Crypto markets added $13 billion in value last week, as a handful of altcoins outperformed Bitcoin. Stocks saw declines for the second week in a row as unemployment data showed little to no progress from the prior week, and politicians failed to secure a $650 billion stimulus bill.

Crypto Markets

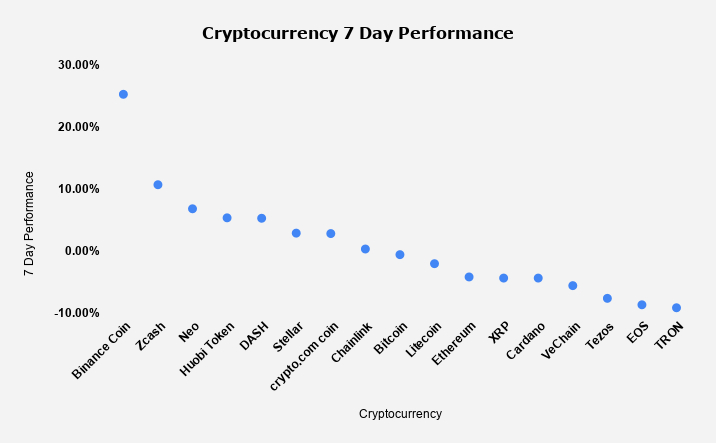

Global crypto markets saw positive gains last week, adding $13 billion in total value. Bitcoin was in the middle of the pact, as a handful of altcoins saw solid gains, compared to Bitcoin which was down -0.60%. Bitcoins market dominance stayed stagnant on the week, hovering around 56.5%. As mentioned in last weeks report, the US Dollar was putting pressure on Bitcoins price, due to the inverse relationship. The Dollar continued its uptrend last week, putting additional pressure on Bitcoin, as the Dollar index rallied for the second week in a row with inflation rising.

Binance Coin

Binance Coin was the market outlier last week, surging +25%. Binance Coin got a push last week as Binance revealed a new product for yield farming. The cryptocurrency exchange introduced Launchpool, a way for investors to generate income through yield farming. The protocol provided interest bearing rewards for BNB tokens and the exchanges native stablecoin, BUSD.

Other Crypto Headlines Last Week

- DeFi recorded record breaking volume in August.

- Bitcoin transactions are increasing among small businesses in Africa. Monthly crypto transfers either in or out of Africa under $10,000 jumped 55% the last year. These transfers now amount to $316 million as of June.

- 700 Ethereum was lost in a Chainlink attack. The attack occurred on August 30th

- Jack Dorsey, the CEO of Twitter continues to embrace Bitcoin, calls it the most viable currency for the internet.

Bitcoin Technical Analysis

Bitcoins price has continued to consolidate since September 4th. At the current levels, Bitcoin is trying to test $10,650 resistance to put bulls back in control. As referenced above, the US Dollar seems to be playing a role in Bitcoins price action. All eyes will continue to be on the Dollar index, which is coming off back to back weekly gains. If Bitcoin fails to accept $10,650 , you could see another leg down to a support test at $9,200. On the flip side, if BTC can accept $10,650 resistance, bulls could push it to $12,500 resistance levels.

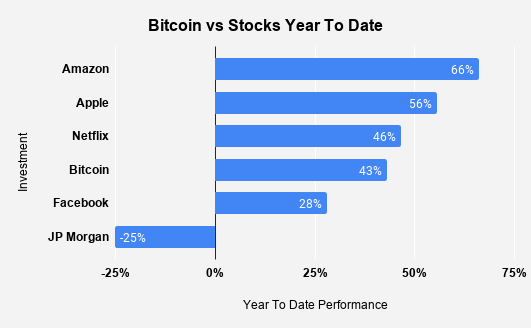

Bitcoin Price Vs Stocks Year To Date

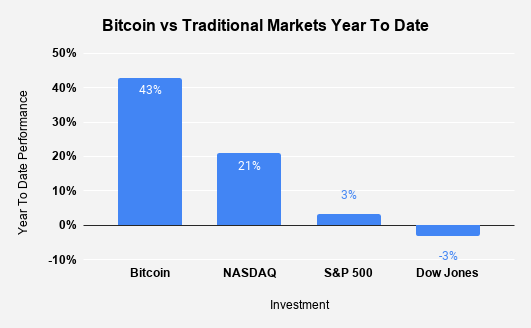

Bitcoin Price Vs Traditional Markets Year To Date

Stock Market Recap

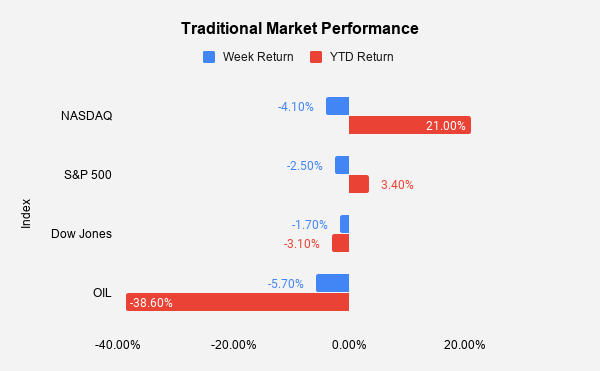

For the second week in a row, stocks saw losses as the technology sector had another sharp pullback. Despite there being no direct catalyst, many believe that valuations, labor markets, and the lack of additional COVID-19 stimulus are fueling the negative sentiment.

Federal Stimulus

During the earlier stages of the pandemic, the government deployed most of its resources, injecting $3.7 trillion in financial stimulus. As we approach mid September, it can be argued that the economy is still in need of additional stimulus to support businesses and households. This time around, politicians are having a difficult time coming to agreement on additional stimulus. Last week the Senate failed to pass the “skinny bill” which would provide $650 billion in additional stimulus. If the government fails to agree on a bill, this could directly affect consumer spending, which was supported by federal payments and unemployment insurance in the earlier stages of COVID-19. With jobless claims showing little to no progress last week, unemployment is still a major concern, especially if COVID-19 spirals into a second wave come flu season.

COVID-19 Complications

With millions of students going back to college during a pandemic recovery, the market has seen data that is raising many red flags. Colleges around the globe have already started to send students home, as the campuses have become a COVID-19 hotspot. Campus infections have now hit 88,000 as of last weeks data.

At the end of the day, the economic recovery will only be as good as the Coronavirus recovery. Market sentiment was strong going into August, but has started to fade, as investors see the college setting right now and start to question the recovery status. Despite the seven-day average falling from its peak in late July ( 65,000 + ) , to 40,000 ( last week ), cases are still stabilizing at a higher rate. This can be easily identified by looking at data from June. In June, the new cases seven day average was significantly lower, coming in at about 25,000. It will be extremely interesting to see what happens at colleges, especially with flu season around the corner. If cases start to propel north, you could see a lot more uncertainty surfacing in traditional markets, resulting in additional selling.

Image Source: Pixabay

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice. This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.