DeFi trading looks to scale into new horizons as two companies join forces to tackle the current infrastructure. On September 22, 2020, WeOwn announced that they were collaborating with DMALINK. The partnership will focus on bringing revolutionary solutions to the DeFi space, and building on inefficiencies that currently exist within the Ethereum framework.

DeFi – A Potential Game Changing Partnership

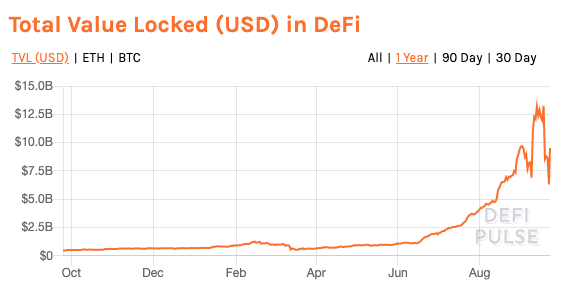

The Decentralized Finance (DeFi) sector has been attracting a lot of attention this year as total value locked in DeFi protocols has surged from $446M to $9.52B over the last year. The chart below from DeFi Pulse outlines the exponential growth the sector has experienced this year. As Visionary Financial outlined in a previous report, the market has seen unprecedented growth since inception, in which total value locked in protocols was only $4 in 2017.

As part of the partnership, the two companies plan to offer solutions that combine low latency trade executing and real-time settlement and clearing. To achieve their goal, DMALINK and WeOwn will utilize a decentralized multi-custodian hybrid blockchain.

The Objective

The objective of their collaborative effort is to come up with solutions based on the existing technology stack of the two companies. In the new ecosystem, client assets will be held by custodians and tokenized on a custodial blockchain ledger. Consequently, the platform will integrate into the full lifecycle of each trade.

What the Leaders Had to Say

When commenting on the issue, the CEO of DMALINK Manu Choudhary said that many DeFi projects today run on Ethereum. He noted that despite being popular with the DeFi sector, Ethereum was not stable. Additionally, it was not an enterprise-friendly protocol. The CEO noted that Ethereum had demonstrated that it was incapable of scaling to meet the institutional needs and large financial markets.

The shortcomings of Ethereum were why they had partnered with WeOwn, according to Choudhary. He noted that WeOwn had made the bold move of creating a stable and scalable protocol. The DMALINK CEO concluded by saying that their goal was to create a hybrid platform that was scalable, performance-driven, and focused on decentralization and transparency.

While commenting on the partnership with DMALINK, the WeOwn CEO Sascha Ragtschaa said that they were excited to be working with DMALINK. Ragtschaa added that the partnership would culminate in the launch of the first European cross-asset decentralized exchange (DEX).

According to the WeOwn CEO, the novel structure of their protocol would help to eliminate counterparty, clearing, and settlement risks. Besides that, traders would be able to execute and settle trades in milliseconds amongst multiple custodians.

The CEO noted that by eliminating intermediary costs, they could pass those savings directly to clients. He added that it was a great initial use case, which would bring large volumes to their platform and exchange from the first day of launch. Besides that, it would enhance their service offering for existing clients, partners, and the SME market they serve.

What is DMALINK

DMALINK is a data-centric ECN ( electronic communication network ) that is designed for professional Foreign Exchange traders. Its focus is on Emerging Markets, Scandie crosses, and CE3 ( Central European three currencies ). Industry leaders including Proprietary Trading Firms, Corporates, Funds, and Banks who require sustainable liquidity access across non-G-7 pairs currently utilize their services.

About WeOwnMarket

WeOwn is a revolutionary digital platform that is designed to assist SMEs to manage their investors better as well as improve the stakeholder engagement. The WeOwn platform allows companies and investors to conduct all their corporate activities, including voting online in a secure manner.

For firms that need quick access to funding, WeOwn offers peer-to-peer lending and equity financing. The platform offers SMEs the benefit of end-to-end digital capital solutions as well as a secondary marketplace for enhanced traction with investors.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice. This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.