Bitcoin IRA, the fastest growing digital IRA tech platform, recently announced that Ethereum is now available in retirement accounts. The company has also launched new guides to educate investors on Ethereum, and the upcoming launch of Ethereum 2.0 . Bitcoin IRA continues to be the top spot to purchase physical gold and cryptocurrencies in self-directed retirement accounts.

Bitcoin IRA & Ethereum

Bitcoin IRA, a cryptocurrency IRA company, recently announced that they would be supporting Ethereum in self-directed retirement accounts. Bitcoin IRA has been a premier spot that 50,000+ investors leverage to diversify in physical gold and cryptocurrency. In an environment where Wall Street firms still limit retail clients from investing in this emerging market, Bitcoin IRA is bridging the gap between traditional investing and crypto markets. In a previous report by the company, most of their investor base is taking a passive approach in Q4, valuing “uncorrelated” assets during global uncertainties.

Ethereum Sentiment

Bitcoin IRA has added support for Ethereum during a time when investor sentiment seems to be going up. Despite ETH being the second largest cryptocurrency by market cap, it has had a difficult time scaling its blockchain. With Ethereum’s blockchain being an important foundation for other emerging sectors like DeFi, investors are bullish on “Ethereum 2.0,” which is expected to benefit the network. In terms of volume, ETH currently manages over 25 billion in monthly transactions. Aside from DeFi protocols, other markets depend on Ethereum such as decentralized exchanges, stablecoins, digital collectibles, and others.

In the upcoming weeks, “ETH 2.0” will involve the biggest upgrade to Ethereum’s network since its inception 5 years ago. The upgrade to “Proof of Stake” is expected to increase security on the network, and also increase scalability so that ETH can compete with traditional giants like Visa. Long term investors in Ethereum are excited about the upgrades, because they believe that DeFi protocols have the opportunity to take over traditional financial services.

Ethereum Resources

In a push to educate investors on Ethereum, Bitcoin IRA has outlined various resources that people can check out. According to the press release, the company is offering the following guides:

- Ethereum Investing – Simple 3 minute guide that goes over the basic fundamentals

- Ethereum 2.0 – Overview explaining the significance of the network upgrade

- Ethereum Price Predictions – Expert price targets on ETH in the long term

- Ethereum Staking – Guide to understanding how you can earn interest by holding ETH

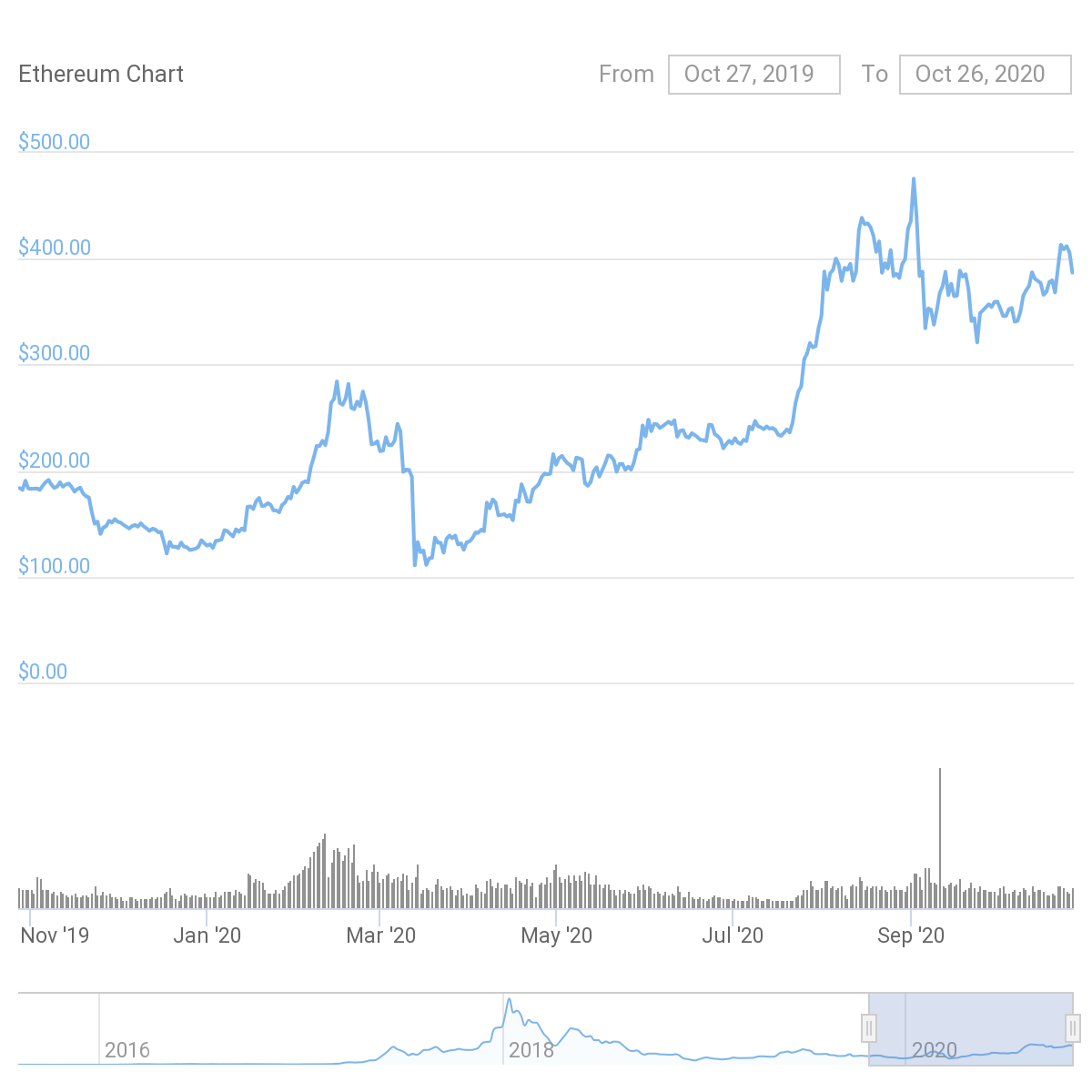

Ethereum Price Performance

As mentioned above, ETH is the second largest cryptocurrency by market cap, with a total market cap of $43,938,007,075. At the time of this report, ETH currently trades around $$387 . Over the last year, ETH has been one of the best performing digital assets. Compared to Bitcoin who has seen +48% growth over the last year, Ethereum has surged +113%.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.