected, and XRP ended up selling off to current price levels around $0.25 .

For a couple weeks now, we can see that XRP has been trading side ways ( consolidating ), attempting to power its way through $0.25 resistance. If we take a look at price action in February, we will quickly see that this $0.25 resistance was an important level that ultimately fueled XRP prices to yearly highs. Many traders will be watching for a close above $0.25 to fuel that upward momentum. In doing so, XRP could very well rally +32% in the near term and retest the yearly highs that were initiated in February.

The consolidation the last couple weeks is indicative of a large price swing in the near term. On the contrary, if XRP price fails to accept $0.25 levels, you could see selling pressure that sends the price to a support test at $0.22. In recent XRP analysis, Visionary Financial outlined what it could look like if $0.22 was tested. Since this original analysis on September 8th, XRP has built positive momentum and has reduced the chances of such a sell-off. As of now, the long consolidation appears to be gearing up for a bull run. If we take a look at the RSI at the bottom of the chart, current RSI levels have historically been a launching pad for bullish price action. With XRP relative strength index currently hovering around 40, the technicals point to oversold territories, which could be another catalyst for a bull run.

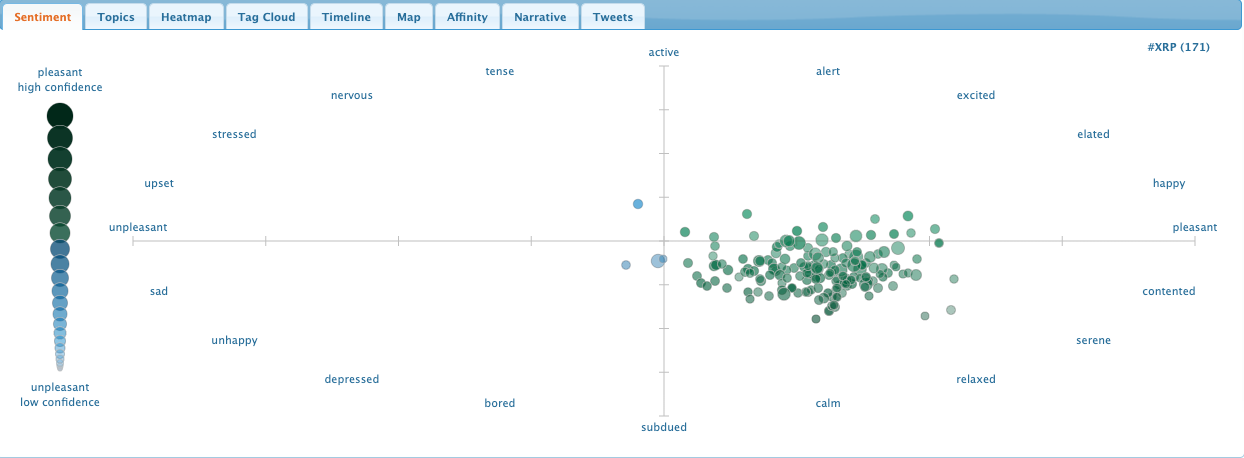

XRP Social Sentiment

On the fundamental side of things, social sentiment continues to be highly correlated to cryptocurrency price action. If we take a look at recent XRP sentiment on a social media platform like Twitter, there has been mostly positive sentiment over the last 24hr. On the chart below, unpleasant tweets are displayed as blue circles, and pleasant tweets are displayed as green circles. At the current price levels, sentiment seems to be highly positive for XRP at the moment.

Image Source: Unsplash

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice. This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.