TradeStation Crypto announced that it was collaborating with Zero Hash on a new solution for its crypto lending service. The strategic relationship is expected to bring efficiency and scalability to TradeStation Crypto’s digital asset loan book.

Benefits of The Partnership

By collaborating with Zero Hash, TradeStation will streamline the loan submission and settlement of digital assets. The company will achieve that by utilizing Zero Hash’s automation and real-time valuation tools. It will help TradeStation Crypto and its counter-parties enjoy greater efficiency throughout the lifecycle of loans.

The lending product created by Zero Hash will allow TradeStation Crypto to bring efficiency and scale to the crypto lending sector. TradeStation Crypto will be amongst the first to utilize the technology. It is a technology designed to bring maturity and a higher level of institutionalization into the crypto space.

TradeStation Crypto can now automate loan settlement and collateral management. It will lead to better counter-party risk management. Additionally, it will simplify the process of accepting multiple forms of collateral. In short, Zero Hash is helping to bring the same level of sophistication found in the equity repo markets to the crypto space.

Features of The Zero Hash Lending Infrastructure

With Zero Hash, TradeStation Crypto will have access to the following features:

-

Balances

It will be possible to verify account balances and deposits in real-time across different crypto assets. Besides that, it comes with ownership validation.

-

Collateral Management

It makes it possible to conduct real-time monitoring as well as automated management of calls for additional collateral and collateral refunds.

-

Multiple Collateral Types

The Zero Hash solution supports over 15 digital assets and over 20 fiat pairs.

-

Loan history

It is possible to access detailed loan history with real-time transaction updates for over 600 transaction pairs.

What Leadership Had To Say

According to the Senior Director of Product Strategy at TradeStation Crypto, James Putra, the digital asset lending space had grown tremendously in 2020. He said that the growth had been driven by the impressive yields on crypto-asset loans. Putra added that there was a need for automation as it was the only way to bring scale to the sector. Additionally, he believes that it will lead to higher levels of institutionalization in the sector.

Commenting on the issue, the Zero Hash CEO, Edward Woodford, said that TradeStation Crypto was paving the way for institutional firms to enter the crypto lending sector. He added that their lending product was one of the most exciting innovations in the industry. Woodford said that they were looking forward to seeing how their product would bring efficiency and scale to the crypto lending sector. He concluded by saying they were looking forward to a continued working relationship to make crypto lending as intuitive and accessible as possible.

Earn Interest On Crypto At TradeStation

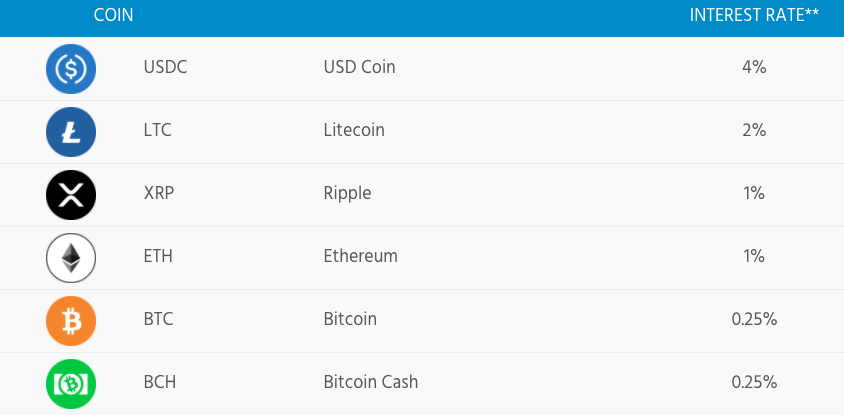

TradeStation has created an environment where active or passive investors can earn interest on their crypto in a seamless manner. As long as users hold a balance in a qualifying digital asset, they are eligible for interest that accrues daily and compounds monthly. Some of the rates they offer can be seen below.

About TradeStation Crypto

TradeStation Crypto is a crypto subsidiary of the TradeStation Group. The company offers crypto brokerage services for self-directed online traders. Its parent company has been around for over 30 years. TradeStation Group is committed to offering traders the best trading technology.

About Zero Hash

Zero Hash is a company that offers a complete suite of settlement services for digital assets. The company allows developers and businesses to focus on creating products and experiences using its API solutions. It creates solutions for payment processors that allow them to conduct international transactions. Additionally, it eliminates the complexity of moving assets for the world’s biggest liquidity providers.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.